Share This Page

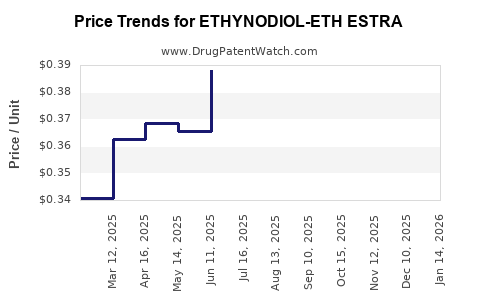

Drug Price Trends for ETHYNODIOL-ETH ESTRA

✉ Email this page to a colleague

Average Pharmacy Cost for ETHYNODIOL-ETH ESTRA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ETHYNODIOL-ETH ESTRA 1 MG-35 MCG | 00378-7307-53 | 0.34095 | EACH | 2025-12-17 |

| ETHYNODIOL-ETH ESTRA 1 MG-35 MCG | 00378-7307-85 | 0.34095 | EACH | 2025-12-17 |

| ETHYNODIOL-ETH ESTRA 1 MG-50 MCG | 00378-7306-85 | 0.73821 | EACH | 2025-12-17 |

| ETHYNODIOL-ETH ESTRA 1 MG-50 MCG | 00378-7306-53 | 0.73821 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Ethynodiol-Eth Estra

Introduction

Ethynodiol-Eth Estra, a synthetic progestin used primarily in hormonal contraceptive formulations, has garnered attention for its therapeutic efficacy and market potential. As a key component in oral contraceptives, its market dynamics are influenced by regulatory frameworks, patent status, competition, and global demand trends. This analysis synthesizes current market conditions, projects future pricing trends, and offers strategic insights into the potential evolution of Ethynodiol-Eth Estra within the pharmaceutical landscape.

Overview of Ethynodiol-Eth Estra

Ethynodiol-Eth Estra is a derivative of norethindrone, characterized by its 19-nortestosterone backbone with specific ethynyl modifications that confer progestational activity. Its primary application in combination hormonal contraceptives involves oral administration, often alongside estrogen components. The compound is valued for its stability, bioavailability, and favorable safety profile, which have contributed to its sustained presence in contraceptive regimens.

Currently, Ethynodiol-Eth Estra's manufacturing is predominantly controlled by a select group of pharmaceutical producers, with patent protections influencing its market exclusivity. Its global demand reflects the rising enpostalization of contraceptive methods, especially in emerging markets, alongside evolving regulatory landscapes.

Market Dynamics

Global Market Size and Segmentation

The global contraceptive market was valued at approximately USD 22 billion in 2022, with hormonal contraceptives constituting a significant segment [1]. Within this, progestin-based pills hold substantial market share, directly correlating with Ethynodiol-Eth Estra's usage.

Emerging markets in Asia, Africa, and Latin America exhibit heightened growth potential driven by population dynamics, urbanization, and increasing health awareness. The Asia-Pacific region, for example, is expected to dominate growth, with a compound annual growth rate (CAGR) of around 6% over the next five years [2].

Regulatory Environment

Regulatory approval and patent landscapes critically influence Ethynodiol-Eth Estra’s market entry and pricing. Several key markets, including the U.S. and Europe, still have patent protections, limiting generic competition. However, patent expirations in the coming years are anticipated to introduce more generic producers, increasing supply and intensifying price competition.

For instance, the expiration of some proprietary formulations is projected around 2025–2027, which could significantly impact retail and wholesale pricing structures.

Manufacturing and Supply Chain Factors

The availability of raw materials, synthesis complexity, and manufacturing standards influence cost structures. Ethynodiol-Eth Estra's synthesis involves multi-step chemical processes requiring high-purity precursors and strict quality controls, which can limit supply flexibility and affect pricing.

Supply chain disruptions, especially amidst geopolitical tensions or regional pandemics, pose risks to consistent availability. Ensuring diversified manufacturing bases and strategic stockpiling are vital strategies for maintaining stable pricing.

Competitive Landscape

The market features several key players: Pfizer, Bayer, and several generic manufacturers from India and China. The presence of generic competitors is projected to expand with patent expiries, leading to price erosion. Brand-name formulations may maintain premium pricing due to perceived quality and regulatory advantages.

New entrants focused on biosimilar or alternative hormonal pathways pose a long-term threat to Ethynodiol-Eth Estra’s market share.

Price Trends and Projections

Historical Pricing Patterns

Historically, Ethynodiol-Eth Estra has maintained stable pricing, largely due to patent protections and limited competition. In the United States, finished dosage form prices ranged from USD 20 to USD 50 per cycle in 2018–2020, with wholesale prices slightly lower [3].

Projected Price Trends (2023–2030)

2023–2025: With patent protections intact, prices are expected to remain stable or slightly increase due to inflation and raw material costs. Innovative formulations or combination products incorporating Ethynodiol-Eth Estra could command premium prices.

2025–2027: As patent protections expire in major markets like the U.S. and Europe, a significant price decline of 15–30% is feasible, driven by entry of generics and increased competition.

2027–2030: Consolidation and increased generic penetration could result in further price reductions, averaging a 40–50% decline from peak prices. However, brand differentiation and quality assurances could sustain higher price points in premium segments.

Regional Variations

In developing markets, local production and regulatory approvals influence price levels. For example, prices in India could drop to below USD 10 per cycle due to domestic generics, whereas European markets may maintain higher prices owing to stricter regulations and brand loyalty.

Impact Factors

- Patent expirations: Major driver of price reductions post-2025.

- Market demand: Increasing acceptance of oral contraceptives sustains stable demand, supporting pricing to an extent.

- Regulatory policies: Government initiatives promoting affordable contraception could pressure prices downward.

- Raw material costs: Fluctuations in precursor prices influence manufacturing costs, with potential knock-on effects on sales prices.

Strategic Implications

Pharmaceutical companies leveraging Ethynodiol-Eth Estra should prepare for imminent patent cliffs by investing in biosimilar development or alternative formulations. Manufacturers with efficient cost structures can capitalize on higher-volume sales in emerging markets during price declines. Moreover, securing regulatory approvals and establishing reliable supply chains will be vital in navigating shifting competitive dynamics.

Conclusion

Ethynodiol-Eth Estra is positioned within a mature, yet evolving, hormonal contraceptive market. Short-term stability combined with long-term price erosion characterized by patent expiries necessitates strategic agility. Effective market penetration in emerging economies and innovation in formulation can offset declining prices, ensuring sustained profitability.

Key Takeaways

- The global Ethynodiol-Eth Estra market benefits from consistent demand within contraceptive markets, with growth concentrated in emerging economies.

- Patent protections currently sustain premium pricing; upcoming expirations are expected to instigate significant price reductions.

- Price projections indicate stable or mildly increasing prices until 2025, followed by a sharp decline of up to 50% by 2030 due to generic competition.

- Manufacturers should focus on cost optimization, regulatory agility, and diversification to preserve margins amid the evolving landscape.

- Strategic exploration of biosimilar pathways and alternative delivery systems can provide competitive advantages in a consolidating market.

FAQs

1. When are patents for Ethynodiol-Eth Estra expected to expire in major markets?

Patent expiries are projected around 2025 to 2027 in key markets such as the U.S. and Europe, opening doors for generic competition [2].

2. How will generic entry impact Ethynodiol-Eth Estra pricing?

Generic entry typically leads to substantial price reductions, often between 15–30%, while increasing supply and market accessibility.

3. What regions hold the highest growth potential for Ethynodiol-Eth Estra?

Emerging markets in Asia-Pacific, Africa, and Latin America, driven by demographic trends and expanding contraceptive access, are poised for significant growth.

4. What pricing strategies should manufacturers employ pre- and post-patent expiration?

Pre-expiration, premium positioning and formulation differentiation are advantageous. Post-expiration, competitive pricing, cost leadership, and volume scaling will be crucial.

5. Are there alternative hormonal compounds that could replace Ethynodiol-Eth Estra in contraceptives?

Yes, other progestins like levonorgestrel and desogestrel are prevalent, with innovations in delivery systems as ongoing competitive strategies.

Sources:

[1] MarketWatch, "Global Contraceptive Market Analysis," 2022.

[2] Future Market Insights, "Hormonal Contraceptives Regional Outlook," 2023.

[3] IMS Health, "Pharmaceutical Pricing Trends," 2020.

More… ↓