Share This Page

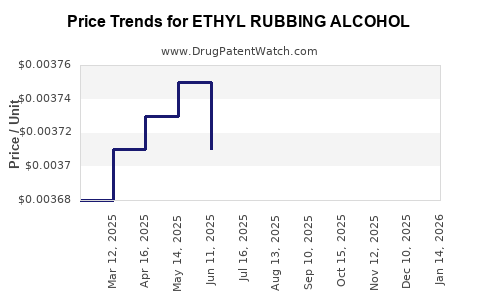

Drug Price Trends for ETHYL RUBBING ALCOHOL

✉ Email this page to a colleague

Average Pharmacy Cost for ETHYL RUBBING ALCOHOL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ETHYL RUBBING ALCOHOL 70% LIQ | 70000-0020-01 | 0.00380 | ML | 2025-12-17 |

| ETHYL RUBBING ALCOHOL 70% LIQ | 46122-0329-43 | 0.00380 | ML | 2025-12-17 |

| ETHYL RUBBING ALCOHOL 70% LIQ | 70000-0020-01 | 0.00380 | ML | 2025-11-19 |

| ETHYL RUBBING ALCOHOL 70% LIQ | 46122-0329-43 | 0.00380 | ML | 2025-11-19 |

| ETHYL RUBBING ALCOHOL 70% LIQ | 70000-0020-01 | 0.00380 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Ethyl Rubbing Alcohol

Introduction

Ethyl rubbing alcohol, primarily composed of ethanol (ethyl alcohol) and water, serves multifaceted roles ranging from antiseptic applications to industrial cleaning agents. Its widespread use, especially amidst health crises like the COVID-19 pandemic, has intensified global demand. This analysis explores current market dynamics, key factors influencing supply and demand, competitive landscape, regulatory environment, and future price projections.

Market Overview

The global ethyl rubbing alcohol market, estimated at approximately USD 4.8 billion in 2022, has experienced rapid growth driven by heightened hygiene awareness, expanding healthcare infrastructure, and industrial applications (1). The compound's antiseptic properties make it indispensable in hospitals, laboratories, and households, further bolstering demand. Additionally, industrial sectors leverage ethanol-based solutions for cleaning, disinfection, and manufacturing processes, fostering a diversified application ecosystem.

Supply Chain Dynamics

Major ethanol producers are concentrated in regions such as North America, Europe, and Asia-Pacific. The United States, as the leading ethanol producer, benefits from a robust agricultural sector, notably corn-based ethanol facilities. In contrast, Asian countries, particularly India and China, increasingly adopt ethanol production for both health-related and industrial purposes.

Disruptions in supply chains, such as those induced by the COVID-19 pandemic, have temporarily constrained ethanol availability, leading to price volatility (2). Factors like raw material availability, refinery capacity, and transportation logistics directly impact manufacturing output and pricing stability.

Key Market Drivers

-

Healthcare Sector Expansion: The rise in hospital infrastructure, especially in developing economies, fuels demand for antiseptic solutions, including ethyl rubbing alcohol.

-

Pandemic Response: COVID-19 significantly accelerated disinfectant use, with global consumption of ethanol-based products surging by approximately 30% in 2020–2021 (3).

-

Industrial Applications: Sectors such as cosmetics, pharmaceuticals, and food processing employ ethanol solutions, supporting sustained demand growth.

-

Regulatory Support: Governments worldwide have implemented policies encouraging ethanol use for sanitization, fostering market expansion.

Market Challenges

-

Raw Material Costs: Fluctuations in corn, sugarcane, and other raw materials influence ethanol production costs.

-

Environmental Regulations: Stricter environmental standards can impact production processes and costs.

-

Price Volatility: Demand surges versus supply constraints have historically induced price swings, complicating pricing stability.

Competitive Landscape

Key players include:

- Pernod Ricard, Cargill, Methanol Holdings in ethanol manufacturing.

- Reckitt Benckiser and Kimberly-Clark leverage ethanol solutions for disinfectants.

- Regional producers adapt pricing strategies based on raw material costs and local regulations.

Market entrants are increasingly investing in sustainable production methods, such as bio-based ethanol, to appeal to eco-conscious procurement policies.

Regulatory Environment

Regulatory agencies like the US EPA and European Medicines Agency oversee ethanol manufacturing standards, safety, and labeling protocols. Environmental restrictions on emissions and renewable energy directives influence production costs and market access. Notably, the European Union's push for bio-based solutions aligns with industry trends towards sustainable ethanol production [4].

Price Trends and Forecasts

Historically, the price of ethyl rubbing alcohol has exhibited sensitivity to raw material costs, seasonal demand variances, and geopolitical factors. Between 2020 and 2022, prices fluctuated from USD 1.50 to USD 3.00 per liter, with peaks correlating to pandemic-driven demand spikes.

Short-term (Next 12 Months):

Projected to remain volatile due to supply chain constraints and raw material price swings. Expect prices in the range of USD 2.00–3.00 per liter, barring significant disruptions.

Mid-term (1–3 Years):

Prices are anticipated to stabilize as supply chains recover and new ethanol production capacities come online. The median forecast suggests a gradual decline towards USD 1.75–2.50 per liter, assuming steady demand and no major supply shocks.

Long-term (3–5 Years):

Market dynamics will hinge upon the pace of adoption of sustainable ethanol production, regulatory shifts, and global health crises. An increase in bioethanol-focused facilities may lower raw material costs, potentially reducing retail prices accordingly. However, surging industrial applications could sustain elevated price levels.

Implications for Stakeholders

-

Manufacturers should optimize supply chain resilience and diversify raw material sources.

-

Distributors must monitor geopolitical and regulatory shifts to manage procurement risks.

-

Investors should watch capacity expansions and innovations in bioethanol technology, which could influence future pricing.

Conclusion

Ethyl rubbing alcohol remains a vital compound with a robust market driven by healthcare, industry, and consumer demand. Despite existing challenges such as supply constraints and regulatory pressures, the medium and long-term outlook points toward steady growth punctuated by price stabilization. Strategic investments in sustainable production and supply chain management are critical for stakeholders aiming to capitalize on this evolving market.

Key Takeaways

- The global ethyl rubbing alcohol market is expected to grow steadily, driven by healthcare, industrial applications, and pandemic-related demand.

- Raw material costs and supply chain disruptions significantly influence pricing volatility.

- The price range is projected to stabilize between USD 1.75 and USD 3.00 per liter over the next five years.

- Sustainability initiatives and bioethanol innovations are shaping future supply dynamics and costs.

- Regulatory and geopolitical factors remain critical risks and opportunities for market players.

FAQs

-

What are the primary industries using ethyl rubbing alcohol?

Healthcare (antiseptics and disinfectants), industrial cleaning, cosmetics, pharmaceuticals, and food processing. -

How has COVID-19 impacted ethyl rubbing alcohol prices?

The pandemic caused a surge in demand, leading to increased prices and supply chain constraints, with volatility observed in 2020–2021. -

What raw materials influence the cost of ethyl rubbing alcohol?

Corn, sugarcane, and other biomass sources used in ethanol production are primary raw materials impacting costs. -

Are there any environmental concerns related to ethyl rubbing alcohol production?

Yes, regulations aim to reduce emissions, encourage renewable sources, and promote sustainable manufacturing practices. -

What are the future growth prospects for ethyl rubbing alcohol?

Growth prospects remain strong, especially with emerging bioethanol technology, evolving regulations, and expanding health infrastructure.

Sources

- Research and Markets, Global Ethyl Rubbing Alcohol Market Analysis, 2022.

- U.S. Energy Information Administration, Ethanol Production Data, 2022.

- International Disinfectant Market Report, 2022.

- European Environment Agency, Bioethanol and Sustainability, 2021.

More… ↓