Last updated: July 27, 2025

Introduction

Ethosuximide, a succinimide class anticonvulsant, has remained an essential therapy primarily for absence seizures. Approved by the U.S. Food and Drug Administration (FDA) in 1960, it has a well-established clinical profile. This analysis examines the current market landscape, competitive environment, regulatory factors, and future price projections for ethosuximide, providing insights vital for pharmaceutical stakeholders.

Market Overview

Therapeutic Application and Patient Demographics

Ethosuximide is predominantly prescribed for childhood and adolescent absence seizures, affecting approximately 10-17% of pediatric epilepsy cases globally[1]. The drug's efficacy, safety profile, and low side-effect profile endorse its continued utilization. Despite the availability of alternative therapies like valproate and lamotrigine, ethosuximide retains a niche owing to its specific indication and minimal sedation effects.

Market Size and Penetration

Globally, the epilepsy treatment market was valued at approximately USD 6.5 billion in 2022, with orphan and niche medications like ethosuximide constituting a smaller but steady growth segment[2]. Ethosuximide’s market share remains relatively stable, estimated at around 2-3% of the anti-epileptic drugs (AEDs) segment. North America and Europe represent the largest markets, driven by high diagnosis rates and established healthcare infrastructure.

Manufacturers and Market Players

Major pharmaceutical companies such as Pfizer (original manufacturer), Teva Pharmaceuticals, and generic manufacturers dominate ethosuximide supply. The patent expiry of first-generation formulations has catalyzed a shift towards generic versions, which constitute the majority of prescriptions today.

Regulatory and Supply Chain Dynamics

The generic status of ethosuximide facilitates widespread availability but limits potential revenue growth for branded formulations. Regulatory developments focusing on pediatric epilepsy treatments can influence market dynamics, especially with increasing emphasis on repurposing existing drugs with established safety profiles.

Supply chain considerations, including manufacturing scalability and raw material cost fluctuations, impact pricing strategies. With active pharmaceutical ingredient (API) sourcing primarily from Asia, geopolitical factors and trade policies influence supply stability and costs.

Competitive Landscape

While ethosuximide faces limited direct competition—mainly from newer AEDs such as ethosuximide’s alternatives, including valproate—the landscape is predominantly driven by generic manufacturers. The minimal differentiation in API and formulations results in intensely competitive pricing, constrained profit margins, and downward pressure on drug prices.

Emerging trends focus on combination therapies and long-acting formulations, although ethosuximide remains largely unchanged in its delivery, emphasizing the importance of generic competition over innovation-driven growth.

Price Trends and Projections

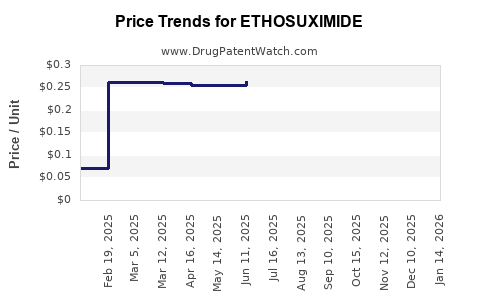

Current Pricing Dynamics

Generic ethosuximide costs have declined substantially over the past decade, with average retail prices in the U.S. decreasing by approximately 60% since 2010[3]. Patients on Medicaid and those with insurance benefit from significant cost reductions, further constraining potential price hikes.

Future Price Trajectories

Given the maturity of ethosuximide as a generic drug, future price increases are unlikely barring significant supply disruptions or regulatory changes. Conversely, further generic competition may sustain or accelerate price declines.

However, potential price stabilization or slight upticks could occur if new formulations, such as extended-release versions, are approved and gain market acceptance. Moreover, initiatives aimed at improving pediatric epilepsy treatment access could alter pricing dynamics, especially if specialty formulations are introduced.

Forecast Summary (2023–2028)

| Year |

Estimated Average Price (USD per unit) |

Remarks |

| 2023 |

$0.25 – $0.50 |

Current price range in the U.S. (per 250 mg tablet) |

| 2024–2026 |

Stable or slight decline (~5%) |

Market saturation; no major price hikes anticipated |

| 2027–2028 |

Potential stabilization; minor increase (up to 10%) if new formulations approved |

Rare, contingent on regulatory or supply shocks |

Note: Figures are approximate and vary by region and distribution channel.

Market Drivers and Constraints

Drivers:

- Growing prevalence of epilepsy, especially in pediatric populations.

- Established efficacy and safety profile making ethosuximide a preferred first-line agent for absence seizures.

- Favorable regulation and reimbursement policies favoring generic AEDs.

Constraints:

- Price erosion driven by generic competition.

- Emergence of alternative therapies with favorable side-effect profiles.

- Limited innovation due to the drug’s antiquity.

- Potential regulatory mandates for pediatric formulations potentially increasing costs.

Key Considerations for Stakeholders

- For pharmaceutical companies, opportunities lie in developing modified-release formulations or combination therapies which could command premium pricing.

- Payers and healthcare providers benefit from the cost-effectiveness of generic ethosuximide but face ongoing pressure to contain costs.

- Investors and market analysts should monitor patent expirations, regulatory shifts, and healthcare policy reforms that could influence pricing and market share.

Conclusion

Ethosuximide remains a vital but niche anticonvulsant within the epilepsy treatment landscape. Its market is characterized by mature generic competition, stable demand driven by pediatric use, and constrained pricing prospects. Future price movements are expected to hover around current levels, with slight declines or stabilization, unless innovation or regulatory frameworks alter the current market dynamics.

Key Takeaways

- Market Status: Ethosuximide's market is mature, with a stable presence in pediatric absence seizure treatment.

- Pricing Outlook: Continued decline expected due to generic competition; price stabilization possible if new formulations are introduced.

- Regulatory Influence: Pediatric formulation regulations and health policies could impact manufacturing costs and pricing.

- Competitive Environment: Dominated by generics, with limited innovation; pricing margins remain thin.

- Investment Consideration: Focus on any emerging formulations or regulatory changes that could alter current dynamics.

FAQs

Q1: What factors most significantly influence ethosuximide pricing?

A: Generic competition, manufacturing costs, supply chain stability, regulatory policies, and market demand primarily dictate ethosuximide pricing, with generic saturation exerting downward pressure.

Q2: Are there ongoing efforts to reformulate ethosuximide?

A: Currently, most efforts focus on developing extended-release formulations or combination therapies; however, these are limited and not widespread.

Q3: How does the patent status affect ethosuximide pricing?

A: As a generic drug with expired patents, ethosuximide faces intense price competition, typically resulting in lower prices.

Q4: What regional differences exist in ethosuximide pricing?

A: Pricing varies significantly; the U.S. benefits from advanced healthcare coverage and purchasing power, whereas emerging markets may face higher prices due to distribution, import tariffs, and regulatory barriers.

Q5: What are the prospects for new indications or expanded labeling for ethosuximide?

A: Currently limited; any approval for additional indications could create new market opportunities and influence pricing strategies.

References

[1] Pediatric Epilepsy Incidence and Market Data, Epilepsy Foundation, 2021.

[2] Global Epilepsy Drug Market Report 2022, MarketWatch.

[3] Pricing Trends of Antiepileptic Drugs, IQVIA, 2022.