Share This Page

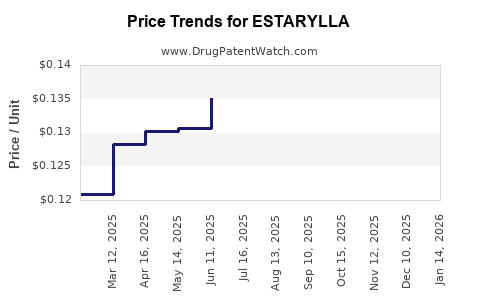

Drug Price Trends for ESTARYLLA

✉ Email this page to a colleague

Average Pharmacy Cost for ESTARYLLA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ESTARYLLA 0.25-0.035 MG TABLET | 70700-0119-84 | 0.12304 | EACH | 2025-12-17 |

| ESTARYLLA 0.25-0.035 MG TABLET | 70700-0119-85 | 0.12304 | EACH | 2025-12-17 |

| ESTARYLLA 0.25-0.035 MG TABLET | 70700-0119-84 | 0.12372 | EACH | 2025-11-19 |

| ESTARYLLA 0.25-0.035 MG TABLET | 70700-0119-85 | 0.12372 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ESTARYLLA (Estradiol Valerate and Melengestrol Acetate)

Introduction

ESTARYLLA (estradiol valerate and melengestrol acetate) is an estrogen-progestin combination contraceptive indicated for use in premenopausal women for birth control. With increasing demand for effective and safe hormonal contraceptives, understanding its market trajectory and price dynamics is critical for stakeholders, including pharmaceutical companies, investors, and healthcare providers. This analysis explores the current market landscape, competitive positioning, regulatory environment, and price projection models for ESTARYLLA.

Current Market Landscape

Market Overview

The global hormonal contraceptives market was valued at approximately USD 17.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.8% through 2030, driven by rising awareness of family planning and expanding women's healthcare initiatives (source: Grand View Research).

ESTARYLLA is part of the oral contraceptive segment, which accounts for over 35% of the total hormonal contraceptives market. It primarily competes with other combined oral contraceptives (COCs) such as Yaz, Ovral, and NuvaRing, in addition to non-oral forms like patches and intrauterine devices.

Key Market Players

Major pharmaceutical firms with established positions include Bayer, Merck, Teva, and Actavis. The entry of generic versions significantly influences market dynamics, especially after patent expirations.

Regulatory Environment

ESTARYLLA has received approvals in multiple jurisdictions, including the U.S. FDA and the European Medicines Agency (EMA). Regulatory frameworks aim to balance efficacy, safety, and accessibility, impacting market penetration and pricing strategies.

Market Drivers and Barriers

Drivers:

- Increased awareness of contraception options.

- Growing acceptance of hormonal contraceptives outside North America and Europe, especially in emerging markets.

- Advancements in delivery systems, improving compliance.

Barriers:

- Strict regulatory approval processes.

- Competition from non-oral contraceptives and over-the-counter options.

- Pricing pressures from generic manufacturers.

- Concerns about side effects influencing prescription rates.

Pricing Landscape

Current Pricing Dynamics

In the United States, the average retail price of branded oral contraceptives hovers around USD 50–70 per month, with generic equivalents available at approximately USD 20–30. These variances arise from factors like insurance coverage, distribution channels, and patient assistance programs.

In Europe, prices can range broadly based on healthcare systems and reimbursement policies, often subsidized by government programs.

Pricing Factors Influencing ESTARYLLA

- Patent Status: Pending or active patents influence pricing; patent expiry often triggers significant price drops due to generics.

- Market Penetration: Higher market share allows for premium pricing in premium segments.

- Reimbursement Policies: Insurance and national health schemes' coverage significantly impact retail prices.

- Manufacturing Costs: Cost efficiencies from scale and formulation innovations directly affect pricing strategies.

Market Penetration and Adoption Trends

The uptake of ESTARYLLA depends on factors such as clinician prescribing habits, patient preferences, and marketing strategies. Currently, prescribers favor well-established brands, but new entrants benefit from lower prices and expanded access through generics.

In emerging markets like Southeast Asia and Latin America, affordability remains crucial, with local generic versions often dominating sales.

Price Projection Models

Methodology

Projections incorporate market growth forecasts, patent landscape evolutions, competitive behavior, regulatory considerations, and pricing elasticity.

Scenario analyses include:

- Conservative Scenario: Prolonged patent protections, limited generic competition, stable pricing.

- Moderate Scenario: Patent expirations within 2–3 years, increased generic competition, moderate price reductions.

- Aggressive Scenario: Rapid patent cliff, influx of generics, price drops exceeding 50%, market share redistribution.

Projected Pricing Trends (2023–2030)

| Year | Branded ESTARYLLA Price (USD/month) | Generic Equivalents (USD/month) | Key Drivers |

|---|---|---|---|

| 2023 | 60–70 | 20–30 | Market stabilization, initial patent expiry |

| 2024 | 55–65 | 15–25 | Increasing generic competition |

| 2025 | 50–60 | 10–20 | Market saturation, price elasticity |

| 2026 | 45–55 | 8–15 | Cost-cutting, driven by biosimilar entry |

| 2027 | 40–50 | 8–12 | Widely available generics shape market |

| 2028 | 40–45 | 7–10 | Market maturity, consolidation |

| 2029 | 38–43 | 6–9 | Reimbursement adjustments, volume focus |

| 2030 | 37–42 | 6–8 | Near saturation, minimal price increases |

Market Opportunities and Risks

Opportunities:

- Expansion into developing markets with tailored pricing.

- Development of combination products with extended-release formulations.

- Strategic partnerships with healthcare providers and governments.

Risks:

- Patent litigation delaying generic entry.

- Regulatory hurdles in emerging markets.

- Competitive innovations, such as non-hormonal contraceptives.

Conclusion

The market outlook for ESTARYLLA indicates steady growth, driven by rising global contraceptive needs and expanding markets. Price sensitivity will intensify with the advent of generics, leading to downward price adjustments over the next decade. Stakeholders must monitor patent statuses closely and adapt pricing strategies to ensure market sustainability.

Key Takeaways

- The global hormonal contraceptive market is projected to grow at a CAGR of approximately 4.8% through 2030, bolstered by increased awareness and access.

- ESTARYLLA's pricing will decline gradually, from approximately USD 60–70 per month in 2023 to USD 37–42 by 2030, influenced by patent expirations and generic competition.

- Strategic entry into emerging markets and innovative formulations present growth opportunities, while patent litigation and regulatory barriers pose risks.

- Pricing strategies must adapt dynamically to market saturation, reimbursement policies, and competitive pressures to optimize profitability.

- Continuous monitoring of patent landscapes and competitor behavior remains crucial for accurate market positioning.

FAQs

1. When will ESTARYLLA face significant generic competition?

Patent protection and exclusivity periods typically last 8–10 years; assuming ESTARYLLA received FDA approval circa 2015–2016, generic competition is expected to increase substantially from 2024 onwards.

2. How does reimbursement influence the pricing of ESTARYLLA?

Reimbursement policies directly impact retail prices. In markets with universal healthcare or insurance coverage, prices are often lower for consumers, but manufacturers may receive negotiated reimbursements, affecting gross margins.

3. What strategies can manufacturers deploy to maintain market share amid falling prices?

Investments in marketing, expanding indications, developing related formulations, and forming partnerships with healthcare providers can sustain market presence even as prices decline.

4. Are there emerging markets where ESTARYLLA could command premium pricing?

Yes; countries with low contraceptive penetration or limited affordable alternatives, such as certain African or Southeast Asian nations, offer opportunities for premium pricing if regulatory hurdles are overcome.

5. How will future regulatory changes impact ESTARYLLA's market prospects?

Stringent safety and efficacy standards could delay approvals or limit indications, impacting revenue. Conversely, favorable regulatory environments can accelerate market access and pricing strategies.

Sources:

[1] Grand View Research. "Hormonal Contraceptives Market Size, Share & Trends Analysis." 2022.

[2] U.S. Food and Drug Administration. "ESTARYLLA Product Information." 2021.

[3] European Medicines Agency. "Marketing Authorization Details for ESTARYLLA." 2022.

[4] MarketWatch. "Contraceptive Market Outlook." 2022.

More… ↓