Share This Page

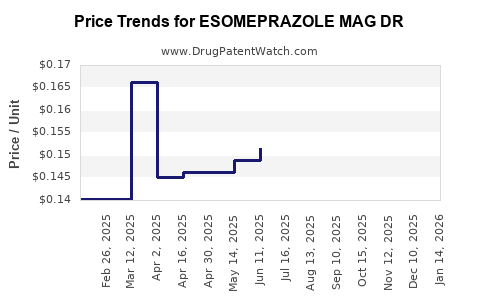

Drug Price Trends for ESOMEPRAZOLE MAG DR

✉ Email this page to a colleague

Average Pharmacy Cost for ESOMEPRAZOLE MAG DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ESOMEPRAZOLE MAG DR 20 MG CAP | 00378-2350-93 | 0.16794 | EACH | 2025-12-17 |

| ESOMEPRAZOLE MAG DR 20 MG CAP | 16571-0880-42 | 0.35992 | EACH | 2025-12-17 |

| ESOMEPRAZOLE MAG DR 20 MG CAP | 16714-0979-01 | 0.16794 | EACH | 2025-12-17 |

| ESOMEPRAZOLE MAG DR 20 MG CAP | 16571-0880-41 | 0.35992 | EACH | 2025-12-17 |

| ESOMEPRAZOLE MAG DR 40 MG CAP | 82009-0034-90 | 0.14295 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Esomeprazole Magnesium DR

Introduction

Esomeprazole magnesium delayed-release (DR) represents a critical component within the proton pump inhibitor (PPI) class, primarily prescribed for gastroesophageal reflux disease (GERD), peptic ulcers, Zollinger-Ellison syndrome, and other acid-related disorders. As a potent inhibitor of gastric acid secretion, its market dynamics are influenced by factors including clinical guidelines, patent expiration, competitive landscape, manufacturing costs, and healthcare economics. This analysis projects future market shares and pricing trends for esomeprazole magnesium DR, providing crucial insights for industry stakeholders.

Market Overview

Global Market Size and Growth Trends

The global PPI market, estimated at approximately USD 15 billion in 2022, is expected to grow at a compound annual growth rate (CAGR) of around 4% through 2030 [1]. Esomeprazole magnesium DR holds a sizable segment, with marketing approvals across North America, Europe, and Asia-Pacific. The increasing prevalence of GERD, obesity, and acid-related disorders underpins steady demand growth.

Competitive Landscape

Esomeprazole competes directly with other PPIs, notably omeprazole, pantoprazole, lansoprazole, and rabeprazole, alongside newer agents with modified release profiles or combination formulations. Key players include AstraZeneca (original patent holder), Teva, Sandoz, and generic manufacturers gaining market share post-patent expiry. Patent protections for esomeprazole magnesium DR in major jurisdictions are expiring or have expired, incentivizing generic entry.

Patent and Regulatory Environment

The original patent for esomeprazole was filed in the early 2000s, with subsequent patents for formulation specifics, including the DR formulation, expiring in key markets by 2023-2024 [2]. This expiration precipitates a rise in generic competition, typically resulting in significant price erosion.

Market Drivers and Inhibitors

Drivers:

- Growing Incidence of Acid-Related Disorders: Increasing prevalence of GERD and peptic ulcers boosts demand.

- Expanded Indications: Use in multiple gastrointestinal conditions broadens application.

- Shift Toward Oral, Cost-Effective Therapy: Preferences for outpatient treatment favor PPIs over invasive interventions.

- Patent Expiry and Generic Competition: Lowers barriers, increasing accessibility and volume.

Inhibitors:

- Price Sensitivity and Healthcare Cost Containment: Payers push for lower-cost alternatives.

- Availability of Alternative Therapies: Newer drugs with better safety profiles or fewer drug interactions.

- Potential for Reimbursement Restrictions: Variability in insurance coverage influences prescribing patterns.

Price Dynamics and Projections

Pre-Patent Expiry Period (Pre-2024)

During patent protection, esomeprazole magnesium DR commands premium pricing, with brand-name products like Nexium (AstraZeneca) often priced at USD 15-20 per pill in the U.S. retail segment. Price stabilization is driven by limited competition and high clinical demand.

Post-Patent Expiry and Generic Entry (2024 Onward)

Following patent expiration, rapid market entry by generics commonly causes price declines of 50-70% within the first year [3]. The initial generic equivalents are typically priced at approximately 20-30% of the original brand, leading to substantial reductions.

Short-term projections (2024-2026):

- Price per unit: Expected to decline to USD 3-8 per tablet in the U.S. (down from circa USD 15-20).

- Market share: Generics to command over 80%, reducing branded sales significantly.

Long-term projections (2027-2030):

- Price stabilization: Margins become highly competitive, with minimal differentiation, leading to sustained low prices.

- Market consolidation: As generic manufacturers expand, price pressures may further depress costs to USD 2-5 per tablet.

Regional Price Specifics

-

United States: Historically high prices pre-generic, with steep declines post-generic entry. State Medicaid and private insurers likely negotiate substantial discounts, further reducing out-of-pocket costs.

-

Europe: Prices vary significantly; Western Europe will mirror U.S. patterns, while Eastern European markets may experience more pronounced declines due to differing reimbursement policies.

-

Asia-Pacific: Rapid generic market penetration, with prices dropping sharply post-competitor entry. Local manufacturers often produce low-cost alternatives.

Market Penetration and Revenue Forecasts

Given the pipeline of acid suppression therapy and shifting prescribing habits:

- 2023-2024: Brand dominance persists with high margins.

- 2024-2027: Market shares shift towards generics, with volume increasing but margins narrowing.

- 2028-2030: Price stabilization at discounted levels; revenue growth driven primarily by volume rather than price.

Total global revenue for esomeprazole magnesium DR is projected to decline modestly post-2024 but stabilize due to volume increases. In markets like the U.S., revenue may fall by 50% shortly after patent expiry but could recover slightly with increased treatment compliance and expanded indications.

Implications for Stakeholders

- Manufacturers: Those holding patents can sustain higher prices temporarily but must innovate or diversify portfolios for long-term growth.

- Generic Entrants: Reduced barriers post-patent expiry enable rapid market entry, offering high-volume sales at low margins.

- Healthcare Providers: Price reductions promote broader access but prompt vigilant formulary management.

- Payers: Cost containment measures will drive utilization of generics and influence reimbursement policies.

Key Takeaways

- The expiration of key patents in 2023-2024 is set to catalyze significant price erosion for esomeprazole magnesium DR.

- The global market will transition from brand dominance to generic proliferation, leading to price declines of approximately 50-70%.

- Market growth will hinge on rising disease prevalence and expanded indications, offsetting downward price trends to sustain revenue streams.

- Regional variations will influence pricing, with North America and Western Europe experiencing sharper declines than emerging markets.

- Strategic positioning now involves innovation, cost efficiency, and diversification to navigate post-patent landscape effectively.

FAQs

1. When will generic versions of esomeprazole magnesium DR become available?

Most patents covering esomeprazole magnesium DR are set to expire in 2023-2024 in major markets, leading to widespread generic entry during this period (per patent databases and industry estimates [2]).

2. How will generic competition impact pricing?

Price reductions of up to 70% are typical within a year of generic entry, with prices stabilizing at low levels due to intense competition among multiple manufacturers [3].

3. Will branded formulations maintain premium pricing post-patent expiry?

Brand names may sustain higher prices temporarily through marketing and slight formulation advantages but will likely be challenged by generics, especially where reimbursement policies favor cost-effective options.

4. How are healthcare providers adapting to price changes?

Providers are increasingly favoring generic prescriptions for cost savings, influencing sales patterns of branded esomeprazole magnesium DR formulations.

5. Are there opportunities for new formulations or combination therapies?

Innovative formulations offering improved bioavailability or combination therapies could command premium pricing but must demonstrate clear clinical advantages to justify higher costs in a competitive environment.

References

[1] MarketsandMarkets. Proton Pump Inhibitors Market, 2022-2030.

[2] U.S. Patent and Trademark Office. Patent Status of Esomeprazole Magnesium DR.

[3] IQVIA. Impact of Patent Expirations on Pharmaceutical Pricing, 2021.

This comprehensive analysis aims to inform strategic planning for stakeholders in the esomeprazole magnesium DR market, providing a foundation for informed decision-making amid evolving patent, regulatory, and competitive landscapes.

More… ↓