Share This Page

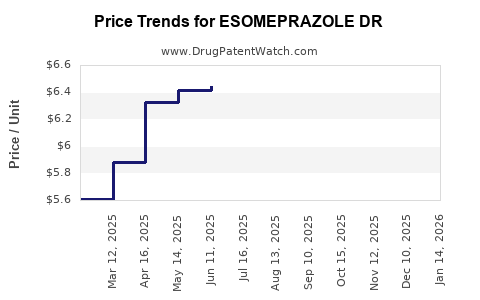

Drug Price Trends for ESOMEPRAZOLE DR

✉ Email this page to a colleague

Average Pharmacy Cost for ESOMEPRAZOLE DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ESOMEPRAZOLE DR 10 MG PACKET | 13668-0548-94 | 6.81103 | EACH | 2025-12-17 |

| ESOMEPRAZOLE DR 2.5 MG PACKET | 13668-0546-94 | 6.98028 | EACH | 2025-12-17 |

| ESOMEPRAZOLE DR 20 MG PACKET | 69097-0528-34 | 5.89619 | EACH | 2025-12-17 |

| ESOMEPRAZOLE DR 5 MG PACKET | 69097-0508-31 | 6.95645 | EACH | 2025-12-17 |

| ESOMEPRAZOLE DR 10 MG PACKET | 69097-0527-34 | 6.81103 | EACH | 2025-12-17 |

| ESOMEPRAZOLE DR 20 MG PACKET | 13668-0549-94 | 5.89619 | EACH | 2025-12-17 |

| ESOMEPRAZOLE DR 2.5 MG PACKET | 69097-0507-31 | 6.98028 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Esomeprazole DR

Introduction

Esomeprazole DR (delayed-release) is a proton pump inhibitor (PPI) primarily used for gastroesophageal reflux disease (GERD), peptic ulcer disease, and Zollinger-Ellison syndrome. The drug’s advanced formulation enhances gastric acidity control, offering improved therapeutic outcomes. As the global demand for effective acid suppression therapies increases, understanding the market landscape and pricing trajectory for Esomeprazole DR is vital for stakeholders including pharmaceutical companies, investors, and healthcare providers.

Market Overview

Global Demand and Market Size

The PPI market, valued at approximately USD 12.1 billion in 2022, is projected to grow at a CAGR of 4.3% through 2030, influenced by increasing GERD prevalence, aging populations, and expanding indications for acid suppression therapies [1]. Esomeprazole, notably branded as Nexium, maintains a significant market share, with generic versions intensifying competition.

Key Market Drivers

- High prevalence of GERD and peptic ulcers: Estimated to affect over 30% of the adult population worldwide, with rising incidence correlating with obesity and lifestyle changes.

- Expanding indications: Off-label uses, such as for Helicobacter pylori eradication, bolster demand.

- Generic entry: Patent expirations for branded formulations (Nexium’s patent expired in 2015) have spurred generic proliferation, intensifying price competition but maintaining volume growth.

- Emerging markets: Increasing healthcare infrastructure investments and rising health awareness augment demand in Asia-Pacific, Latin America, and Africa.

Competitive Landscape

The market features a blend of branded and multiple generic competitors. Key players include AstraZeneca (Nexium), Teva, Mylan, Sun Pharmaceutical, and Dr. Reddy's Laboratories. The presence of numerous generics ensures substantial price erosion but sustains volume-driven revenues.

Regulatory and Patent Dynamics

Patent Horizon

While the primary patent for Nexium lapsed in 2015, secondary patents related to formulations and delivery mechanisms may extend exclusivity subtly, influencing pricing and market entry strategies.

Regulatory Approvals

Regulatory agencies, including the FDA and EMA, have approved various formulations of esomeprazole, including delayed-release capsules, tablets, and in some cases, IV formulations. The approval of new formulations or combination therapies could impact market dynamics, affecting pricing and demand.

Price Analysis and Projections

Current Pricing Landscape

- Branded: Nexium commands premium pricing, often 20-50% above generics, with wholesale prices ranging from USD 3 to USD 5 per capsule in the U.S.

- Generics: Entry of multiple generics has slashed prices substantially, with average prices dropping by approximately 70% since patent expiry. Current market prices for generics in the U.S. hover around USD 0.50 to USD 1.00 per capsule.

- Emerging Markets: Prices are further reduced, with local manufacturing and regulatory pricing controls influencing cost dynamics.

Price Trajectory Forecast (2023-2028)

The price trend indicates continued erosion for branded esomeprazole, driven by generics' intensifying competition. However, demand stability and potential new formulations or combination therapies could support marginal price stabilization.

- Short-term (1-2 years): The market is expected to see negligible fluctuations for generics, maintaining low prices. Branded prices may decrease further, but at a slower rate due to existing patent protections.

- Medium-term (3-5 years): As patent defenses weaken and biosimilar or alternative formulations emerge, pricing may stabilize or slightly decline. Introductions of value-added versions (e.g., combination drugs, extended-release formulations) could create pockets of premium pricing.

- Long-term (5+ years): Market saturation and persistent generic competition are projected to suppress prices further, with average prices potentially decreasing to USD 0.20 - USD 0.50 per capsule in mature markets.

Factors Influencing Price Movement

- Patent litigation and protections: Delays in generic entry due to patent disputes can sustain higher prices temporarily.

- Regulatory policies: Price control regulations, especially in Europe and Asia, can depress prices.

- Market access and reimbursement: Government reimbursement policies favoring generics accelerate price declines.

- Emergence of biosimilars or alternative therapies: Competing modalities like H2 receptor antagonists or novel acid suppressants may impact demand and pricing.

Regional Market Dynamics

| Region | Price Trends | Key Influences |

|---|---|---|

| North America | Declining for generics; stable/branded premium for future offerings | Patent expiries, healthcare reforms, high drug utilization |

| Europe | Similar to North America; price controls limit variability | Stringent price regulation, reimbursement frameworks |

| Asia-Pacific | Lower prices; rapid growth in volume | Growing healthcare access, local production, regulatory barriers |

| Latin America & Africa | Lower cost, variable prices | Cost-sensitive markets, limited access, local manufacturing |

Strategic Implications for Stakeholders

- Pharmaceutical companies should anticipate further price erosion for generic esomeprazole and innovate through biosimilars or new delivery systems.

- Investors should monitor patent litigation timelines, pipeline developments, and regulatory policies that can influence profitability.

- Healthcare providers should consider cost-effective generic options, balancing efficacy with affordability.

- Regulators play a pivotal role in balancing access with innovation incentives through patent and pricing policies.

Key Takeaways

- The global esomeprazole DR market is characterized by high volume but declining prices due to extensive generic competition.

- Short-to-medium-term projections indicate persistent price declines, with prices in mature markets likely to stabilize at or below USD 0.50 per capsule.

- Market players should invest in formulation innovation, biosimilar development, and strategic patent management to sustain profitability.

- Regulatory and reimbursement policies considerably influence regional price variations, requiring tailored strategies per market.

- Growing demand in emerging markets offers substantial volume opportunities, albeit at lower pricing levels.

FAQs

1. What factors most significantly influence esomeprazole DR prices?

Patent status, generic competition, regulatory policies, and regional healthcare reimbursement strategies primarily impact prices.

2. When will branded esomeprazole (Nexium) regain pricing power?

Given patent expiries and aggressive generic competition, branded pricing power is unlikely to return in the near future unless innovative formulations or patent protection are introduced.

3. How do emerging markets affect the global esomeprazole market?

Emerging markets contribute increasing volumes with lower price points, expanding overall market size but limiting margins for manufacturers.

4. Are there new formulations of esomeprazole expected to impact prices?

Yes, potential new formulations, such as combination drugs or extended-release versions, could command premium pricing but will face competition from established generics.

5. What strategies should generic manufacturers adopt?

Focus on cost-efficient manufacturing, securing regulatory approvals swiftly, and exploring niche indications or formulations to differentiate offerings.

References

[1] Research and Markets. Proton Pump Inhibitors (PPIs) Market Forecasts, 2023.

[2] IQVIA Data. Global Pharmaceutical Pricing & Market Trends, 2022.

[3] IMS Health. Global Drug Price Trends, 2022.

More… ↓