Last updated: July 27, 2025

rket Analysis and Price Projections for ERTAPENEM

Introduction

Ertapenem, marketed under brand names such as Invanz, is a carbapenem antibiotic used primarily for complicated intra-abdominal infections, skin and soft tissue infections, community-acquired pneumonia, and as surgical prophylaxis. As a broad-spectrum β-lactam with once-daily dosing, Ertapenem remains a vital component in antimicrobial therapy. This analysis evaluates the current market landscape, competitive dynamics, regulatory environment, and provides insightful price projections to guide industry stakeholders.

Market Overview

Global Demand and Epidemiological Trends

The global antibiotic market is witnessing steady growth driven by increasing bacterial infections, rising antimicrobial resistance (AMR), and expanding healthcare infrastructure, especially in emerging markets[1]. Specifically, the demand for broad-spectrum carbapenems like Ertapenem is rising due to their efficacy against resistant pathogens.

Ertapenem's segment growth is also supported by the rising prevalence of complicated infections. According to WHO data, antimicrobial resistance causes over 700,000 deaths globally annually, compelling increased usage of advanced antibiotics[2]. As hospitals implement stewardship programs to optimize antimicrobial use, the demand for prescription-specific, broad-spectrum agents like Ertapenem remains high.

Market Segmentation and Regional Dynamics

-

North America: Dominates the global Ertapenem market due to high healthcare spending, routine antimicrobial use, and strict regulatory pathways. The U.S. accounts for the largest share, with approximately 40% of the global market[3].

-

Europe: Second in market share, driven by high prevalence of resistant infections and stringent treatment guidelines that favor carbapenem use.

-

Emerging Markets (Asia-Pacific, Latin America, Middle East): Exhibit rapid growth potential, fueled by expanding healthcare access, increasing infection rates, and lower drug prices driven by generic competition.

Competitive Landscape

Several pharmaceutical companies produce Ertapenem, including Merck (Invanz), Sagent Pharmaceuticals, and Teva Pharmaceuticals. Merck remains the market leader with patent protections expiring at different intervals across regions. The transition from patented formulations to generics has substantially impacted pricing dynamics, especially in price-sensitive markets.

Patent expiry and generics proliferation have led to increased competition, exerting downward pressure on prices[4]. Moreover, the emergence of biosimilars or new carbapenems (e.g., Doripenem, Meropenem) constrains growth.

Regulatory and Patent Status

Ertapenem entered the market in 2001, with patent protection in the U.S. and Europe lasting until approximately 2017–2018. The expiration of these patents triggered generic entries, significantly affecting pricing. Regulatory agencies like the FDA and EMA maintain stringent approval standards but continue to approve biosimilars and generic versions, further intensifying market competition.

In low- and middle-income countries (LMICs), regulatory barriers are less restrictive, often resulting in earlier generic market entry, amplifying volume but depressing prices.

Pricing Dynamics and Factors Influencing Prices

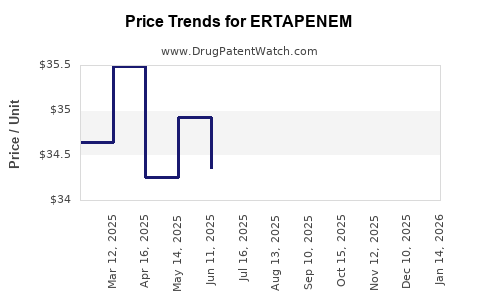

Current Pricing Environment

-

Brand-name Ertapenem products typically retail at approximately $100–$150 per vial in developed markets, varying based on formulation, dosage, and purchase agreements[5].

-

Generic versions often sell for $20–$50 per vial, depending on regional market conditions and volume discounts.

Key Price Influencers

- Patent status: Patent expiry leads to price erosion due to generic competition.

- Regulatory approvals: Faster approvals in LMICs boost volume, impacting global pricing strategies.

- Manufacturing costs: Economies of scale in generic production reduce prices.

- Reimbursement policies: Insurance coverage levels influence patient out-of-pocket expenses and attempts by manufacturers to set competitive pricing.

- Antimicrobial stewardship: Policies limiting unnecessary carbapenem usage can restrict volume, impacting revenue and price strategies.

Market Projections and Future Price Trends

Short-term Outlook (1–3 Years)

The imminent patent expirations in key regions (U.S. and Europe) are expected to introduce multiple generics, placing continued downward pressure on prices. Industry analysts forecast a 10–15% annual decline in average pricing for brand-name Ertapenem in these regions, reflecting increased competition.

Simultaneously, growth in the volume of prescriptions—a result of expanding indications and higher bacterial resistance—could partially offset price declines, supporting overall revenue stability or modest growth in specific markets.

Medium- to Long-term Outlook (3–5 Years)

By 2026–2028, the proliferation of generic options is projected to push prices down further, with some markets witnessing per-vial prices as low as $10–$20. However, rising resistance concerns and potential new formulations (e.g., combination therapies or novel delivery methods) might stabilize or even increase pricing in niche or constrained markets.

Emerging markets with limited patent protections and developing healthcare infrastructure will likely see sustained low prices but high volume growth, offering opportunities for market penetration and increased access.

Influence of Antimicrobial Stewardship and Resistance Trends

Enhanced stewardship efforts might curb overuse of carbapenems, constraining volume growth. Conversely, increasing multidrug-resistant infections could elevate demand for Ertapenem, especially if resistance to other antibiotics escalates, creating localized pricing pressures or shortages due to supply-demand imbalances.

Emerging Opportunities and Challenges

- Biosimilar Development: The entry of biosimilar carbapenems, once approved, may reshape the competitive landscape, further reducing prices.

- Combination Therapies: Development of fixed-dose combinations involving Ertapenem could open new markets but may also influence pricing strategies.

- Regulatory Variations: Differences in approval pathways and patent laws across regions introduce complexities to forecasting.

Conclusion: Key Takeaways

- Patent expiries have driven prices downward in developed markets, with generics leading the charge, exerting significant price erosion.

- Market growth is primarily volume-driven in emerging regions owing to expanding healthcare access, but overall pricing remains subdued.

- Antimicrobial resistance patterns and stewardship policies are critical determinants influencing future demand and pricing.

- Pricing projections suggest continued decline in cost per vial over the next 3–5 years, particularly in regions with significant generic penetration.

- Business strategies should focus on differentiating through value-added services (e.g., reliability of supply, combination therapies) rather than competing solely on price.

Key Takeaways

- Ertapenem’s market is consolidating around generic competition, leading to sustained price reductions, especially post-patent expiration in mature markets.

- Developing markets present volume-driven growth opportunities, albeit with lower pricing, enhancing global accessibility.

- Antimicrobial resistance escalation will influence demand dynamics, possibly creating shortages or requiring premium pricing for novel formulations.

- Stakeholders must monitor regulatory changes and patent landscapes to optimize market entry and pricing strategies.

- Innovative formulations or combination therapies could serve as value differentiators amid aggressive price competition.

FAQs

1. When are patents for Ertapenem expected to expire globally?

Patents for Ertapenem, primarily held by Merck, have expired or are expiring in several regions, including the U.S. (around 2017–2018) and Europe, paving the way for generic entries and price reductions. Actual expiration dates vary across countries due to different patent laws.

2. How does generic competition affect the price of Ertapenem?

Generic competition triggers significant price declines, often reducing the per-vial cost by 50–80%, depending on market maturity and regulatory environment, thereby making the drug more accessible but reducing margins for innovators.

3. What regions present the highest growth potential for Ertapenem?

Emerging markets, such as China, India, Brazil, and parts of Southeast Asia, exhibit high growth potential due to expanding healthcare systems and lower penetration of patented drugs, despite lower prices.

4. How is antimicrobial resistance impacting Ertapenem’s market?

Rising resistance, especially among Gram-negative bacteria, increases reliance on carbapenems like Ertapenem, potentially sustaining demand in resistant infection cases, though stewardship efforts may limit overuse and influence pricing and volume.

5. Are there emerging alternatives to Ertapenem that could influence its market?

Yes, new β-lactamase inhibitors and novel carbapenems are under development, which could erode Ertapenem’s market share if proven superior or more cost-effective. Additionally, combination therapies and innovative delivery formats may reshape competitive dynamics.

References

[1] MarketsandMarkets. Antibiotics Market by Type, Application, and Region — Global Forecast. 2022.

[2] World Health Organization. Antimicrobial resistance factsheet. 2021.

[3] IQVIA. The Global Use of Medicines in 2022.

[4] U.S. Patent and Trademark Office. Patent expiry timelines for Merck’s Ertapenem.

[5] GoodRx. Ertapenem (Invanz) Price and Cost Comparison. 2023.