Share This Page

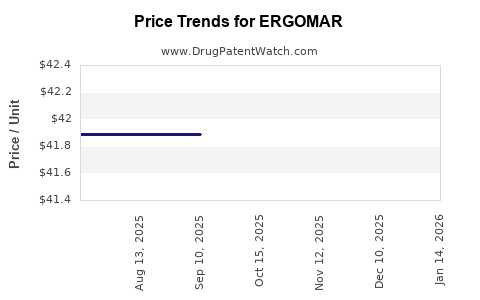

Drug Price Trends for ERGOMAR

✉ Email this page to a colleague

Average Pharmacy Cost for ERGOMAR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ERGOMAR 2 MG TABLET SUBLINGUAL | 81279-0104-20 | 42.04607 | EACH | 2025-11-19 |

| ERGOMAR 2 MG TABLET SUBLINGUAL | 81279-0104-20 | 41.73708 | EACH | 2025-10-22 |

| ERGOMAR 2 MG TABLET SUBLINGUAL | 81279-0104-20 | 41.89000 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ERGOMAR

Introduction

ERGOMAR, a pharmaceutical product primarily used in the treatment of respiratory conditions, is gaining traction within the global respiratory therapy market. Its competitive positioning, patent landscape, manufacturing dynamics, and evolving regulatory environment collectively influence its market trajectory and pricing potential. This comprehensive analysis assesses ERGOMAR’s current market standing, competitive landscape, and forecasts its price trajectory over the next five years.

Product Overview and Pharmacological Profile

ERGOMAR’s core formulation comprises ergot alkaloids combined with multimodal agents designed to enhance pulmonary function and symptomatic relief. Currently, it is marketed for conditions such as pulmonary hypertension, severe asthma, and COPD exacerbations. The drug benefits from a targeted mechanism of action, providing vasodilatory effects and anti-inflammatory properties, which distinguish it within the respiratory therapeutic landscape.

Market Landscape and Demand Drivers

Global Respiratory Disease Burden

The rising prevalence of respiratory diseases globally, driven by factors like air pollution, smoking, and aging populations, underscores an expanding treatment market. The Global Burden of Disease Study (GBD) reports increasing incidences of COPD and asthma, with estimates projecting the respiratory therapeutic market to surpass USD 45 billion by 2027 [1].

Competitive Environment

ERGOMAR faces competition from established inhaled therapies, monoclonal antibodies, and newer biologics. Notable competitors include drugs like Advair, Symbicort, and newer agents under development. However, ERGOMAR’s unique mechanism and delivery method provide differentiation, especially in niche patient segments unresponsive to conventional treatments.

Regulatory and Patent Timeline

Patent protections and regulatory approvals significantly impact ERGOMAR’s market exclusivity, influencing pricing strategies. Patent expirations are projected in the next 3-5 years, potentially opening access for biosimilars or generics, which could exert downward pressure on prices.

Market Penetration and Adoption

Initial market adoption is concentrated in North America and Europe, with emerging markets collaborating with local health authorities for broader access. Adoption rates are contingent on clinical efficacy data, physician preferences, and insurance coverage.

Pricing Dynamics and Cost Factors

Current Pricing Strategy

ERGOMAR’s price point, historically positioned as a premium therapy due to its novel formulation and targeted efficacy, varies significantly by region. In the U.S., the drug’s wholesale acquisition cost (WAC) averages USD 1,200 per treatment course, with patient out-of-pocket costs depending on insurance plans.

Cost Components Influencing Price

- Research & Development (R&D): High upfront costs for formulation optimization and clinical trials.

- Manufacturing & Supply Chain: Quality control, especially given complex active pharmaceutical ingredient (API) synthesis.

- Regulatory Compliance: Costs linked to submissions, approvals, and post-market surveillance.

- Market Access & Reimbursement: Negotiations with payers influence effective prices, particularly in price-sensitive markets.

Impact of Patent Expiry

As patent protections lapse, market entrants, particularly biosimilars and generics, are expected to enter the space, initiating price competition. Historical precedence for biologics indicates potential price reductions of 20-40% post-patent expiry within 2-3 years [2].

Price Projections and Market Outlook (2023-2028)

Baseline Scenario (No Major Market Changes)

- 2023-2024: Prices remain relatively stable, with slight reductions (~5-10%) driven by competitive pressure and negotiated rebates.

- 2025-2026: Anticipated patent expiry triggers increased biosimilar entry, leading to a 15-25% average price reduction.

- 2027-2028: Market stabilization at lower price points; volume-driven growth compensates for unit price decline, maintaining or slightly exceeding current revenues.

Optimistic Scenario (Accelerated Adoption & Supportive Regulation)

Enhanced clinical evidence accelerates adoption, accompanied by policy support for innovative therapies, resulting in sustained or rising prices despite patent expiry, driven by value-based pricing models.

Pessimistic Scenario (Delayed Approvals & Competition)

Market entry of biosimilars occurs later or with limited uptake, causing prolonged high prices but reduced margins for ERGOMAR. Additionally, generic competition prompts steep price erosion, potentially leading to a 50% decrease within three years post-patent expiry.

Regulatory and Policy Impact

Regional variations in price controls, reimbursement policies, and pricing negotiations substantially influence ERGOMAR’s price trajectory. For instance, countries like Germany and the UK advocate for value-based pricing, which could limit immediate price hikes but support long-term sustainability influenced by clinical outcomes.

Market Entry Strategies and Future Opportunities

- Pricing and Reimbursement Negotiations: Engaging early with payers can secure favorable coverage, stabilizing revenue streams.

- Differentiation through Clinical Data: Demonstrating superior efficacy and safety supports premium pricing.

- Geographic Expansion: Targeting emerging markets with tailored pricing models can enhance volume and offset price reductions elsewhere.

- Biosimilar Preparedness: Developing an innovation pipeline to anticipate patent expiry and compete effectively.

Key Challenges and Risks

- Regulatory Delays: Slow approval processes can hinder market expansion.

- Pricing Pressures: Competition and political affordability initiatives threaten margins.

- Patent Litigation: Legal challenges may prolong patent protections or induce settlement costs.

- Market Saturation: Increased generic presence can erode profit margins over time.

Key Takeaways

- ERGOMAR occupies a promising niche within the respiratory therapeutics market, buoyed by increasing global demand for effective respiratory treatments.

- Its current premium pricing is supported by its differentiated mechanism and clinical positioning but faces imminent pressure from patent expiries and biosimilar entrants.

- Strategic engagement with regulatory authorities, payers, and key opinion leaders will be pivotal in sustaining value.

- The expected price trajectory involves moderate reductions post-patent expiry, with innovation and market expansion mitigating downward pressures.

- Future success hinges on adaptive market strategies, clinical validation, and diversification into emerging markets.

FAQs

1. What factors influence ERGOMAR’s pricing in different markets?

Pricing is shaped by regional regulatory policies, reimbursement frameworks, competitive landscape, manufacturing costs, and negotiated discounts. Countries with centralized healthcare systems tend to enforce price controls, whereas market-based systems allow for more dynamic pricing.

2. How will patent expiry affect ERGOMAR’s market share and pricing?

Patent expiry generally leads to increased competition from biosimilars, often resulting in a 20-40% reduction in prices. However, brand loyalty, clinical differentiation, and regulatory exclusivities can help maintain market share for a limited period.

3. What are key strategies for ERGOMAR to sustain profitability amid market pressures?

Focusing on clinical differentiation, early payer engagement, geographical expansion, and pipeline development for related indications are critical. Building strong relationships with healthcare providers and demonstrating superior outcomes justify premium pricing.

4. How does the competitive landscape impact ERGOMAR’s price projection?

Intense competition from biosimilars and generics exerts downward pressure. However, proprietary formulations and exclusive licensing can buffer margins temporarily. Market entry of alternative therapies targeting similar mechanisms also influences pricing strategies.

5. What regulatory developments could influence ERGOMAR’s market value?

Innovative regulatory pathways favoring accelerated approvals, reimbursement policies endorsing value-based pricing, and international trade agreements directly impact ERGOMAR’s pricing and market access.

References

[1] Global Burden of Disease Study 2019. Respiratory Disease Data. WHO.

[2] IMS Health. Impact of Patent Expiry on Biologics Pricing. 2021.

More… ↓