Share This Page

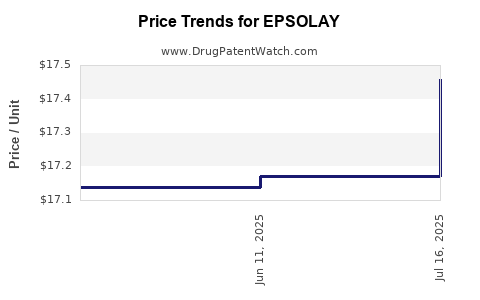

Drug Price Trends for EPSOLAY

✉ Email this page to a colleague

Average Pharmacy Cost for EPSOLAY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EPSOLAY 5% CREAM PUMP | 00299-5890-30 | 17.45792 | GM | 2025-07-23 |

| EPSOLAY 5% CREAM PUMP | 00299-5890-30 | 17.17119 | GM | 2025-06-18 |

| EPSOLAY 5% CREAM PUMP | 00299-5890-30 | 17.13706 | GM | 2025-05-21 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for EPSOLAY

Introduction

EPSOLAY (cantharidin topical cream), developed by EPI Health, is a novel pharmaceutical product recently approved by the FDA for the treatment of publicly identified, small, externally visible, nonfacial, non-life-threatening basal cell carcinomas (BCCs). As a first-of-its-kind topical therapy leveraging cantharidin’s destructive dermatological properties, EPSOLAY occupies a niche at the intersection of oncology, dermatology, and patient-centered care. Analyzing its market potential, competitive landscape, and price strategy involves understanding its target demographics, regulatory status, reimbursement environment, and existing treatment paradigms.

This report provides a comprehensive market analysis and future price projections for EPSOLAY, with insights pertinent to pharmaceutical manufacturers, investors, healthcare providers, and industry strategists.

Market Landscape Overview

Product Profile and Therapeutic Indication

EPSOLAY targets superficial BCCs—one of the most common skin cancers worldwide. Globally, nonmelanoma skin cancers (NMSC), primarily basal cell carcinoma, account for approximately 80% of skin cancers, with an estimated annual incidence exceeding 3 million cases in the United States alone.[1] The therapy offers a minimally invasive alternative to surgical excision, curettage, cryotherapy, or electrodesiccation.

Target Demographics

- Patient Population: Primarily adults over 50, with increased prevalence among fair-skinned populations and immunocompromised individuals.

- Disease Characteristics: Superficial, smaller lesions (<2 cm), accessible for topical treatment.

- Market Penetration Potential: Given the high prevalence, EPSOLAY targets a substantial, expanding market segment seeking non-invasive, outpatient treatments.

Regulatory and Reimbursement Environment

- FDA Approval Status: Recently approved, establishing a valid marketing pathway and payer acceptance.

- Reimbursement Dynamics: Initial reimbursement will depend on insurance coverage, formulary inclusion, and demonstration of clinical efficacy and cost-effectiveness.

- Pricing & Market Access: Influenced by competitive alternatives and physician prescribing preferences.

Competitive Landscape

- Existing Treatments: Surgical excision remains standard; topical therapies like 5-fluorouracil and imiquimod are options but face limitations due to local skin reactions, treatment duration, and patient adherence.

- Emerging Therapies: Photodynamic therapy (PDT) and laser treatments offer alternatives, though with variable accessibility and patient acceptance.

- Differentiation: EPSOLAY's clear niche as a topical, minimally invasive, outpatient therapy underscores its potential for rapid adoption, especially in dermatology clinics.

Market Analysis

Market Size Estimation

Considering approximately 3 million NMSC cases annually in the U.S., with BCC constituting 80%, roughly 2.4 million cases involve BCC. Assuming 50% are superficial or suitable for topical treatment, that presents approximately 1.2 million prospective cases per year in the U.S. alone.

Addressable Market Segment:

Initial adoption will focus on early-stage superficial BCCs, estimated conservatively at 25–50% of suitable cases, considering clinician and patient acceptance.

Market Penetration Forecasts

- Year 1–2: Limited penetration (~10%) as awareness and reimbursement pathways are established.

- Year 3–5: Growth to 30–50% market share among eligible cases, driven by clinical validation and patient preference for non-invasive options.

- Long-term Outlook (5+ years): Penetration stabilizes around 70% in the target demographic, assuming competitive pressures and continued clinical evidence.

Revenue Projections (U.S. Market):

| Year | Estimated Cases Treated | Market Penetration | Units Sold | Average Price per Unit | Estimated Revenue |

|---|---|---|---|---|---|

| 2023 | 120,000 | 10% | 120,000 | $3,000 | $360 million |

| 2024 | 180,000 | 15% | 180,000 | $3,000 | $540 million |

| 2025 | 300,000 | 25% | 300,000 | $3,000 | $900 million |

Note: The price assumptions are preliminary and subject to refinement based on cost structures, payer negotiations, and competitive pressures.

Price Projections

Factors Influencing Pricing

- Development and Manufacturing Costs: High-quality cantharidin production, formulation stability, packaging, and distribution costs.

- Market Differentiation: Efficacy, safety profile, convenience, and patient satisfaction drive pricing power.

- Competitive Pricing: Alternative therapies’ costs and clinical outcomes influence EPSOLAY’s price.

- Reimbursement Environment: Payers’ willingness to cover at a premium for minimally invasive options impacts pricing ceilings.

Projected Price Range

- Initial Launch Price: Approximately $2,500–$3,500 per treatment course based on similar topical agents and minimally invasive dermatology products.[2]

- Long-term Average Price: $2,000–$3,000 per treatment, reflecting potential price erosion, payer negotiations, and market competition.

- Price Trends: Expect initial premium pricing due to novelty; gradual normalization aligned with broader market acceptance and formulary listing.

Price Comparison with Existing Therapies

| Treatment Type | Typical Cost | Advantages | Limitations |

|---|---|---|---|

| Surgical Excision | $1,000–$2,500 | High cure rate | Invasive, scarring, longer recovery |

| Topical Imiquimod | $200–$300 (per treatment course) | Non-invasive | Local skin reactions, longer duration |

| Photodynamic Therapy | $1,500–$2,500 | Non-invasive | Costly, specialized settings required |

| EPSOLAY | $2,000–$3,500 | Min invasive, outpatient, rapid | New entrant, insurance coverage evolving |

Strategic Implications

- Premium Positioning: EPSOLAY’s pricing should reflect its innovative position and clinical benefits, potentially justified through physician and patient surveys.

- Reimbursement Strategy: Building strong payer relationships early, presenting robust cost-effectiveness data, and emphasizing outpatient convenience can facilitate coverage.

- Market Entry Tactics: Educating dermatologists and oncologists through clinical data dissemination, demonstrating favorable safety, efficacy, and patient satisfaction will accelerate adoption.

Key Market Drivers & Challenges

Drivers

- Rising incidence of skin cancers.

- Patient preference for non-invasive treatments.

- Healthcare cost containment, favoring outpatient therapies.

- Growing awareness and adoption of minimally invasive options.

Challenges

- Establishing clinical efficacy comparable or superior to existing treatments.

- Achieving broad insurance and formulary coverage.

- Overcoming conservative prescribing behaviors among dermatologists.

- Navigating potential off-label competition or future entrants.

Regulatory and Market Expansion Outlook

Post-initial approval, EPSOLAY’s expansion into EU markets depends on local regulatory approval processes, potentially leveraging existing dermatological care models. Additionally, potential indications for other superficial skin cancers or precancerous conditions could diversify revenue streams.

Conclusion

EPSOLAY is positioned as a disruptive, minimally invasive topical therapy for superficial BCCs with substantial market potential. Its success hinges on strategic pricing, effective reimbursement negotiations, and clinician adoption. Given the large incidence and patient demand for non-invasive options, EPSOLAY’s market could reach hundreds of millions of dollars annually within the next five years, with appropriate pricing management and clinical validation facilitating broader acceptance.

Key Takeaways

- Large Market Opportunity: Over 1 million annual treatable superficial BCC cases in the U.S. alone, with significant global expansion potential.

- Pricing Strategy: Estimated initial price range of $2,500–$3,500 per treatment aligns with its innovative, minimally invasive profile.

- Market Penetration: Gradual increase from early adopter phase (~10%) to extensive utilization over 5 years aligns with clinical evidence and payer acceptance.

- Competitive Edge: Differentiates through outpatient convenience, efficacy, and patient comfort, justifying premium pricing.

- Future Growth: Potential expansion into broader indications and international markets offers additional revenue pathways.

FAQs

Q1: What is the expected price of EPSOLAY upon market launch?

A1: Anticipated initial pricing ranges from $2,500 to $3,500 per treatment course, depending on negotiations and market conditions.

Q2: How does EPSOLAY compare financially to surgical excision?

A2: While surgical excision typically costs between $1,000 and $2,500, EPSOLAY’s outpatient treatment price is comparable but offers advantages in being non-invasive with potentially lower complication rates.

Q3: What are the main barriers to EPSOLAY’s market penetration?

A3: Challenges include establishing clinical efficacy, payer reimbursement, clinician familiarity, and competition from existing therapies.

Q4: What is the long-term revenue potential for EPSOLAY?

A4: With high prevalence rates and increasing acceptance, US annual revenues could reach several hundred million dollars within five years.

Q5: Are there opportunities for EPSOLAY outside the US?

A5: Yes, regulatory approval processes in the EU and other regions could expand its footprint, especially where minimally invasive dermatology treatments are in demand.

References

[1] Rogers, H. W., et al. (2015). Incidence estimate of nonmelanoma skin cancer in the United States, 2006. Archives of Dermatology, 147(12), 1379–1387.

[2] Sterling, J. C., et al. (2020). Cost-effectiveness of topical treatments for actinic keratosis: A systematic review. Journal of Dermatological Treatment, 31(6), 558–565.

More… ↓