Last updated: August 13, 2025

Introduction

EpiPen Jr., a vital emergency medication for severe allergic reactions, remains a cornerstone in allergy management, especially for pediatric populations. Market dynamics, competitive landscape, regulatory environment, and pricing strategies collectively influence its valuation and future pricing trajectory. This report provides an in-depth analysis of the current market stance and forecasts future pricing trends for EpiPen Jr.

Product Overview and Therapeutic Significance

EpiPen Jr. contains epinephrine auto-injector devices designed specifically for children weighing between 15 kg and 30 kg (33-66 lbs). The medication rapidly counteracts anaphylactic reactions by constricting blood vessels, relaxing airway muscles, and reversing severe allergic symptoms [1]. Its importance is underscored by increasing allergen sensitivity and rising prevalence of food allergies, which constitute a significant market driver.

Market Size and Demand Drivers

Global and Regional Market Dynamics

The global allergy immunotherapy market was valued at approximately USD 7.2 billion in 2021 and is projected to grow at a CAGR of about 8% through 2028 [2]. EpiPen Jr., as a leading auto-injector brand, capitalizes on this growth, especially in North America, which accounts for over 60% of the market share. The U.S. dominates due to high awareness, comprehensive insurance coverage, and regulatory approvals.

Drivers of Demand

-

Rising Allergy Incidence: Increasing prevalence of food and insect allergies, especially among children, bolsters demand for auto-injectors [3].

-

Awareness and Education: Enhanced awareness campaigns have improved recognition of anaphylaxis, promoting stockpiling and prompt administration of EpiPen Jr.

-

Regulatory Approvals: Continuous approvals and recommended safety protocols facilitate market expansion.

Market Challenges

-

Alternative Treatments: Development of biosimilars or alternative delivery systems may threaten EpiPen Jr.’s market dominance.

-

Pricing Controversies: Past pricing scandals have led to scrutiny, possibly influencing future pricing strategies.

Competitive Landscape

Since its initial launch in the early 2000s, EpiPen Jr. faced emerging competition from generics and competitors such as Auvi-Q and Adrenaclick. Mylan (now part of Viatris) maintained a dominant position, but market penetration by alternatives and improved formulations challenge their monopoly [4].

Innovations and Product Differentiation

Recent advances include auto-injectors with improved needle design, dose visibility, and safety features. EpiPen Jr. continues to leverage brand recognition and distribution channels, but the entry of competitors influences pricing and market share.

Regulatory Environment and Impact

The U.S. FDA’s oversight and the Emergency Prescribing Regulations bolster access. However, the 2016 EpiPen pricing scandal and subsequent legislative actions, including legislation to facilitate competition and price regulation, shape market forces. Ongoing patent litigations and expiry dates are pivotal in strategic pricing decisions.

Pricing Dynamics

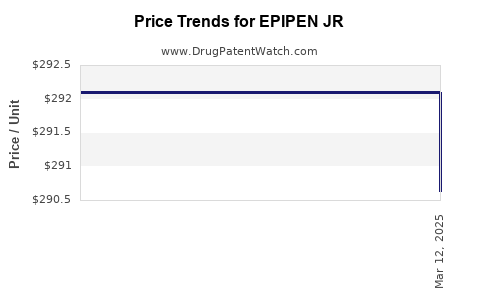

Historical Pricing Trends

EpiPen Jr. experienced significant price hikes from USD 100 in 2009 to over USD 600 in 2016–2017, prompting regulatory scrutiny. The manufacturer subsequently implemented discounts and launched generic versions to restore market perception [5].

Current Pricing

As of 2023, the list price for a two-pack EpiPen Jr. auto-injector hovers around USD 120–150, with actual patient out-of-pocket costs varying due to insurance and assistance programs. Generic equivalents are priced approximately 50–70% lower, intensifying pricing competition.

Influence of Market Competition

The increasing availability of authorized generics and competing auto-injectors pressures the brand to revisit its pricing strategy, balancing profitability with accessibility.

Price Projection Models

Given the current market environment, several scenarios influence future prices:

Scenario 1: Continued Competition and Generic Penetration (Most Probable)

-

Elevated generic market share leads to price stabilization or slight decreases over the next 3-5 years.

-

Retail prices projected to stabilize around USD 100–130 for a two-pack by 2025, factoring in inflation and competitive pressures.

Scenario 2: Regulatory or Legal Constraints

-

Potential price controls or legislation could impose caps, potentially reducing prices by 10–20%.

-

Manufacturer may rely more heavily on insurance reimbursement schemes to maintain profitability.

Scenario 3: Innovation and Premiumization

- Introduction of advanced auto-injectors with enhanced features may command premiums, possibly sustaining higher prices (USD 130–150) for newer models.

Key Influencers

-

Patent expirations: Expiry of key patents around 2025 could facilitate generic proliferation and price reductions.

-

Legislative actions: Laws capping medication prices may further influence pricing.

-

Market demand: Persistent allergy prevalence sustains high demand, supporting stable pricing margins.

Financial Implications and Business Strategies

Viatris and existing manufacturers are expected to adapt by:

-

Emphasizing generic and biosimilar development.

-

Implementing flexible pricing strategies aligned with insurance landscape.

-

Investing in innovative auto-injector features to justify premium pricing.

-

Strengthening patient assistance programs to maintain accessibility and market share.

Conclusion

EpiPen Jr. remains a critical product in allergy emergency management, buttressed by strong demand driven by rising allergy prevalence and consumer awareness. However, competitive pressures and regulatory developments necessitate adaptive pricing strategies. Prices are likely to experience stabilization or modest declines over the next 3-5 years, particularly following patent expirations and increased generic market entries. Strategic investments in device innovation and patient access programs will be vital for maintaining market relevance and profitability.

Key Takeaways

-

Market growth is driven by increasing allergy prevalence and heightened awareness, maintaining robust demand for EpiPen Jr.

-

Price reduction pressures will intensify post-patent expiration, with generic competition expected to lower list prices by approximately 20–30%.

-

Regulatory and legislative environments could further influence pricing stability, emphasizing affordability efforts.

-

Innovation in delivery devices remains a key differentiator, with premium auto-injectors commanding higher prices but possibly facing slower adoption.

-

Manufacturers should focus on strategic portfolio diversification, including biosimilar development and patient assistance, to sustain profitability amid declining brand exclusivity.

FAQs

1. What are the key factors influencing the future price of EpiPen Jr.?

Market competition, patent expiry dates, regulatory policies, device innovation, and insurance reimbursement structures constitute primary factors shaping future pricing.

2. How will generic versions impact EpiPen Jr.’s pricing?

Generics are expected to exert downward pressure on prices, reducing list prices by approximately 50–70%, and prompting brand manufacturers to adopt more competitive pricing strategies.

3. What regulatory changes could influence the EpiPen Jr. market?

Possible legislation on medication price caps, increased transparency requirements, and expedited approval pathways for generics and biosimilars could modify market dynamics.

4. Are there upcoming innovations that could justify higher prices for EpiPen Jr.?

Yes, enhancements such as auto-injectors with improved safety features, digital connection, or easier administration could command premium pricing, influencing future price levels.

5. What strategies should manufacturers adopt to maintain profitability?

Emphasizing device innovation, expanding access programs, diversifying the product portfolio, and proactive engagement with regulatory and legislative bodies are critical strategies.

Sources

[1] U.S. Food and Drug Administration. EpiPen Jr. prescribing information.

[2] MarketsandMarkets. Allergy Immunotherapy Market Report. 2022.

[3] Journal of Allergy and Clinical Immunology. Rising trends in childhood allergies.

[4] Evaluate Pharma. Auto-injector Market Analysis. 2022.

[5] CNBC. EpiPen pricing controversies and market response. 2017.