Last updated: July 27, 2025

Introduction

Epinephrine, also known as adrenaline, is a critical drug in emergency medicine, primarily used to treat severe allergic reactions (anaphylaxis), cardiac arrest, and other life-threatening conditions. Its pivotal role in emergency protocols ensures consistent demand across healthcare sectors, prompting ongoing interest from pharmaceutical companies, policymakers, and investors. This analysis explores the current market landscape, key drivers, competitive dynamics, regulatory influences, and forecasted pricing trends for epinephrine.

Market Overview

Global Market Size

The global epinephrine market was valued at approximately USD 680 million in 2022, with projections indicating a compound annual growth rate (CAGR) of about 6.2% from 2023 to 2030, reaching an estimated USD 1.2 billion by the end of the decade [1]. Growth drivers include rising incidences of allergic reactions, expansion of emergency care infrastructure, and increased awareness of anaphylaxis management.

Key Segments

- Product Forms: The market comprises auto-injectors (EpiPen, Auvi-Q), prefilled syringes, ampules, and vials.

- Indications: Anaphylaxis remains the dominant application, followed by cardiac emergencies.

- Distribution Channels: Hospitals, pharmacies, emergency response units, and retail outlets.

Market Drivers

Rising Prevalence of Allergic Diseases

The global rise in allergic conditions, notably food allergies, insect bites, and drug allergies, has driven the demand for epinephrine auto-injectors. For example, data indicates that food allergies affect over 220 million people worldwide, with prevalence rising annually [2].

Improved Emergency Care Infrastructure

Enhanced awareness and availability of epinephrine in emergency kits bolster market growth, especially in developed economies. Government initiatives in multiple nations promote free or subsidized auto-injectors in schools and public spaces.

Technological Advancements and Product Innovation

Development of more user-friendly auto-injectors and alternative formulations potentially expand market reach. Companies investing in safer, more reliable devices gain competitive advantage.

Regulatory Approvals and Policy Changes

Regulations facilitating broader OTC sales of epinephrine auto-injectors in several regions, such as the U.S. and EU, increase accessibility, stimulating market expansion.

Competitive Landscape

Major players include Mylan (now part of Viatris), Alcon, Kaléo, Medi-Rx, and Trudrugs. Mylan's EpiPen has historically dominated the auto-injector market, though recent market entries and technological improvements by competitors are disrupting this duopoly.

Intellectual property and patent expirations play significant roles. Notably, Mylan’s patent expired in 2017 due to litigation, opening the market to biosimilar competitors and likely exerting downward pressure on prices.

Pricing Dynamics

Current Pricing Trends

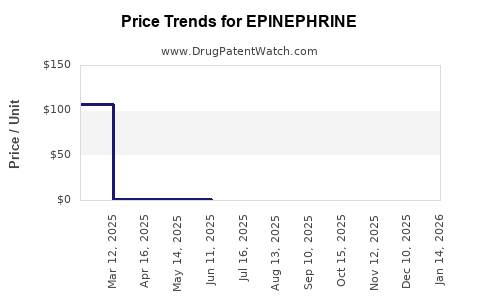

The pricing of epinephrine auto-injectors has been a contentious issue. The list price of a two-pack EpiPen in the U.S. escalated from approximately USD 100 in 2004 to over USD 600 in 2016, necessitating insurance subsidies and manufacturer rebates [3]. Since then, the market has seen some stabilization, yet prices remain high relative to manufacturing costs.

In contrast, generic or biosimilar epinephrine formulations, available in prefilled syringes or vials, are priced significantly lower, often at USD 2-$4 per dose in bulk purchasing contracts.

Factors Influencing Cost Variability

- Regulatory and Patent Status: Patent expirations introduce generics and biosimilars, reducing prices.

- Distribution Channels: Retail pharmacy markup and insurance reimbursements impact out-of-pocket costs.

- Manufacturing Costs: High purity standards and sterile manufacturing processes add to expenses.

- Market Competition: Entry of biosimilars tends to exert downward pressure.

- Packaging and Delivery Systems: Innovations aiming for ease of use or multi-dose configurations may influence pricing.

Forecasted Price Trends (2023-2030)

Auto-Injectors and Brand-Name Products

While established brands like Mylan’s EpiPen are projected to maintain premium pricing, increased competition from biosimilar devices is expected to drive prices downward. Industry analysts forecast a gradual decline in the retail price of epinephrine auto-injectors by approximately 2-4% annually post-2025, driven by biosimilar market penetration and market saturation.

Biosimilars and Generic Formulations

As biosimilar products gain regulatory approval, their prices are expected to stabilize around 60-70% of brand-name equivalents. Price points may reduce to USD 100-$200 per two-pack in high-income markets and even lower in emerging economies.

Global Variations

Pricing will be markedly different across regions:

- United States: Despite high current prices, increased biosimilar competition and policy interventions could reduce prices by up to 40% over the next five years.

- Europe: Regulatory support and existing biosimilar frameworks anticipate a 20-30% price reduction.

- Emerging Markets: Prices are already lower, but access remains limited; further reductions may be offset by supply chain constraints.

Regulatory and Market Risks

- Regulatory Delays: Biosimilar approvals might face hurdles, delaying price competition.

- Reimbursement Policies: Changes in healthcare reimbursement standards may influence affordability and demand.

- Patent Litigation and Legal Challenges: Ongoing legal disputes over intellectual property rights can impact supply and pricing.

- Global Health Policies: Emergency medical reserve policies and stockpiling strategies impact demand stability, especially amid pandemics or health crises.

Key Market Opportunities

- Innovation in Delivery Devices: Multi-dose, needle-free, or wearable auto-injectors could diversify product offerings.

- Expanding into Developing Countries: Growing allergic disease prevalence presents untapped markets with increasing demand.

- Partnerships with Healthcare Providers: Collaborations to increase awareness and distribution can expand market reach.

- Regulatory Streamlining: Faster approvals for biosimilars and generics could accelerate price reductions.

Conclusion

The epinephrine market remains vital in emergency medicine, with sustained demand driven by increasing prevalence of allergic conditions and improved healthcare infrastructure. While traditional brand-name products dominate, biosimilars and generic formulations are poised to significantly influence pricing trends, potentially lowering costs by up to 70% over the next decade. Strategic innovation and regulatory navigation will be critical for stakeholders seeking sustainable growth.

Key Takeaways

- The global epinephrine market is projected to grow at a CAGR of approximately 6.2%, reaching USD 1.2 billion by 2030.

- Price stabilization or slight decline is anticipated due to biosimilar competition, with reductions of up to 40% expected in developed markets.

- Patent expirations and regulatory approvals are accelerants for biosimilar market entry, heightening price competition.

- Emerging markets present growth opportunities, driven by rising allergic disease incidence and expanding healthcare access.

- Innovation in delivery systems and strategic partnerships will be essential for maximizing market share and profitability.

FAQs

1. What factors are driving the growth of the epinephrine market?

The rise in allergic diseases, enhanced emergency care infrastructure, regulatory support for biosimilars, and increased public awareness are primary growth drivers.

2. How will biosimilars impact epinephrine prices?

Biosimilars are likely to reduce prices by approximately 60-70% compared to brand-name auto-injectors, especially as regulatory pathways streamline and market competition intensifies.

3. What regions will see the most significant price reductions?

The United States and Europe, owing to regulatory changes and increased biosimilar availability, are expected to experience notable price declines.

4. Are there any risks that could affect market stability?

Yes. Patent disputes, delayed regulatory approvals, supply chain disruptions, and changes in reimbursement policies could influence supply, demand, and prices.

5. What innovations could influence future pricing and market dynamics?

Advanced delivery devices, multi-dose systems, needle-free injectors, and increased market penetration in low-income countries are crucial innovation areas shaping future dynamics.

References

[1] MarketsandMarkets, "Epinephrine Market by Product Type, Application, and Region," 2022.

[2] World Allergy Organization, "The global prevalence of food allergies," 2021.

[3] Kaiser Family Foundation, "Epinephrine Auto-Injectors Pricing Trends," 2018.