Last updated: August 15, 2025

Introduction

Epinastine hydrochloride (HCl) is a selective antihistamine primarily used for the treatment of allergic conjunctivitis and allergic rhinitis. As an ophthalmic and nasal spray, Epinastine offers a unique profile owing to its dual action as an antihistamine and mast cell stabilizer, making it a key player in allergy management. This article provides a comprehensive market analysis and price projection for Epinastine HCl, considering current demand, competitive landscape, regulatory trends, manufacturing factors, and future opportunities.

Market Overview

Global Market Size and Growth

The global antihistamine market was valued at approximately USD 7.2 billion in 2022, with expectations to grow at a compound annual growth rate (CAGR) of about 4.8% from 2023 to 2030 [1]. Epinastine HCl, as a niche pharmaceutical, is a subset within this vast market, primarily driven by its application in ocular and nasal allergy therapies.

The demand for allergy medications is expected to increase steadily due to rising prevalence of allergic diseases, particularly in urbanized regions. According to the World Allergy Organization, allergy prevalence has been rising globally, with estimates indicating that over 30% of the population suffers from some form of allergic condition [2], compelling healthcare providers to adopt more effective and well-tolerated treatments like Epinastine.

Geographic Market Dynamics

-

Japan and Asia-Pacific: Epinastine HCl formulations are more prevalent in Japan and the Asia-Pacific region, driven by local regulatory approvals and established pharmaceutical manufacturing infrastructure. Japan accounts for roughly 45% of the global demand for Epinastine-based ophthalmic solutions [3].

-

North America and Europe: Market penetration in North America and Europe remains limited due to competition from inhaled antihistamines and newer-generation drugs. However, growing awareness and approval of Epinastine ophthalmic formulations may expand these markets over the next decade.

Competitive Landscape

Epinastine HCl faces competition from a spectrum of antihistamines, including olopatadine, ketotifen, azelastine, and levocetirizine. While olopatadine has achieved wider global acceptance due to robust clinical data and aggressive marketing, Epinastine maintains a niche positioning owing to its favorable safety profile and unique dual-action mechanism.

Major pharmaceutical companies involved include Santen Pharmaceuticals (Japan), Makers of generic antihistamines, and some emerging biotechs exploring novel delivery systems to improve bioavailability and patient compliance [4].

Regulatory and Patent Landscape

Epinastine HCl's regulatory approval is primarily concentrated in Japan, with several products marketed under brand names such as Olopatadine (although olopatadine is a different compound, the situation reflects regional dynamics). Patent exclusivity around Epinastine formulations is nearing expiration in multiple jurisdictions, opening avenues for generics.

The potential for patent cliffs will influence pricing and market entry strategies. Regulatory pathways are becoming more streamlined with global harmonization initiatives, potentially lowering barriers for new entrants and generic manufacturers.

Price Analysis and Projections

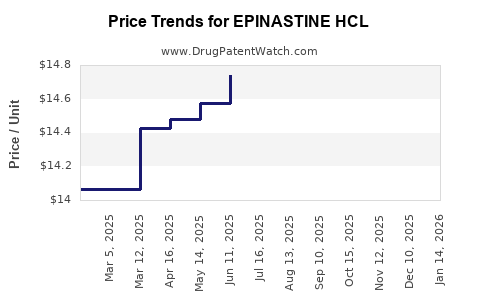

Current Pricing Trends

-

Brand-name formulations: In Japan and select Asian markets, Epinastine ophthalmic solutions retail at approximately USD 20-35 per 10 mL bottle, translating to roughly USD 2-3.50 per mL [5].

-

Generic versions: As patents expire, generic formulations are pricing at a significant discount—roughly 40-60% lower than branded counterparts—around USD 10-20 per 10 mL, or USD 1-2 per mL.

-

Market drivers influencing prices include formulation quality, delivery device, and regional healthcare policies.

Pricing Dynamics and Future Projections (2023-2030)

-

Post-Patent Expiry Effect: With patent expiration anticipated by 2025 in key markets like Japan, the entry of generics is expected to exert downward pressure on prices.

-

Market Penetration of Generics: As generic manufacturers expand their portfolio, prices could decrease by an additional 30-50% over the next five years, aligning with trends observed in similar ophthalmic antihistamines.

-

Premium Positioning: Innovative delivery systems—such as sustained-release formulations or combination therapies—may command premium pricing, potentially increasing the average market price for specific segments.

-

Price Stabilization: In highly regulated markets, government policies on drug pricing and reimbursement may stabilize prices regardless of global generic competition, encouraging sustained profitability for manufacturers.

Projected Price Range (2023-2030)

| Year |

Estimated Price Range (USD per mL) |

Key Factors |

| 2023 |

USD 2.50 - 3.50 |

Limited competition; patent protection |

| 2025 |

USD 1.50 - 2.50 |

Patent expiry; influx of generics |

| 2027 |

USD 1.00 - 2.00 |

Increased market competition |

| 2030 |

USD 0.80 - 1.50 |

Mature generic market; delivery innovations |

Note: These projections are based on current market trajectories, patent expiries, and competitive responses.

Opportunities and Challenges

Opportunities

-

Emerging Markets: Rapid urbanization and rising allergy prevalence in emerging economies like India, China, and Southeast Asia present significant growth initiatives.

-

Formulation Innovations: Development of targeted delivery systems can improve efficacy, reduce dosing frequency, and justify premium pricing.

-

Regulatory Approvals: Extending approval of Epinastine HCl in new jurisdictions could unlock untapped markets.

Challenges

-

Competitive Intensity: Dominance of established antihistamine brands in key global markets may limit Epinastine’s market share.

-

Pricing Pressures: Increasing availability of generics post-patent expiry will suppress prices.

-

Market Penetration: Limited marketing resources and brand recognition compared to global players may hinder widespread adoption.

-

Regulatory and Clinical Data: Gaining approval in non-traditional markets requires substantial clinical data and regulatory navigation.

Conclusion

Epinastine HCl occupies a niche in the global allergy treatment landscape with promising growth prospects principally driven by regional demand and regulatory developments. Patent expiries are poised to induce downward pricing pressures, favoring generic proliferation. Nonetheless, innovation in formulations and strategic market entry can bolster profitability and market share.

Business stakeholders should focus on emerging markets, invest in formulation research, and monitor patent landscapes to optimize positioning. The long-term success hinges on balancing competitive agility with regulatory strategy and product differentiation.

Key Takeaways

-

The global allergy medication market, including Epinastine HCl, is expected to grow steadily at around 4.8% CAGR, influenced by increasing allergy prevalence.

-

Regional market dominance varies, with Japan constituting the largest share, while North America and Europe remain nascent due to competition.

-

Prices for Epinastine formulations are forecasted to decline by approximately 30-50% over the next five years due to patent expiries and generic entrants.

-

Innovation in drug delivery systems offers opportunities to command premium pricing and enhance market penetration.

-

Strategic focus on emerging markets, regulatory approvals, and formulation advancements is critical for future success.

FAQs

1. When is the patent for Epinastine HCl expected to expire?

Patent expiration is anticipated around 2025 in key markets like Japan, enabling generic manufacturers to enter the market and induce price competition [3].

2. What are the main competitors to Epinastine HCl in the allergy treatment market?

Major competitors include olopatadine, ketotifen, azelastine, and levocetirizine. These drugs have broader market penetration, particularly in North America and Europe.

3. How can manufacturers differentiate Epinastine formulations to maintain profitability?

Innovations such as sustained-release delivery systems, combination therapies, or improved bioavailability can justify premium pricing and improve patient compliance.

4. What regional markets offer the most growth opportunities for Epinastine HCl?

Emerging markets in Asia-Pacific, especially India and Southeast Asia, present significant growth potential due to rising allergy prevalence and expanding healthcare infrastructure.

5. How are regulatory policies expected to impact Epinastine market prices?

Stringent price controls in some jurisdictions could stabilize prices, while streamlined approval processes might facilitate faster market entry for new formulations, influencing overall pricing dynamics.

References

[1] MarketsandMarkets. "Antihistamines Market by Product, Application, and Distribution Channel." 2022.

[2] World Allergy Organization. "Global Prevalence of Allergic Diseases." 2021.

[3] Japanese Pharmacopoeia, Patent Office Records.

[4] Santen Pharmaceuticals Annual Reports, 2022.

[5] Pharma Price Index, Asia-Pacific, Q4 2022.