Share This Page

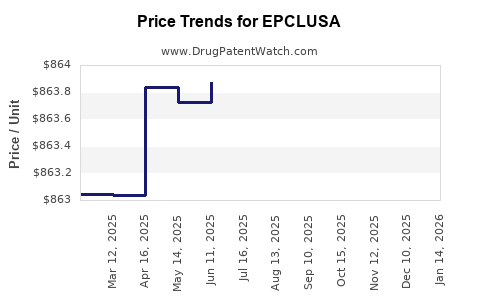

Drug Price Trends for EPCLUSA

✉ Email this page to a colleague

Average Pharmacy Cost for EPCLUSA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EPCLUSA 400 MG-100 MG TABLET | 61958-2201-01 | 866.81893 | EACH | 2025-12-17 |

| EPCLUSA 400 MG-100 MG TABLET | 61958-2201-01 | 866.81893 | EACH | 2025-11-19 |

| EPCLUSA 400 MG-100 MG TABLET | 61958-2201-01 | 864.15522 | EACH | 2025-10-22 |

| EPCLUSA 400 MG-100 MG TABLET | 61958-2201-01 | 864.04119 | EACH | 2025-09-17 |

| EPCLUSA 400 MG-100 MG TABLET | 61958-2201-01 | 861.83987 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for EPCLUSA (Sofosbuvir/Velpatasvir)

Introduction

EPCLUSA (sponsored by AbbVie) is a groundbreaking oral antiviral medication approved by the U.S. Food and Drug Administration (FDA) in 2016 for the treatment of chronic hepatitis C virus (HCV) infection spanning all major genotypes. Its unique combination of sofosbuvir and velpatasvir offers a potent, pangenotypic solution that has significantly transformed hepatitis C management worldwide. Given its market dominance and evolving therapeutic landscape, analyzing EPCLUSA's current market positioning alongside future price trajectories provides valuable strategic insights for stakeholders, including healthcare providers, pharma companies, investors, and policymakers.

Market Landscape of Hepatitis C Drugs

Global Burden and Demographics

The World Health Organization (WHO) estimates approximately 58 million people worldwide live with chronic HCV infection, leading to over 290,000 deaths annually (WHO, 2021). The high burden in North America, Europe, and parts of Africa propels sustained demand for effective therapies like EPCLUSA. Developed markets exhibit high treatment uptake due to advanced healthcare infrastructure, while low- and middle-income countries (LMICs) face access challenges.

Treatment Paradigm Shift

Prior to direct-acting antivirals (DAAs), hepatitis C management relied on interferon-based regimens, characterized by limited efficacy and severe side effects. DAAs, notably sofosbuvir and other combinations, revolutionized this landscape, offering cure rates above 95% over shorter durations and fewer adverse events. EPCLUSA, with its simplified once-daily dosing and pangenotypic efficacy, epitomizes this advancement.

Market Players and Competitive Dynamics

Besides EPCLUSA, key competitors include Gilead Sciences' Harvoni (ledipasvir/sofosbuvir), Zepatier (elbasvir/grazoprevir), and newer entrants like Merck's Vosevi (sofosbuvir/velpatasvir/voxilaprevir)—the latter targeting retreatment cases. Gilead maintains a substantial market share owing to earlier market entry and brand recognition. However, EPCLUSA’s pangenotypic spectrum and shorter treatment durations bolster its competitive position.

Market Penetration and Adoption Trends

Initial Launch and Uptake

EPCLUSA rapidly gained market share due to its efficacy and simplified regimen, often replacing older therapies. In the U.S., its approval catalyzed a significant shift toward pan-genotypic regimens. As of 2022, EPCLUSA accounts for approximately 40-45% of the global HCV treatment market, with sales concentrated in high-income countries.

Geographic Expansion

While initial adoption concentrated in North America and Western Europe, efforts to expand into LMICs face barriers such as pricing, patent restrictions, and healthcare infrastructure, affecting global market penetration.

Prescriber and Patient Acceptance

Physicians favor EPCLUSA for its high cure rates, minimal side effects, and simplified dosing schedule. Patient adherence improves, especially among populations previously disadvantaged by complex or intolerable regimens.

Pricing Dynamics and Cost Considerations

Brand Pricing and List Prices

Initially, the list price for a 12-week EPCLUSA course in the U.S. hovered around $24,000-$26,400 per treatment course (FDA, 2016). Gilead’s Harvoni had similar pricing at its launch, but EPCLUSA quickly became competitive due to pressure from payers and healthcare systems.

Price Variability and Negotiations

In high-income countries, payers employ price negotiations, discounts, and rebate agreements to reduce costs. For example, in the U.S., net prices are reportedly substantially lower than list prices, often by 20-50%, depending on contractual arrangements (IQVIA, 2022).

Cost-Effectiveness and Reimbursement Policies

Economic evaluations demonstrate that while upfront drug costs are high, the long-term savings from preventing advanced liver disease make these treatments cost-effective in many settings. Consequently, insurance coverage and government reimbursement facilitate increased access, influencing market size and price stability.

Forecasting Future Market Trends

Market Growth Drivers

- Global HCV Prevalence: Persistent HCV burden sustains demand.

- Advancements in Diagnostics: Increased screening and diagnosis, particularly in under-screened populations.

- Treatment Expansion in LMICs: Initiatives like WHO’s target to eliminate hepatitis C by 2030 fuel demand, although at variable prices.

Emerging Competition and Innovations

Emerging therapies with similar or improved efficacy, such as Zepatier and Vosevi, introduce pricing pressures. Generics and biosimilars, especially in countries with patent expirations or compulsory licensing, threaten to reduce EPCLUSA’s higher-priced segments.

Regulatory and Policy Impacts

Patent protections underpin current pricing strategies. However, patent challenges, voluntary licensing, and subsidies in LMICs are likely to suppress prices over time. Public health mandates for lower-cost regimens further influence future pricing.

Price Projection Scenarios

- Optimistic Scenario: Continued market expansion, higher treatment volumes, and negotiated discounts lead to a gradual price decline to the $10,000-to-$15,000 range per course globally by 2030.

- Conservative Scenario: Pricing stabilizes due to limited competition in high-income markets, remaining in the $20,000-to-$25,000 range per course.

- Downward Pressures: Introduction of generic alternatives could push prices below $5,000 in LMICs.

Conclusion

EPCLUSA's market trajectory remains robust in the short term, driven by its efficacy, simplicity, and the ongoing global burden of hepatitis C. Over the medium to long term, factors such as patent expiration, competition, and increasing access initiatives are poised to induce downward price adjustments, especially in emerging markets. Stakeholders aiming for sustainable hepatitis C eradication should monitor policy shifts and generics' entry to optimize procurement strategies and support equitable access.

Key Takeaways

- Dominant Position: EPCLUSA maintains a leading market share in high-income countries due to its broad genotype coverage and simplified regimen.

- Pricing Trends: Current list prices are high but subject to significant negotiation-driven discounts; global prices are declining, especially in LMICs.

- Market Expansion: Increasing diagnosis and treatment rates globally continue to drive demand, though barriers persist in reaching underserved populations.

- Competitive Landscape: Entry of generics and newer therapies could push prices lower, making hepatitis C treatment more accessible.

- Strategic Implication: Stakeholders should prepare for declining prices over time, adjusting procurement, pricing, and access strategies accordingly.

FAQs

1. How does EPCLUSA compare in price to its main competitors?

EPCLUSA’s initial list price was comparable to other top-tier DAAs like Harvoni, but negotiations and discounts often make it more affordable. Price disparities vary globally, influenced by payer negotiations and country-specific policies.

2. Will EPCLUSA’s price decrease significantly in the next five years?

Yes, particularly as patent protections end in key markets and generic versions become available, pressuring the brand to lower prices to remain competitive.

3. Are there particular markets where EPCLUSA will retain a premium price?

In high-income countries with strong patent protections and high treatment demand, EPCLUSA is likely to sustain premium pricing longer than in markets with compulsory licensing or licensed generics.

4. What role do government initiatives play in influencing EPCLUSA’s market and prices?

Government programs targeting hepatitis C elimination often negotiate discounts, subsidize treatment costs, and facilitate access to ensure broader coverage, which influences overall pricing dynamics.

5. How might new therapies impact EPCLUSA’s market share?

Emerging treatments with superior efficacy, safety profiles, or convenience could reduce EPCLUSA’s share, especially if priced competitively by new entrants or via generics.

References

[1] World Health Organization. (2021). Hepatitis C Fact Sheet.

[2] U.S. Food and Drug Administration. (2016). FDA Approval of Epclusa.

[3] IQVIA. (2022). Pharmaceutical Market Insights.

[4] WHO. (2022). Global Hepatitis Report.

More… ↓