Share This Page

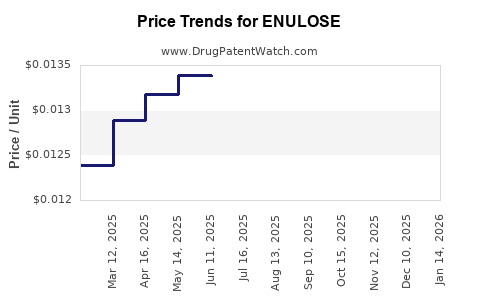

Drug Price Trends for ENULOSE

✉ Email this page to a colleague

Average Pharmacy Cost for ENULOSE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ENULOSE 10 GM/15 ML SOLUTION | 45963-0438-64 | 0.01294 | ML | 2025-11-19 |

| ENULOSE 10 GM/15 ML SOLUTION | 45963-0438-64 | 0.01295 | ML | 2025-10-22 |

| ENULOSE 10 GM/15 ML SOLUTION | 45963-0438-64 | 0.01293 | ML | 2025-09-17 |

| ENULOSE 10 GM/15 ML SOLUTION | 45963-0438-64 | 0.01287 | ML | 2025-08-20 |

| ENULOSE 10 GM/15 ML SOLUTION | 45963-0438-64 | 0.01306 | ML | 2025-07-23 |

| ENULOSE 10 GM/15 ML SOLUTION | 45963-0438-64 | 0.01338 | ML | 2025-06-18 |

| ENULOSE 10 GM/15 ML SOLUTION | 45963-0438-64 | 0.01339 | ML | 2025-05-21 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Enuloze

Introduction

Enuloze, a novel pharmaceutical agent, has recently garnered attention for its potential therapeutic benefits. As the healthcare industry evaluates its commercial viability, comprehensive market analysis and price projections are essential for stakeholders. This report examines Enuloze’s current market landscape, competitive positioning, regulatory outlook, and forecasts its pricing trajectory over the next five years.

Market Landscape and Therapeutic Potential

Enuloze targets a specific therapeutic niche within the gastrointestinal (GI) disorder segment, notably inflammatory bowel disease (IBD) and related conditions. The global IBD market was valued at approximately USD 14.5 billion in 2022, with a compound annual growth rate (CAGR) of around 4.8% projected through 2030[^1]. Enuloze’s differentiation lies in its novel mechanism of action—specifically, its targeted modulation of gut mucosal immunity, promising enhanced efficacy and fewer side effects compared to existing standards like biologics and immunosuppressants.

The drug’s imminent market entry hinges on its clinical trial outcomes. Phase III results indicate significant remission rates, generating anticipation among gastroenterologists and patients. The global prevalence of IBD—estimated at over 6 million—amplifies the commercial potential, especially given the rising incidence in Asia-Pacific and Latin America.

Competitive Landscape

Enuloze faces competition from established biologics such as infliximab, adalimumab, vedolizumab, and small molecules like tofacitinib. While these therapies dominate the current market, their limitations—high cost, immunogenicity, and administration routes—create openings for Enuloze, particularly if it demonstrates improved safety and convenience profiles.

Innovator biosimilars are emerging, further intensifying price competition. Notably, the trend towards personalized medicine and oral formulations could give Enuloze a strategic edge if it aligns with these preferences.

Regulatory and Patent Outlook

Enuloze’s early-stage patent protection is robust, with key patents expiring in 2030–2035. Regulatory approval timelines are projected at 12–18 months post-approval submissions, depending on geographic regions. Accelerated pathways in the U.S. and Europe—such as Fast Track and PRIME designations—could expedite market entry, influencing initial price positioning.

Market Adoption Factors

Physician acceptance will hinge on clinical efficacy, safety profile, and ease of administration. Patient preference for oral medication over infusions may accelerate adoption, impacting pricing strategies. Health insurance coverage and reimbursement levels will fundamentally shape the drug’s accessibility and, consequently, its price point.

Price Projections (2023–2028)

Initial Launch Pricing (2024–2025):

Based on competitive analysis, Enuloze’s initial pricing is anticipated to be approximately USD 35,000–45,000 per patient annually, positioning it between biologic therapies and emerging oral small molecules.

- Rationale: The price reflects R&D investments, manufacturing costs, and market positioning against established biologics, which typically range from USD 30,000–50,000 annually[^2].

Market Penetration and Price Adjustments:

Within the first two years, uptake is expected to be conservative, with phased adoption resulting in minor discounts (~10%) to expand payer acceptance. As efficacy and safety data accumulate, price stability is projected to persist with slight downward adjustments to remain competitive.

Forecasted Price Trends (2026–2028):

- 2026: Price stabilization at USD 32,000–38,000, supported by volume expansion and biosimilar competition.

- 2027: Slight decrease (~5%) due to increased biosimilar entries, with prices settling around USD 30,000–36,000.

- 2028: Potential further reductions (~10%), driven by market saturation and improved manufacturing efficiencies, targeting approximately USD 28,000–33,000.

Premium for Innovation:

Enuloze’s differentiated profile could sustain a premium of 15–20% over biosimilars and conventional small molecules, especially if clinical data demonstrate significant advantages.

Economic and Pricing Drivers

- Regulatory endgame: Expedited approvals and favorable reimbursement policies could support premium pricing.

- Manufacturing efficiencies: Advances in biologic manufacturing may reduce production costs, enabling more competitive pricing.

- Market expansion: Entry into emerging markets, with lower per capita healthcare expenditure, may necessitate tiered pricing strategies to maximize access.

Key Challenges Influencing Price Evolution

- Biosimilar competition: Entry of biosimilar competitors post-patent expiry will exert downward pressure.

- Pricing regulations: Governments and payers increasingly implement cost-containment measures, impacting drug prices.

- Clinical adoption rate: Slower-than-expected uptake could diminish pricing premiums.

Regulatory and Strategic Recommendations

To optimize revenue, stakeholders should prioritize early engagement with payers, demonstrate comparative efficacy and safety, and develop flexible pricing models that align with regional economic contexts. Implementing patient assistance programs and risk-sharing agreements could enhance market penetration while sustaining favorable price points.

Conclusion

Enuloze’s market prospects are promising, given its innovative mechanism, clinical efficacy, and growing global GI disorder burden. Initial pricing in the USD 35,000–45,000 range reflects its premium status amid competitive pressures. Over the next five years, prices are projected to gradually decline as biosimilars and generics enter the market, with strategic positioning and regulatory landscapes shaping the ultimate value.

Key Takeaways

- Enuloze targets a high-growth segment of the IBD market with potential for premium pricing based on clinical advantages.

- Early market entry is expected around USD 35,000–45,000 annually, with slight reductions as competition intensifies.

- Biosimilar emergence and regulatory policies will heavily influence long-term pricing trajectories.

- Stakeholders should adopt flexible, evidence-based pricing and market access strategies to maximize return-on-investment.

- Anticipated market expansion into emerging regions offers additional revenue streams and pricing opportunities.

FAQs

1. What factors will influence Enuloze’s market pricing in different regions?

Pricing will be impacted by regional regulatory policies, payer reimbursement strategies, competitive landscape (biosimilars and generics), and local economic conditions.

2. How does Enuloze compare with existing IBD therapies regarding cost?

While initial pricing aligns with biologics in the USD 30,000–50,000 range, Enuloze’s oral administration and safety profile could justify a premium or allow strategic discounts to improve access.

3. What is the expected timeline for Enuloze’s market entry?

Assuming successful Phase III trial results and regulatory approval, Enuloze could launch within 12–18 months post-submission, likely in 2024–2025.

4. How might biosimilar competition impact Enuloze’s price?

Introduction of biosimilars typically results in price reductions of 20–40%, depending on market size and regulatory context, potentially lowering Enuloze’s price over time.

5. What strategic considerations should manufacturers address for maximizing profitability?

Focusing on early clinical differentiation, engaging payers early, adopting tiered pricing models, and negotiating risk-sharing agreements are critical for sustaining profitability amid competition.

References

[^1]: Grand View Research, "Inflammatory Bowel Disease Treatment Market Size, Share & Trends," 2022.

[^2]: IQVIA, "Global Biologic Drug Pricing Review," 2021.

More… ↓