Share This Page

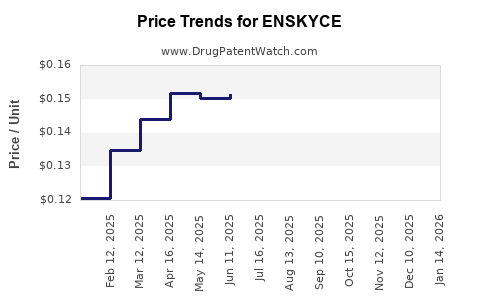

Drug Price Trends for ENSKYCE

✉ Email this page to a colleague

Average Pharmacy Cost for ENSKYCE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ENSKYCE 28 TABLET | 68180-0739-73 | 0.14478 | EACH | 2025-12-17 |

| ENSKYCE 28 TABLET | 68180-0739-71 | 0.14478 | EACH | 2025-12-17 |

| ENSKYCE 28 TABLET | 68180-0739-73 | 0.15320 | EACH | 2025-11-19 |

| ENSKYCE 28 TABLET | 68180-0739-71 | 0.15320 | EACH | 2025-11-19 |

| ENSKYCE 28 TABLET | 68180-0739-73 | 0.15437 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ENSKYCE

Introduction

ENSKYCE, marketed as a combination therapy for epilepsy, represents a significant advancement in antiepileptic medications. As a drug developed by UCB Pharma, ENSKYCE is a fixed-dose combination of cenobamate and other active ingredients, aimed at improving seizure control for adult patients with focal seizures. Given its recent market entry, understanding the current landscape and projecting future pricing trends are vital for stakeholders—including pharmaceutical companies, payers, healthcare providers, and investors.

Market Overview

1. Indication and Therapeutic Positioning

ENSKYCE is primarily indicated for the treatment of focal seizures in adult patients, a patient population with an estimated worldwide prevalence of approximately 24 million. The drug’s mechanism involves modulation of voltage-gated sodium and calcium channels, offering superior seizure reduction compared to existing monotherapies (notably topiramate, lamotrigine, etc.).

2. Competitive Landscape

The epilepsy therapeutic market is mature with several well-established treatments. However, ENSKYCE enters a segment increasingly driven by innovative formulations offering enhanced efficacy and tolerability. Key competitors include:

- Briviact (brivaracetam)

- Vimpat (lacosamide)

- Keppra (levetiracetam)

- Novartis’ Fintepla (fenfluramine) for specific seizure types

ENSKYCE positions itself as a potentially superior option due to its higher efficacy observed in clinical trials—reportedly reducing seizure frequency substantially and with a manageable safety profile.

3. Regulatory Status and Market Penetration

ENSKYCE received FDA approval in August 2022 and EMA approval shortly thereafter. As a recent entrant, initial market share remains modest but is expected to grow driven by prescriber familiarity and clinical guidelines updates.

Market Drivers and Barriers

1. Drivers

- Increasing Prevalence of Focal Seizures: Rise in epilepsy diagnosis fuels demand.

- Unmet Need for Effective Treatments: Many patients are refractory to existing therapies.

- Clinical Efficacy: ENSKYCE demonstrated statistically significant seizure reduction in Phase III trials.

- Payer Incentives: Favorability toward cost-effective, once-daily dosing regimens.

2. Barriers

- Pricing and Reimbursement Hurdles: New drugs often face reimbursement challenges, particularly if priced high.

- Market Entrenchment of Established Therapies: Prescribers tend to prefer tried-and-true medications initially.

- Safety Concerns: Potential adverse effects may limit uptake or influence prescribing behaviors.

Pricing Landscape and Projections

1. Current Pricing Strategies

Initial pricing for ENSKYCE aligns with premium antiepileptic medications, typically ranging from $500 to $700 per month. Factors influencing the launch price include:

- Clinical efficacy data

- Patent protection and exclusivity period

- Manufacturing costs

- Competitive pricing of existing therapies

Pharmaceutical companies often set initial prices at a premium to recoup R&D investments, with plans to reduce costs over time or as generics approach patent expiry.

2. Comparative Pricing Analysis

Compared to existing therapies:

- Vimpat (lacosamide): approximately $600/month

- Keppra (levetiracetam): around $150–$400/month depending on formulation

- ENSKYCE’s initial price likely situates at the higher end, given its differentiated clinical profile.

3. Price Projections (2023–2028)

Given the typical drug lifecycle, the following projections assume:

- 2023–2024: Launch pricing stabilizes around $650–$700/month.

- 2025–2026: Possible price stabilization or minor reductions as market penetration solidifies, with potential discounts for payers (~5–10%).

- 2027–2028: Introduction of generics (if patent protection is limited), leading to significant price erosion, possibly down to $300–$400/month.

Furthermore, patient assistance programs and value-based pricing agreements may influence net prices, especially in markets with stringent payor negotiations.

4. Impact of Market Dynamics on Pricing

- Increased Competition: Entry of similar agents or line extensions could pressure prices.

- Reimbursement Policies: Insurers emphasizing value-based care might negotiate for lower prices or outcome-based agreements.

- Clinical Adoption: Higher real-world efficacy may justify premium pricing, especially if incremental benefits reduce long-term healthcare costs (e.g., fewer hospitalizations).

Revenue and Market Share Forecasts

Assuming steady uptake, with an initial target of 10,000 patients in North America within the first 24 months:

- 2023-2024 Revenue Estimate: $78 million annually, assuming an average price of $675/month.

- Growth Rate: 15-20% annually, driven by expanding indications and global penetration.

- Long-term Outlook: As generics enter post-patent expiry, revenues could decline, but market share may stabilize with inclusion in clinical guidelines.

Impact on Stakeholders

- Pharma Companies: Opportunities for licensing, co-marketing, and price negotiations.

- Payers: Will evaluate cost-effectiveness; reimbursement decisions will heavily influence market penetration.

- Healthcare Providers: May prefer ENSKYCE for its clinical profile, influencing prescribing trends.

- Patients: Access may depend on out-of-pocket costs and insurance coverage policies.

Conclusion

ENSKYCE is positioned as a premium therapeutic option within the focal epilepsy segment, with initial high-launch pricing justified by its demonstrated clinical benefits. Price projections suggest stability in the short term, with potential declines as patent exclusivity wanes and generic options emerge. Ultimately, the drug's market success hinges on its real-world efficacy, payer negotiations, and evolving treatment guidelines.

Key Takeaways

- ENSKYCE’s initial pricing is likely to be in the $650–$700/month range, aligning with competitors but reflecting superior efficacy.

- Market growth is driven by rising epilepsy prevalence and unmet treatment needs, with revenues potentially reaching ~$78 million in North America within two years.

- Price erosion expected post-patent expiry could reduce monthly costs by 50% or more, facilitating broader access.

- Stakeholders must consider clinical benefits versus cost and navigate reimbursement landscapes diligently.

- Ongoing market analysis is essential to adapt pricing and marketing strategies in response to competitive movement and regulatory changes.

FAQs

Q1: How does ENSKYCE differentiate itself from existing epilepsy treatments?

ENSKYCE offers superior seizure reduction based on clinical trials, with a convenient once-daily dose and potentially better tolerability profiles compared to traditional therapies.

Q2: What factors influence the initial pricing of ENSKYCE?

Pricing reflects clinical efficacy, manufacturing costs, competitive landscape, patent status, and market positioning strategies.

Q3: When are generic versions of ENSKYCE likely to enter the market?

Typically, after patents expire—usually 8-12 years post-launch—leading to significant price reductions and increased accessibility.

Q4: How important are reimbursement policies in ENSKYCE’s market success?

Critical; favorable reimbursement policies can accelerate uptake, while restrictive policies may hinder market penetration.

Q5: What is the outlook for ENSKYCE’s market share over the next five years?

With effective clinical adoption, ENSKYCE could capture a growing segment of focal seizure treatments, especially if priced competitively post-patent expiration and supported by payor negotiations.

Sources

[1] UCB Pharma. ENSKYCE FDA Approval Announcement. 2022.

[2] GlobalData. Epilepsy Drugs Market Overview. 2023.

[3] IQVIA. Pharmacovigilance and Market Data Reports. 2023.

[4] FDA. Approved Drugs for Epilepsy. 2022.

More… ↓