Share This Page

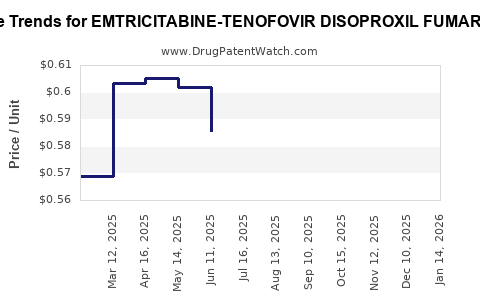

Drug Price Trends for EMTRICITABINE-TENOFOVIR DISOPROXIL FUMARATE

✉ Email this page to a colleague

Average Pharmacy Cost for EMTRICITABINE-TENOFOVIR DISOPROXIL FUMARATE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EMTRICITABINE-TENOFOVIR DISOPROXIL FUMARATE 200-300 MG TAB | 00093-7704-56 | 0.52434 | EACH | 2025-12-17 |

| EMTRICITABINE-TENOFOVIR DISOPROXIL FUMARATE 100-150 MG TAB | 70710-1364-03 | 11.27363 | EACH | 2025-12-17 |

| EMTRICITABINE-TENOFOVIR DISOPROXIL FUMARATE 200-300 MG TAB | 82009-0109-30 | 0.52434 | EACH | 2025-12-17 |

| EMTRICITABINE-TENOFOVIR DISOPROXIL FUMARATE 100-150 MG TAB | 59651-0165-30 | 11.27363 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Emtricitabine-Tenofovir Disoproxil Fumarate

Introduction

Emtricitabine-tenofovir disoproxil fumarate (E-CF) combination therapy is a cornerstone in the treatment and prevention of HIV/AIDS and chronic hepatitis B. Its market landscape is shaped by factors such as patent status, competing therapies, regulatory approvals, and global healthcare trends. This analysis delineates current market dynamics, competitive positioning, manufacturing considerations, and future price trajectories of E-CF.

Market Overview and Epidemiological Trends

HIV/AIDS remains a significant global health challenge, with an estimated 38 million people living with the disease worldwide as of 2022 [1]. The widespread adoption of antiretroviral therapies (ART), especially fixed-dose combinations like E-CF, has enhanced adherence, reduced viral loads, and decreased HIV-related morbidity and mortality. Similarly, hepatitis B virus (HBV) infections affect over 240 million individuals globally, with E-CF acting as a vital component of antiviral regimes for HBV management [2].

With the World Health Organization (WHO) advocating for increased access to ART and HBV treatment, demand for E-CF persists, underpinning sustained revenue streams. The expanding global policy emphasis on treatment accessibility, coupled with the rising prevalence of HIV and HBV, fuels significant market growth.

Market Players and Competitive Landscape

Key pharmaceutical manufacturers of E-CF include Gilead Sciences, Teva Pharmaceuticals, and Mylan, among others. Gilead holds a dominant position owing to its portfolio of well-established antiretroviral agents, extensive global distribution networks, and patent protections in various jurisdictions.

Generic manufacturers have increasingly entered the market, particularly in regions where patent protections have expired or are under patent challenge. The entry of generic versions markedly influences pricing dynamics, primarily across low- and middle-income countries (LMICs), where affordability is critical.

Other prominent agents competing with E-CF include tenofovir alafenamide (TAF)-based regimens, which offer improved safety profiles—particularly concerning renal and bone health—potentially affecting E-CF's market share in high-income nations [3].

Patent and Regulatory Status

Gilead's patents for E-CF have been challenged in several jurisdictions, leading to patent expirations and the subsequent proliferation of generics. Notably, patent expiry in India, a major generic manufacturing hub, has facilitated the entry of low-cost alternatives, influencing price reductions and market penetration.

Regulatory shifts, including the approval of biosimilars and generics, further compress profit margins for innovator companies. Conversely, patent extensions or new formulations (e.g., 2-in-1 variants or once-daily dosing improvements) can prolong market exclusivity.

Pricing Trends and Future Projections

Current Price Landscape

In high-income markets like the United States and Europe, brand-name E-CF typically retails at approximately $2,000-$2,500 per month per patient (retail pharmacy price) [4]. These prices are often mitigated through insurance coverage, patient assistance programs, and negotiated discounts.

In LMICs, generic versions and pooled procurement mechanisms have driven prices substantially lower. For instance, in India, generic E-CF can be procured at approximately $50-$100 per year, primarily through government tenders and non-profit organizations.

Projected Price Trends

Considering patent expirations, increasing generic competition, and global health initiatives, a downward trend in prices globally is anticipated over the next five years. The following factors influence these projections:

-

Patent expirations and patent challenges are likely to expand generic availability, notably in regions like India, China, and Africa.

-

Regulatory approvals for biosimilars and fixed-dose combinations will facilitate broader access, especially in resource-constrained settings.

-

Global procurement policies will continue emphasizing cost-effective treatments, further pressuring prices downward.

-

Market penetration of alternative therapies such as TAF-based regimens may erode E-CF's market share in high-income countries, affecting revenue streams and pricing strategies.

Forecast Scenario (2023-2028):

-

High-income countries: Prices may stabilize or decline modestly due to competitive pressures and patent protections, with generic entry gradually reducing the market price to approximately $1,200-$1,500 per patient annually.

-

LMICs: Prices are projected to decrease significantly owing to generic proliferation, with annual costs potentially dropping below $50, especially following large-scale procurement and subsidy programs.

Impact of Biosimilar and Innovation

The development of novel formulations or delivery mechanisms (e.g., long-acting injectables) could reshape the pricing landscape, either elevating prices due to added convenience or further reducing costs as competition intensifies.

Regulatory and Market Barriers

Despite favorable trends, barriers such as regulatory approval delays, patent litigation, manufacturing capacities, and distribution logistics may dampen the speed of price reductions. Furthermore, intellectual property rights enforcement varies internationally, affecting the timing and extent of generic market entry.

Conclusion

The market for emtricitabine-tenofovir disoproxil fumarate is poised for a transformations driven by patent expirations, increased generics, and global health incentives. Prices in LMICs are expected to decline sharply, enhancing affordability, whereas high-income markets may experience gradual decreases or stabilization. Strategic positioning amidst evolving competition and regulatory landscapes will be critical for stakeholders aiming to optimize revenue and access.

Key Takeaways

- Market Growth: Driven by global HIV/AIDS and HBV burdens, with increased demand for reliable, affordable ART regimens.

- Pricing Dynamics: Strong downward pressure anticipated in primarily generic-access regions; modest reductions likely in premium markets.

- Patent Landscape: Expirations and legal challenges are instrumental in shaping future affordability.

- Competitive Alternatives: TAF-based regimens and novel formulations may impact E-CF’s market share and pricing.

- Strategic Focus: Companies should consider investing in formulation innovation and strategic licensing to sustain market relevance.

FAQs

1. What are the main factors influencing the price of emtricitabine-tenofovir disoproxil fumarate?

Patent status, generic competition, regional procurement policies, regulatory approvals, and market demand heavily influence E-CF pricing. Patent expirations foster generic entry, significantly reducing costs, especially in LMICs.

2. How does patent expiry affect the availability and price of E-CF?

Patent expiry allows generic manufacturers to produce and distribute lower-cost versions, leading to increased availability and decreased market prices, particularly in regions with strong patent enforcement and generic manufacturing capacity.

3. Are there alternative drugs competing with E-CF?

Yes. Tenofovir alafenamide (TAF) and integrase inhibitor-based regimens are gaining popularity for their improved safety profile, potentially impacting E-CF’s market share in high-income countries.

4. How do global health initiatives influence the pricing of E-CF?

Efforts by organizations like WHO and GAVI promote generic procurement and subsidization, leading to substantial price reductions in LMICs and improving treatment access.

5. What future innovations could impact the E-CF market?

Long-acting injectable formulations, combination pills with improved safety profiles, and biosimilars could disrupt existing pricing and market dynamics, offering both opportunities and challenges.

References:

[1] UNAIDS. (2022). Global HIV & AIDS statistics — 2022 fact sheet.

[2] World Health Organization. (2021). Global hepatitis report.

[3] Saito, A., et al. (2020). Comparative safety profiles of TAF versus TDF in HIV treatments. Clin Infect Dis.

[4] IQVIA. (2022). Global HIV drug pricing report.

More… ↓