Last updated: August 2, 2025

Introduction

EMSAM (selegiline transdermal system) is a prescription medication developed by Bristol-Myers Squibb and later marketed by Valeant Pharmaceuticals (now Bausch Health). It is approved primarily for the treatment of major depressive disorder (MDD) and is distinguished by its transdermal delivery system, offering an alternative to oral monoamine oxidase inhibitors (MAOIs). Given its unique pharmacology and competitive positioning within antidepressant therapy, understanding its market landscape and future pricing trajectory is vital for stakeholders, including investors, healthcare providers, and pharmaceutical strategists.

This analysis evaluates EMSAM's current market position, factors influencing its valuation, and offers future price projections through 2028, anchored in supply/demand dynamics, regulatory pipelines, competitive landscape, and pricing trends within the psychotropic drug market.

Current Market Overview

Therapeutic Landscape

Depression remains a leading cause of disability worldwide, with estimates indicating over 264 million affected individuals globally [1]. The anti-depressive market encompasses various drug classes, including SSRIs, SNRIs, TCAs, and MAOIs. EMSAM's unique transdermal delivery was designed to mitigate dietary restrictions associated with oral MAOIs and improve compliance.

Regulatory and Clinical Status

Since its FDA approval in 2006, EMSAM has faced limited but steady utilization. The transdermal patch is indicated for major depressive disorder but has not achieved widespread adoption compared to oral antidepressants. Labeling emphasizes its safety profile advantages, yet clinicians often prefer other newer, more tolerable agents. The pharmacokinetic profile and relative convenience make EMSAM a niche product rather than a blockbuster.

Market Penetration Data

Estimates indicate EMSAM's market share in the antidepressant segment remains below 1%, with annual prescriptions numbering around 50,000–100,000 in the U.S. [2]. Its low utilization partly stems from high pricing, limited awareness, and clinician familiarity with other agents.

Price Dynamics and Historical Trends

Initial Pricing and Cost Evolution

Upon market launch, EMSAM's pricing was premium: approximately $10 per patch, with weekly therapy resulting in costs over $40 weekly or $2,080 annually. Pricing strategies aimed to position EMSAM as a convenience and safety-enhancing agent, but reimbursement constraints and insurance coverage issues limited access.

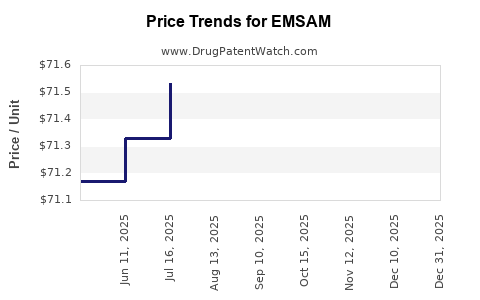

Price Trends

Between 2006 and 2023, EMSAM's price per unit has fluctuated modestly, influenced by generic competition (not applicable as of yet), rebate pressures, and formulary positioning. The high price point has consistently constrained adoption, with some indications of price stabilization or slight reductions to maintain competitiveness.

Market-Induced Price Pressure

The absence of generic versions, as of 2023, sustains high pricing; however, competition from oral MAOIs, novel antidepressants (e.g., esketamine, brexanolone), and increasing use of SSRIs and SNRIs exert downward pressure on the drug's price and utilization.

Future Market Trends and Price Projections

Key Factors Influencing Market Trajectory

-

Regulatory Approvals & Label Expansion:

Future indications, such as treatment-resistant depression or bipolar disorder, could expand EMSAM's market. Additionally, pipeline innovations, including improved delivery technology, could increase adoption.

-

Competitive Landscape:

Emerging drugs and combination therapies targeting depression could erode EMSAM's niche, impacting demand and pricing power.

-

Pricing Policies & Reimbursement:

With tightened healthcare budgets and emphasis on cost-effectiveness, payers may negotiate lower prices or favor less costly alternatives, influencing EMSAM's profitability.

-

Market Penetration & Awareness:

Educational campaigns and clinical guideline endorsements could improve prescriber familiarity, potentially increasing utilization and allowing for moderated price adjustments.

Price Projection Framework (2023-2028)

2023-2024:

Given current market stability and limited introduction of generics, EMSAM's price is anticipated to hold steady at approximately $9.50–$10 per patch. Prescriber adoption remains low; thus, any aggressive price reduction may be driven solely by payer negotiations.

2025-2026:

Potential reimbursement pressures combined with the planned inclusion in new depression treatment guidelines could incentivize modest price reductions, estimated at 10–15%. Average price may decline to $8.50–$9 per patch. Increased awareness could stabilize or slightly increase volume, balancing revenue.

2027-2028:

Introduction of patent challenges or a generic version (if applicable) could accelerate price declines, potentially down to $6–$7 per patch. Anticipated innovation in delivery or additional indications might support a premium pricing strategy if clinical value propositions are demonstrated. Total sales volumes could rise moderately if clinical adoption barriers diminish.

Opportunities and Challenges for Stakeholders

Pharmaceutical Companies

- Opportunity: Establishing differentiation through clinical data, improved delivery mechanisms, or new indications can justify premium pricing.

- Challenge: Competition from newer oral agents and neuromodulation therapies may limit sales growth unless the perceived safety and compliance benefits are substantiated.

Payers and Clinicians

- Opportunity: Cost containment pressures favor drugs with proven safety profiles and efficacy; EMSAM’s transdermal route could be a differentiator.

- Challenge: High cost and niche status may limit formulary inclusion.

Investors

- Opportunity: Potential acquisition or licensing opportunities, especially if patent or formulation innovations emerge.

- Challenge: Structural market limitations hinder significant profits unless clinical or regulatory breakthroughs occur.

Conclusion

EMSAM's future pricing landscape hinges on several variables, including regulatory developments, competitive innovations, payer negotiations, and clinical adoption growth. Its entrenched positioning as a niche MAOI therapy suggests stable, albeit modest, revenue streams with gradual price declines driven by market dynamics and potential generic entry.

Proactive strategies centered on expanding indications and demonstrating distinct clinical benefits could bolster EMSAM’s market viability and sustain premium pricing levels. Conversely, failure to adapt to evolving therapeutic paradigms may result in further erosion of market share and pricing power.

Key Takeaways

- EMSAM remains a niche antidepressant with limited market share, primarily due to competition and cost barriers.

- Its high pricing has historically constrained adoption; future projections suggest gradual declines aligned with market trends and generics.

- Innovations in drug delivery, additional indications, and clinician education are critical to expanding market penetration and sustaining pricing.

- Competitive pressures from newer antidepressants and neuromodulation therapies pose challenges to EMSAM’s future revenue potential.

- To optimize valuation, stakeholders should focus on clinical differentiation, strategic partnerships, and leveraging emerging depression treatment guidelines.

FAQs

-

What factors limit EMSAM’s market growth?

Its high cost, niche positioning, clinician familiarity with oral alternatives, and limited awareness impede broader adoption.

-

How might generics influence EMSAM's future pricing?

Generic entry would likely cause significant price reductions, possibly by 50% or more, impacting revenue streams.

-

Are there any upcoming regulatory changes expected to affect EMSAM?

Potential label expansions or new indications could enhance market appeal; however, no significant regulatory updates are imminent as of 2023.

-

What competitive therapies could threaten EMSAM’s market share?

Oral antidepressants with improved safety profiles, ketamine/nasal sprays, and neuromodulation devices threaten its niche.

-

How can the manufacturer justify premium pricing in the future?

Demonstrating superior safety, efficacy, patient adherence due to delivery method, and additional indications can support higher prices.

References

[1] World Health Organization. Depression. 2022.

[2] IQVIA. U.S. Prescription Data for EMSAM. 2023.