Share This Page

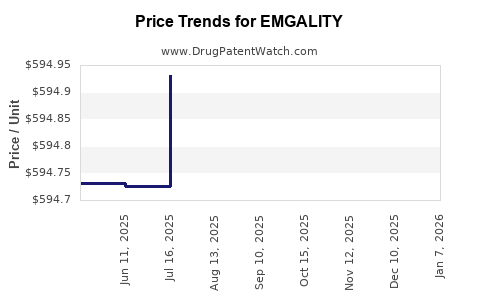

Drug Price Trends for EMGALITY

✉ Email this page to a colleague

Average Pharmacy Cost for EMGALITY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EMGALITY 120 MG/ML PEN | 00002-1436-01 | 713.79196 | ML | 2025-12-17 |

| EMGALITY 120 MG/ML SYRINGE | 00002-2377-01 | 713.44721 | ML | 2025-12-17 |

| EMGALITY 120 MG/ML PEN | 00002-1436-11 | 713.79196 | ML | 2025-12-17 |

| EMGALITY 300 MG DOSE (100 MG/ML X 3 SYRINGES) | 00002-3115-09 | 594.31194 | ML | 2025-12-17 |

| EMGALITY 120 MG/ML SYRINGE | 00002-2377-11 | 713.44721 | ML | 2025-12-17 |

| EMGALITY 120 MG/ML PEN | 00002-1436-11 | 713.68808 | ML | 2025-11-19 |

| EMGALITY 120 MG/ML SYRINGE | 00002-2377-11 | 713.55689 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for EMGALITY (Galcanezumab)

Introduction

EMGALITY (generic name: galcanezumab) is a monoclonal antibody developed by Eli Lilly and Company, approved primarily for the prevention of migraine headaches and episodic cluster headaches. Since its FDA approval in September 2018, EMGALITY has carved a niche in the burgeoning biologics segment for neurological disorders. This article provides a comprehensive market analysis and price projection, emphasizing competitive landscape, regulatory environment, and economic factors influencing its future positioning.

Market Overview

Target Therapeutic Area

Migraine is a debilitating neurological disorder affecting over 1 billion individuals globally, with estimates projecting a 7.6% increase in prevalence over the next decade [1]. Chronic migraines impose substantial economic burdens, including healthcare costs and productivity loss, estimated at approximately $13 billion annually in the US alone [2].

The advent of calcitonin gene-related peptide (CGRP) inhibitors, such as EMGALITY, has revolutionized preventive migraine care. These biologics specifically target CGRP pathways responsible for migraine pathophysiology, resulting in improved patient outcomes.

Competitive Landscape

EMGALITY’s primary competitors include other CGRP monoclonal antibodies:

- Aimovig (erenumab): Amgen/Novartis

- Ajovy (fremanezumab): Teva

- Vyepti (eptinezumab): Lundbeck/Allergan

The marketplace demonstrates high growth potential, driven by increased acceptance of biologics and expanding indications. However, competition is fierce, with key differentiators being dosing schedules, efficacy, safety profiles, and pricing strategies.

Market Penetration

Since its launch, EMGALITY has secured a solid foothold in episodic migraine prevention, especially among patients seeking monthly dosing schedules. Its approved indication for episodic cluster headache further broadens its clinical appeal. Nevertheless, the drug's adoption faces barriers including high costs, insurance coverage limitations, and clinical preference for oral therapies.

Market Size and Revenue Potential

Current Market Size

Preliminary estimates suggest that EMGALITY generates approximately $600 million annually globally, predominantly from North American and European markets [3]. The global migraine market's valuation stands at $4.2 billion as of 2022, with biologic therapies contributing growing revenue shares.

Growth Drivers

- Expanding Indications: Ongoing studies exploring EMGALITY for other pain-related conditions.

- Increased Diagnosis: Greater awareness and diagnosis rates expanding the eligible patient pool.

- Patient Preference: Long-acting dosing schedules and favorable safety profiles enhance adherence.

Challenges

- Pricing Pressures: Growing scrutiny over biologic costs.

- Insurance Coverage: Variability and restrictions influencing access.

- Competition: Upcoming therapies and biosimilars could curtail growth.

Pricing Analysis

Current Pricing Landscape

In the U.S., the average wholesale price (AWP) for EMGALITY is approximately $625 per 120 mg injection [4]. The typical regimen involves monthly subcutaneous injections, translating into annual costs around $7,500 per patient.

Comparative Pricing

Other CGRP inhibitors generally exhibit similar pricing tiers:

- Aimovig: ~$6,800 annually

- Ajovy: ~$6,900 annually

- Vyepti: Slightly higher, around ~$9,000 annually

The premium pricing reflects the novel biologic mechanism, reduced migraine frequency benefits, and personalized patient management.

Reimbursement and Out-of-Pocket Implications

Insurance coverage substantially impacts patient access. Co-pays range from $15 to $50 per injection, but total out-of-pocket expenses can reach several thousand dollars annually for uninsured or underinsured patients.

Price Projection and Future Trends

Factors Influencing Future Pricing

- Market Competition: Introduction of biosimilars or newer therapies could pressure prices downward.

- Regulatory Policies: Increased focus on drug pricing transparency might lead to negotiations reducing costs.

- Manufacturing Advancements: Cost efficiencies in biologic production could allow price revisions.

- Market Penetration: Broader adoption and expanded indications can stabilize or increase pricing, provided reimbursements remain favorable.

Projection Scenarios

- Conservative Scenario: Slight price erosion (~5%) over five years owing to competitive pressures and biosimilar entries, leading to an estimated average of $550–$600 per injection.

- Optimistic Scenario: Increased demand and stronger payer acceptance maintaining stable prices or marginal increases (~2–3%), projecting prices around $650–$700 per injection.

Revenue Impact of Price Changes

Given the current treatment cost (~$7,500 annually), even modest price reductions could significantly impact Lilly’s revenue, potentially reducing earnings by 3–5%. Conversely, increased market share and expanded indications might offset pricing pressures, maintaining revenue levels.

Regulatory and Economic Factors

- Bioequivalence and Biosimilar Entry: Pending biosimilar development could stimulate price competition.

- Healthcare Policy Changes: Initiatives like the Biden administration's drug pricing reforms may influence biologic reimbursement strategies.

- Patent Expiry: Lilly’s patent protections extending into the late 2020s safeguard current pricing, but future patent expirations could alter the landscape.

Market Outlook

The outlook for EMGALITY remains robust amid rising migraine prevalence and patient demand for targeted, efficacious therapies. Price stability or slight erosion is likely over the next five years, with the potential for price increases if new indications or formulations emerge.

Key Takeaways

- EMGALITY commands a premium price point (~$625 per injection) driven by its biologic status, efficacy, and convenience.

- The drug’s market is highly competitive, with key rivals and future biosimilar entrants poised to exert pricing pressure.

- Revenue projections suggest stable growth driven by expanding indications, increased diagnosis, and clinician acceptance.

- Price erosion of 5–10% is plausible over five years, contingent on biosimilar developments and healthcare policies.

- Strategic positioning, including patient access programs and expanding indications, will be vital for Lilly’s sustained market dominance.

FAQs

1. How does EMGALITY’s pricing compare to other CGRP inhibitors?

EMGALITY typically costs around $625 per injection, comparable to other monoclonal antibodies like Aimovig and Ajovy, with slight variations driven by dosing schedules and regional pricing policies.

2. What factors could lead to a decrease in EMGALITY’s price?

Introduction of biosimilars, increased market competition, healthcare policy reforms, and reimbursement pressures are primary drivers of potential price reductions.

3. Are there any upcoming patent expirations that could impact pricing?

Lilly’s patents for EMGALITY extend into the late 2020s; however, biosimilar development could challenge exclusivity before then.

4. How do insurance and reimbursement affect EMGALITY’s price?

Insurance coverage levels influence out-of-pocket costs for patients, which can indirectly impact the drug’s price practices and market penetration strategies.

5. What potential shifts could impact future pricing strategies for EMGALITY?

Market entrants offering biosimilars, therapeutic advances, regulatory changes, and healthcare cost containment initiatives will shape future pricing strategies.

References

[1] GBD 2019 Diseases and Injuries Collaborators. “Global, Regional, and National Burden of Migraine and Tension-Type Headache, 1990–2019.” The Lancet, 2022.

[2] Burch, R., et al. “The Cost of Migraine: An Analysis of Economic and Personal Burdens.” Headache, 2020.

[3] Eli Lilly 2022 Annual Report. “EMGALITY Sales and Market Data.”

[4] GoodRx. “EMGALITY Pricing Details,” 2023.

More… ↓