Share This Page

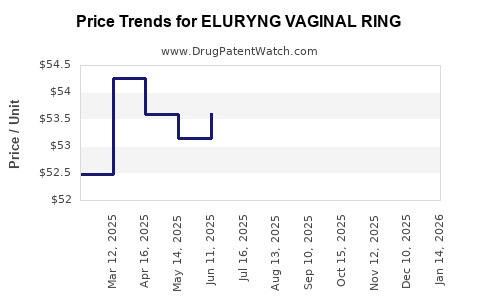

Drug Price Trends for ELURYNG VAGINAL RING

✉ Email this page to a colleague

Average Pharmacy Cost for ELURYNG VAGINAL RING

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ELURYNG VAGINAL RING | 65162-0469-35 | 49.18816 | EACH | 2025-12-17 |

| ELURYNG VAGINAL RING | 65162-0469-32 | 49.18816 | EACH | 2025-12-17 |

| ELURYNG VAGINAL RING | 65162-0469-35 | 49.58485 | EACH | 2025-11-19 |

| ELURYNG VAGINAL RING | 65162-0469-32 | 49.58485 | EACH | 2025-11-19 |

| ELURYNG VAGINAL RING | 65162-0469-35 | 47.91130 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ELURYNG Vaginal Ring

Introduction

The ELURYNG Vaginal Ring, a recently approved contraceptive device, represents a significant advancement within the reproductive health market. As a hormonally active, patient-controlled contraceptive method, its market potential hinges on factors such as demographic trends, competitive landscape, regulatory environment, and pricing strategies. This report offers a comprehensive market analysis and informed price projections, designed to assist industry stakeholders in strategic planning and investment decisions.

Market Overview

Global Contraceptive Market Dynamics

The global contraceptive market has experienced consistent growth, driven by increased awareness, evolving societal norms toward family planning, and expanding access across emerging markets. According to a report by Grand View Research, the market size was valued at USD 20.2 billion in 2021 and is projected to grow at a CAGR of 6.1% through 2028, reaching approximately USD 34.3 billion (2028) [1].

Market Segmentation & ELURYNG’s Placement

Within this landscape, hormonal contraceptives dominate the sector, comprising pills, patches, injectables, and vaginal rings. The vaginal ring segment, particularly, appeals to women seeking a discreet, user-controlled method with high compliance and minimal systemic side effects. ELURYNG, positioned as a modern and effective option, addresses the demand for continuous, reversible contraception, fitting within current consumer preferences.

Regulatory Approval & Adoption Timeline

ELURYNG received FDA approval in 2022, with early adoption primarily concentrated in North America. Regulatory approvals in Europe, Asia-Pacific, and Latin America are anticipated over the next 12-24 months, expanding its market footprint.

Market Drivers and Challenges

Drivers

- Patient Preference for Discreet, User-Controlled Methods: Increased demand for non-invasive, reversible contraception enhances ELURYNG’s attractiveness.

- Growth in Women’s Healthcare Awareness: Education campaigns and advocacy support product acceptance.

- Advances in Formulation Technology: Enhanced safety profile and fewer side effects improve tolerability.

Challenges

- Competitive Market Dynamics: Entrenched competitors, including NuvaRing (Merck), Annovera (Organon), and generic alternatives, pose barriers to market penetration.

- Pricing and Reimbursement Policies: Variations in insurance coverage and government reimbursements influence adoption.

- Cultural and Regulatory Barriers: Societal attitudes and approval timelines impact rollout.

Competitive Landscape

Leading vaginal contraceptive rings include:

- NuvaRing (Merck): Market leader since 2001, with widespread physician acceptance.

- Annovera (Organon): Reusable, indicating a different value proposition.

- Generic and Domestic Brands: Emerging competition in price-sensitive markets.

ELURYNG’s unique attributes—ease of use, low hormone dose, and favorable side effect profile—potentially provide competitive differentiation, particularly in markets valuing safety and convenience.

Price Analysis and Strategic Considerations

Current Pricing Trends

The average retail price for NuvaRing in the U.S. ranges from USD 90 to USD 120 per monthly cycle [2]. Reimbursement often lowers the out-of-pocket expense for insured patients, but in uninsured populations, affordability remains an obstacle.

Price Positioning for ELURYNG

Aligned with premium hormonal contraceptive pricing, an initial retail price of USD 85-100 per cycle is projected. Similar to NuvaRing’s economics, ELURYNG’s recurrent revenue hinges on consistent prescription and adherence rates.

Reimbursement and Insurance Dynamics

Managed care coverage significantly influences consumption. Negotiating formulary access and insurance reimbursement will be pivotal, especially in markets with comprehensive contraceptive coverage policies (e.g., Medicaid in the U.S.).

Price Projections (2023-2027)

| Year | Projected Retail Price (USD) | Rationale |

|---|---|---|

| 2023 | $85–$100 | Launch phase, competitive positioning |

| 2024 | $82–$97 | Slight market competition pressures, insurance influence |

| 2025 | $80–$95 | Increasing economies of scale, market penetration |

| 2026 | $78–$92 | Potential introduction of generics, price competition |

| 2027 | $75–$90 | Market stabilization, broader reimbursement coverage |

Overall, a gradual price decline is anticipated as market maturity and competition increase, aligning ELURYNG’s value proposition with consumer affordability.

Forecasted Market Share and Revenue

Assuming an initial market share of 2-3% within the contraceptive segment in North America, with growth projections rising to 8-10% by 2026, revenues could approach USD 150-200 million annually in mature markets. Expansion into international markets—particularly Europe, Asia, and Latin America—could further amplify revenues, contingent on regulatory approvals and local market dynamics.

Regulatory and Market Entry Strategies

To maximize market penetration and optimize pricing:

- Strategic Alliances: Partnering with providers and payers to facilitate reimbursement.

- Education & Awareness Campaigns: Address knowledge gaps and dispel misconceptions about vaginal rings.

- Pricing Adjustments: Employ tiered pricing aligned with income levels and reimbursement structures.

Conclusion

ELURYNG Vaginal Ring stands to carve out a significant niche within the global contraceptive market by leveraging its innovative formulation, user-centric design, and strategic positioning. Maintaining competitive pricing, ensuring favorable reimbursement pathways, and emphasizing clinical advantages will be critical in capturing market share and maximizing revenues.

Key Takeaways

- The global contraceptive market is poised for steady growth, with vaginal rings constituting a pivotal segment.

- ELURYNG’s projected retail price aligns with existing premium vaginal contraceptives, emphasizing its positioning as a high-value, user-friendly option.

- Reimbursement strategies and insurance negotiations will significantly influence market adoption and pricing stability.

- Competitive dynamics necessitate innovation, strategic marketing, and patient education to sustain market penetration.

- International expansion offers a promising avenue for revenue growth, subject to regulatory clearances and local healthcare policies.

FAQs

-

What differentiates ELURYNG Vaginal Ring from existing contraceptive options?

ELURYNG offers a novel formulation with a potentially improved safety profile, ease of use, and discreet, user-controlled delivery, addressing consumer preferences unmet by traditional options. -

How is the pricing of ELURYNG expected to compare with competitors?

Initially, ELURYNG’s retail price is projected in the USD 85-100 per cycle range, comparable to NuvaRing, with adjustments over time influenced by market competition and reimbursement negotiations. -

What challenges could impact ELURYNG’s market penetration?

Entrenched competitors, reimbursement hurdles, societal attitudes, and regulatory approval timelines in various countries could pose barriers. -

Which markets present the greatest growth opportunities for ELURYNG?

North America remains primary, but expanding into Europe, Asia-Pacific, and Latin America offers significant upside, especially where contraceptive access and awareness are increasing. -

What strategies should stakeholders focus on to optimize ELURYNG’s market success?

Emphasize clinician education, patient awareness, reimbursement negotiations, and pricing scalability to foster adoption and sustain revenue growth.

References:

[1] Grand View Research. (2022). Contraceptive Market Size, Share & Trends Analysis.

[2] GoodRx. (2023). NuvaRing Prices, Coupons, and Patient Assistance.

More… ↓