Last updated: July 27, 2025

Introduction

ELIQUIS (apixaban), developed and marketed by Bristol-Myers Squibb and Pfizer, is an orally active anticoagulant approved for preventing stroke in non-valvular atrial fibrillation, treating deep vein thrombosis (DVT), pulmonary embolism (PE), and reducing post-operative thrombotic risk. Since its launch in 2012, ELIQUIS has become a prominent player in the direct oral anticoagulant (DOAC) market. Analyzing its current market positioning and projecting future pricing trends are critical for stakeholders, including investors, healthcare providers, and policy makers.

Market Dynamics

Market Size and Growth Trajectory

The global anticoagulant market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7.2% from 2023 to 2030, reaching an estimated valuation of USD 33 billion by 2030 [1]. This growth is driven by increasing prevalence of atrial fibrillation, venous thromboembolism, and rising awareness of stroke prevention strategies.

ELIQUIS holds a significant market share, competing primarily with Xarelto (rivaroxaban), Eliquis, and Pradaxa (dabigatran). Its favorable profile, including lower bleeding risk compared to warfarin, and ease of administration have bolstered its adoption.

Market Penetration and Competitive Landscape

ELIQUIS’s market penetration benefits from extensive clinical trial data demonstrating superior safety and efficacy profiles. It has captured a considerable portion of the non-valvular atrial fibrillation segment, commanding roughly 30–35% of the global oral anticoagulant market [2].

However, competition remains stiff, especially from Xarelto, which benefits from broader indications and longer market presence. Biosimilar and generic entries, particularly in European markets, threaten to erode ELIQUIS's pricing power in the coming years.

Regulatory Developments and Patent Landscape

Bristol-Myers Squibb and Pfizer’s patent exclusivity for ELIQUIS is expected to expire around 2026–2027 in major markets, opening doors for biosimilar competition. Patent litigations and regulatory approvals influence market exclusivity and, consequently, pricing strategies.

Pricing Landscape

Current Price Points

In the United States, the average wholesale price (AWP) for ELIQUIS ranges from USD 450 to USD 600 per month, with actual transaction prices often lower due to discounts and pharmacy benefit manager (PBM) negotiations [3].

European prices vary, generally aligning with regional pricing policies and reimbursement frameworks, often ranging between EUR 350 and EUR 500 monthly.

Pricing Trends and Factors Influencing Price Projections

-

Patent Expiry and Biosimilar Entry

Upcoming patent expirations are poised to increase market competition, likely prompting price reductions of 20–50% in key markets [4].

-

Market Penetration of Generics and Biosimilars

Once biosimilars enter, generic competition could lead to significant price erosion, especially in price-sensitive markets.

-

Reimbursement Policies and Healthcare Economics

Governments and insurers' willingness to reimburse at current levels influences pricing stability. A shift toward value-based healthcare may push prices downward in pursuit of cost-effectiveness.

-

Manufacturing and Supply Chain

Improved production efficiencies and potential biosimilar manufacturing cost reductions could facilitate lower pricing post-patent expiry.

-

Clinical and Real-World Evidence

Demonstrations of cost-effectiveness relative to competitors will impact pricing flexibility, especially if new data favor ELIQUIS’s safety profile.

Price Projections (2023–2030)

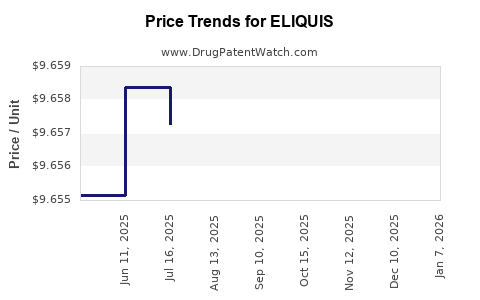

Short-Term (2023–2025):

- Likely price stability due to patent protections and market share retention.

- Expect modest increases, around 2–3% annually, driven by healthcare inflation and value-based negotiations.

Mid to Long-Term (2026–2030):

- Anticipated sharp price declines once patent barriers weaken, with reductions ranging from 25% to 50% in the U.S. and Europe.

- Entry of biosimilars could trigger aggressive pricing strategies, further reducing ELIQUIS’s prices by 30–60%, depending on reimbursement policies and market uptake.

Regional Variations:

- U.S. prices could decline more rapidly due to sophisticated PBM negotiating power.

- European markets may see gradual reductions influenced by regional health technology assessments (HTAs) and price controls ([5]).

- Emerging markets might experience less dramatic reductions, maintaining higher relative prices due to less competitive biosimilar presence.

Implications for Stakeholders

Investors should anticipate a stabilization phase pre-2026 followed by potential valuation adjustments correlating with biosimilar market entry.

Healthcare providers may face increased access to lower-cost alternatives, influencing prescribing habits and formulary decisions.

Manufacturers must strategize around patent litigation and biosimilar development to maximize revenue or prepare for price erosion.

Regulatory and Policy Impact

Regulatory agencies such as the FDA and EMA are increasingly emphasizing biosimilarity approval pathways, which can accelerate generic competition. Price controls in countries like the UK, Canada, and Australia remain influential in setting precedent for pricing adjustments globally.

Conclusion

ELIQUIS enjoys a strong market position through its safety profile and clinical efficacy. However, impending patent expirations and growing biosimilar options threaten to reduce its pricing power significantly. A strategic focus on patient outcomes, cost-effectiveness, and market adaptation will be vital for maintaining profitability and competitive advantage.

Key Takeaways

- Market Growth: The global anticoagulant market will expand at approximately 7.2% CAGR till 2030, with ELIQUIS remaining a key player.

- Pricing Stability and Decline: Near-term prices are stable; significant reductions are expected post-2026 due to biosimilar competition.

- Regional Variability: Pricing reductions will vary globally based on regulatory environment, reimbursement policies, and biosimilar adoption.

- Strategic Considerations: Stakeholders should prepare for patent challenges, biosimilar entry, and evolving reimbursement landscapes impacting drug pricing.

- Innovation and Evidence: Continuous clinical research demonstrating superior safety and effectiveness can support sustained value propositions beyond price alone.

FAQs

1. When does patent expiration for ELIQUIS in major markets occur?

Patent protections are expected to expire around 2026–2027 in the U.S. and EU, opening the pathway for biosimilar development and competition.

2. How will biosimilar competition influence ELIQUIS pricing?

Biosimilar entry is likely to induce a 30–60% decrease in ELIQUIS prices, depending on regional market dynamics and regulatory approvals.

3. Are there any upcoming regulatory approvals that could impact ELIQUIS’s market?

Regulatory bodies are focused on biosimilar pathways. Approval of biosimilars for apixaban is currently in development, which could influence the competitive landscape significantly.

4. How does regional regulation affect ELIQUIS pricing?

Price controls and reimbursement policies differ regionally, often leading to more aggressive price reductions in markets with strong healthcare regulation, like Europe and North America.

5. What strategies can manufacturers adopt to extend ELIQUIS’s market life?

Investing in clinical research, demonstrating superior safety and efficacy, exploring combination therapies, and engaging in early biosimilar development are key strategies.

References

- MarketsandMarkets. "Anticoagulant Market by Product, Type, Application, and Region – Global Forecast to 2030." 2022.

- Global Data. "Market Share and Competitive Dynamics in Oral Anticoagulants." 2022.

- Red Book, IBM Micromedex. Average wholesale drug prices data, 2023.

- EvaluatePharma. "Impact of Patent Expirations on the Cardiology Market." 2022.

- European Medicines Agency. "Pricing and Reimbursement Policies for Innovative Medicines." 2022.