Share This Page

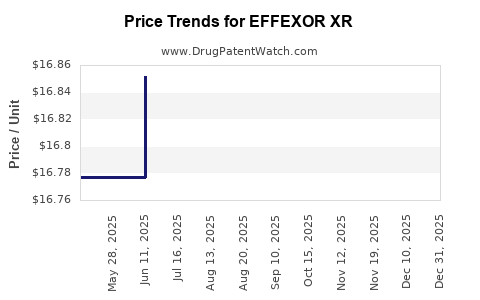

Drug Price Trends for EFFEXOR XR

✉ Email this page to a colleague

Average Pharmacy Cost for EFFEXOR XR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EFFEXOR XR 150 MG CAPSULE | 58151-0127-93 | 20.58460 | EACH | 2025-11-19 |

| EFFEXOR XR 37.5 MG CAPSULE | 58151-0125-77 | 16.86273 | EACH | 2025-11-19 |

| EFFEXOR XR 150 MG CAPSULE | 00008-0836-21 | 20.58460 | EACH | 2025-11-19 |

| EFFEXOR XR 150 MG CAPSULE | 58151-0127-77 | 20.58460 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Effexor XR (Venlafaxine Extended-Release)

Introduction

Effexor XR (venlafaxine extended-release) stands as a leading selective serotonin-norepinephrine reuptake inhibitor (SNRI) used primarily for the treatment of major depressive disorder, generalized anxiety disorder, and panic disorder. Since its debut, Effexor XR has maintained a significant market presence owing to its efficacy profile and established clinical positioning. This article provides a comprehensive market analysis of Effexor XR, evaluating current dynamics, key drivers, competitive landscape, and future price projections within a highly competitive and evolving pharmaceutical environment.

Market Landscape Overview

Market Size and Growth Trajectory

The global antidepressant market was valued at approximately USD 15.5 billion in 2022 and is projected to grow at a CAGR of around 3.5% through 2028, driven by increasing mental health awareness, rising prevalence of depression, and expanding access to healthcare. Effexor XR occupies a substantial share, particularly across North America and Europe, where its approval dates back to the early 2000s and it enjoys widespread prescription use [1].

In the United States alone, antidepressant prescription volume surged from approximately 268 million prescriptions in 2018 to over 372 million in 2022, reflecting strong demand for SNRI classes, including Effexor XR [2].

Market Segmentation

- By Indication: Major depressive disorder (MDD) remains the primary driver; anxiety and panic disorders contribute significantly to revenue diversification.

- By Distribution Channel: Retail pharmacies, hospital outpatient clinics, and online pharmacies are growing segments; online sales accounted for roughly 12% of antidepressant sales in 2022, predicted to increase with digital health initiatives.

- By Geography: North America leads, accounting for over 45% of global sales; Europe is the second-largest market; Asia-Pacific presents high growth potential due to increasing mental health awareness.

Competitive Dynamics

Key Players and Offerings

- Generic Competition: Gained prominence following patent expirations of Effexor XR in 2019, leading to a sharp decline in brand-name sales.

- Brand Alternatives: Other SNRI and SSRI drugs like Cymbalta (duloxetine), Pristiq (desvenlafaxine), and Lexapro (escitalopram) vie for market share, often competing on efficacy, tolerability, and cost.

- Emerging Therapies: Novel antidepressants, including ketamine-based therapies and digital mental health solutions, threaten traditional pharmacotherapies’ dominance.

Patent and Patent Challenges

Effexor XR’s primary patent faced legal challenges, culminating in generic entry that significantly impacted revenue streams. Despite this, brand loyalty, physician prescribing habits, and formulary placements continue to influence ongoing market shares.

Current Pricing Dynamics

Historical Price Trends

At launch, Effexor XR commanded a premium retail price, averaging approximately USD 250–300 per month for a standard dose. Post-patent expiry, generic versions saw a steep price decrease, with retail prices falling below USD 50 per month for generics.

Current Price Landscape

- Brand-Name Effexor XR: Prices range from USD 250 to USD 350 per month, depending on insurance coverage, dosage, and pharmacy.

- Generics: Retail prices hover around USD 20–50 per month, with variations based on manufacturer and geographic factors.

- Insurance and Reimbursement: Insurance coverage heavily influences patient out-of-pocket costs, often favoring generics for cost savings.

Future Price Projections

Impact of Patent Expiry and Generics

The expiration of Effexor XR patents in 2019 resulted in a significant drop in brand-name sales, with estimates indicating a 70% decline within two years. Moving forward, generic erosion is expected to continue, further depressing prices.

Market Trends Influencing Pricing

- Cost-Saving Initiatives: Ongoing pressure from healthcare payers to reduce expenditures will sustain generic dominance.

- Prescriber Preferences: Despite generics’ affordability, some clinicians continue to prescribe brand Effexor XR for specific patient populations, maintaining a residual premium.

- New Formulations or Indications: Potential reformulations or expanded indications could temporarily stabilize prices or prompt premium renewals.

- Digital and Biosimilar Developments: Advances in digital health may influence prescribing behaviors, especially if alternative therapies emerge.

Price Outlook (Next 5 Years)

- Brand Effexor XR: Expect residual pricing in the USD 200–250/month range due to niche indications or formulary preferences.

- Generics: Anticipated to stabilize around USD 15–25/month, with minor fluctuations depending on supply chain factors and manufacturing costs.

- Overall Market: Competition from emerging therapies may pressure overall prices downward, especially in mature markets.

Factors Influencing Price Forecasts

- Regulatory Environment: Stringent patent laws and biosimilar pathways could impact pricing.

- Market Penetration of Alternatives: The introduction of alternative therapies such as SNRIs with better tolerability or novel mechanisms may limit pricing power.

- Healthcare Policy and Reimbursement Trends: Shift toward value-based care and formulary restrictions favoring generics will exert downward pressure.

- Patient Access and Affordability Initiatives: Increasing focus on reducing medication costs may lead to price stabilization or further reductions.

Conclusion

Effexor XR’s transition from a flagship antidepressant to a largely generic market illustrates the typical lifecycle dynamics in high-value pharmacotherapy. While the brand continues to hold niche value, aggressive generic competition and evolving therapeutic landscapes have driven prices downward, with prospects for minor premium repositioning in select scenarios. Continuous monitoring of patent statuses, competitive launches, and healthcare policy changes will be essential for accurate market and pricing projections.

Key Takeaways

- Market Saturation Post-Patent Expiry: Generics dominate Effexor XR’s market, significantly lowering prices.

- Pricing Trends: Expect continued stabilization at low levels for generics, with residual brand premiums in specific settings.

- Competitive Pressures: Emerging therapies and digital health innovations threaten traditional antidepressant markets.

- Investment Implications: Strong reliance on patent protection and formulary positioning influences potential return on investments in Effexor XR.

- Strategic Positioning: Companies should focus on differentiating formulations, expanding indications, or integrating digital health to sustain value.

FAQs

-

What is the primary factor driving price declines of Effexor XR?

The expiration of pediatric and adult patent protections in 2019 facilitated proliferation of generic versions, resulting in substantial price reductions. -

Will Effexor XR regain market share?

Unlikely in the face of generic competition and newer therapies; however, niche indications or specific formulations may sustain residual demand. -

How do insurance plans affect Effexor XR pricing?

Insurance reimbursement policies often favor generics, reducing out-of-pocket expenses and influencing prescriber choices. -

Are there new formulations or indications expected for Effexor XR?

No active late-stage developments are publicly announced; future repositioning would depend on clinical trial successes and regulatory approvals. -

What emerging therapies threaten Effexor XR’s market?

Novel antidepressants, ketamine-based treatments, and digital mental health solutions are increasingly adopted as alternatives.

References

[1] Global Market Insights. (2023). Antidepressants Market Report.

[2] IQVIA. (2022). Prescribing Data and Trends.

More… ↓