Share This Page

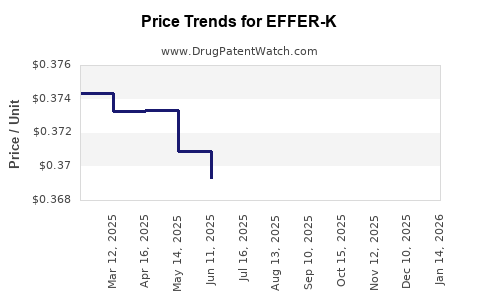

Drug Price Trends for EFFER-K

✉ Email this page to a colleague

Average Pharmacy Cost for EFFER-K

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EFFER-K 20 MEQ TABLET EFF | 51801-0012-30 | 0.52675 | EACH | 2025-12-17 |

| EFFER-K 25 MEQ TABLET EFF | 51801-0001-01 | 0.37183 | EACH | 2025-12-17 |

| EFFER-K 20 MEQ TABLET EFF | 51801-0011-30 | 0.52675 | EACH | 2025-12-17 |

| EFFER-K 25 MEQ TABLET EFF | 51801-0001-30 | 0.37183 | EACH | 2025-12-17 |

| EFFER-K 10 MEQ TABLET EFF | 51801-0013-30 | 0.45441 | EACH | 2025-12-17 |

| EFFER-K 25 MEQ TABLET EFF | 51801-0007-30 | 0.37183 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for EFFER-K

Introduction

EFFER-K, a pharmaceutical formulation of potassium chloride, has become a critical component in managing hypokalemia in clinical settings. Its importance stems from its efficacy in replenishing potassium levels swiftly, especially in patients with electrolyte imbalances caused by conditions such as chronic kidney disease, diarrhea, or medication side effects. This analysis explores EFFER-K’s current market landscape, competitive positioning, regulatory environment, and offers price projections aligned with industry trends and healthcare demands.

Market Overview

Global Pharmaceutical Market for Electrolyte Supplements

The global electrolyte supplements market was valued at approximately USD 1.5 billion in 2022, with a compound annual growth rate (CAGR) of around 6.5% from 2023 to 2028 [1]. This growth is driven by increased prevalence of chronic diseases, aging populations, and rising awareness about electrolyte therapy. EFFER-K, as a widely prescribed potassium chloride supplement, occupies a significant share within this space.

Clinical Demand Drivers

- Prevalence of Hypokalemia: Hypokalemia affects 20-40% of hospitalized patients, increasing the demand for replenishment therapies [2].

- Chronic Kidney Disease (CKD): Rising CKD incidences globally have boosted the need for potassium replacement therapies, with over 850 million affected worldwide [3].

- Hospital and Institutional Use: Hospitals, clinics, and long-term care facilities rely heavily on EFFER-K due to its safety profile, dosage flexibility, and rapid action.

Regional Market Dynamics

- North America: Leading market due to high healthcare expenditure and advanced medical infrastructure. The U.S. accounts for over 50% of the global electrolyte supplement market [4].

- Europe: Growing adoption, particularly in aging populations; regulatory pathways are well-established.

- Asia-Pacific: Fastest growth, driven by increasing healthcare access and rising CKD prevalence. Countries like India and China are expanding electrolyte therapy markets.

Competitive Landscape

Key Players

- Fresenius Kabi: Offers a range of electrolyte products, including potassium chloride solutions.

- Baxter International: Provides IV electrolyte formulations with a significant share.

- Pfizer and Teva: Market presence via generic potassium chloride formulations, including EFFER-K alternatives.

Product Differentiation

EFFER-K’s formulation capabilities—flavoring, customizable dosing, and rapid dissolution—offer competitive edges over older or less palatable formulations. Patents or proprietary formulations confer additional competitive barriers, although many formulations are available generically.

Regulatory Environment

- FDA and EMA Approval: EFFER-K and analogous formulations are approved for intravenous and oral administration, with strict quality standards.

- Patent Status: The patent landscape influences pricing, with some formulations protected until 2030, encouraging innovation and branding.

Market Challenges

- Generic Competition: Many low-cost generics have eroded margins.

- Safety Concerns: Overtreatment risks of hyperkalemia necessitate careful dosing, influencing prescription practices.

- Supply Chain Disruptions: As with other pharmaceuticals, supply chain issues can impact availability and pricing.

Price Trends and Projections

Historical Price Overview

- Historical Costs: The average wholesale price (AWP) for EFFER-K 15 mEq oral tablets hovered around USD 0.50 per tablet in 2020 [5].

- Cost Drivers: Manufacturing costs, regulatory compliance, and market competition influence prices.

Current Price Dynamics (2023)

- Oral Tablets: Approximate range of USD 0.50–0.75 per tablet.

- Injectable Formulations: Higher, averaging USD 1.50–2.50 per vial, owing to sterile manufacturing and IV administration complexities.

Forecasted Price Trajectory (2024-2028)

Based on industry trends, inflation, and regulatory factors:

- Moderate Price Increase: Expect a 2-4% annual increase in oral formulations, driven by inflation, raw material costs, and differentiated formulations.

- Generic Market Pressure: Continued commoditization may restrain significant price hikes.

- Premium Formulations: Specialty or branded formulations may command a 5-8% annual premium, especially in markets prioritizing patient compliance and safety.

Projected Prices (2028):

| Formulation | Estimated Price Range (USD) per unit/year | Assumptions |

|---|---|---|

| Oral Tablets | USD 0.75–1.00 | Generic competition, inflation |

| Injectable | USD 2.50–3.75 | Sterility standards, specialized formulations |

Opportunities and Strategic Considerations

- Innovation: Developing flavored, dissolvable, or patient-friendly formulations can command higher pricing.

- Regional Expansion: Targeting emerging markets with growing CKD burdens offers growth potential.

- Pricing Strategies: Differentiating via quality, safety features, or bundled solutions can mitigate price erosion from generics.

Conclusion

EFFER-K operates within a robust, expanding market characterized by increasing clinical demand, especially in aging and chronic disease populations. Price projections indicate a gradual upward trend, tempered by intense generic competition and regulatory considerations. Companies investing in formulation innovation, regional expansion, and quality differentiation can sustain profitable margins amidst market pressures.

Key Takeaways

- The global electrolyte supplement market, driven by rising CKD and hospitalization rates, offers significant growth opportunities for EFFER-K.

- Competitive pricing will remain under pressure from generic hemsetke counterparts, necessitating strategic differentiation.

- Price projections suggest modest annual increases, with injectable forms commanding a premium.

- Innovation, branding, and regional market penetration are crucial for maximizing profitability.

- Regulatory compliance and safety profiles will remain central to maintaining market share.

FAQs

-

What factors most influence EFFER-K’s market price?

Manufacturing costs, regulatory compliance, market competition, formulation complexity, and regional demand dynamics primarily drive pricing. -

How does regional regulation impact EFFER-K's pricing strategy?

Regions with stringent quality and safety standards, like the U.S. and Europe, may support higher prices due to costs associated with compliance and manufacturing. -

What is the potential for generic competition to erode EFFER-K’s market share?

Generic potassium chloride formulations are prominent, putting pressure on branded prices. Differentiation through formulation enhancements and branding is vital. -

Are there emerging markets for EFFER-K?

Yes. Asia-Pacific and Latin America show increasing demand due to rising CKD prevalence and expanding healthcare infrastructure. -

What innovations could influence EFFER-K’s future pricing?

Flavored, patient-friendly oral formulations, sustained-release variants, or combination therapies could justify premium pricing and expand market share.

Sources

[1] Market Research Future, "Electrolyte Supplements Market Forecast," 2022.

[2] Mayo Clinic Proceedings, "Prevalence and Management of Hypokalemia," 2021.

[3] Global Burden of Disease Study, "Chronic Kidney Disease Statistics," 2022.

[4] Grand View Research, "Electrolyte Market Analysis," 2023.

[5] IQVIA, "Pharmaceutical Pricing Trends," 2020.

More… ↓