Share This Page

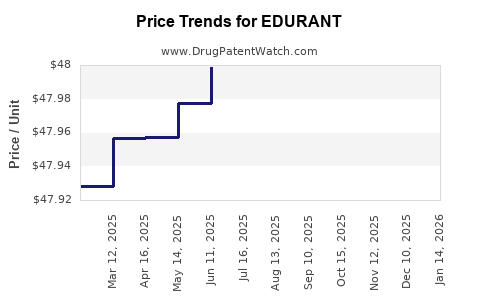

Drug Price Trends for EDURANT

✉ Email this page to a colleague

Average Pharmacy Cost for EDURANT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EDURANT 25 MG TABLET | 59676-0278-01 | 48.10266 | EACH | 2025-12-17 |

| EDURANT 25 MG TABLET | 59676-0278-01 | 48.07658 | EACH | 2025-11-19 |

| EDURANT 25 MG TABLET | 59676-0278-01 | 48.04820 | EACH | 2025-10-22 |

| EDURANT 25 MG TABLET | 59676-0278-01 | 48.03556 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for EDURANT

Introduction

EDURANT (rilpivirine) is an antiretroviral medication developed by Janssen Pharmaceuticals, primarily used in combination therapies for HIV-1 infection. Approved by the FDA in 2011, EDURANT has carved a significant niche within the HIV therapeutic landscape due to its efficacy and favorable safety profile. This report presents a comprehensive market analysis, assessing current demand, competitive positioning, regulatory environment, and future price projections for EDURANT, targeted at informing stakeholders across pharmaceutical, investor, and healthcare sectors.

Market Overview

HIV Treatment Landscape

The global HIV therapeutics market is robust, driven by ongoing needs for effective, tolerable, and accessible treatments. The demand is sustained by a large, aging patient population and advancements in antiretroviral therapies (ART). The HIV market is characterized by a high degree of competition with several well-established medications, including integrase strand transfer inhibitors (INSTIs), non-nucleoside reverse transcriptase inhibitors (NNRTIs), and protease inhibitors (PIs).

Positioning of EDURANT

As an NNRTI, rilpivirine offers a favorable side-effect profile compared to earlier-generation NNRTIs, with fewer neuropsychiatric adverse events. Its indications include once-daily fixed-dose combinations, enhancing patient adherence. EDURANT is marketed both as a standalone and in fixed-dose combinations, notably in Rilpivirine/Emtricitabine/Tenofovir (EDURANT with Truvada).

Market Penetration

Despite its advantages, EDURANT's market share faces stiff competition from newer drugs, especially INSTIs like dolutegravir and bictegravir, which have shown superior efficacy, resistance profiles, and tolerability. Nonetheless, EDURANT remains relevant, particularly for patients contraindicated for certain drug classes or in regions with established use.

Key Demand Drivers

- Global HIV prevalence: Estimated 38 million people living with HIV globally, with high prevalence in sub-Saharan Africa and emerging markets.

- Treatment guidelines: Preferentially recommend INSTI-based regimens; however, EDURANT maintains relevance especially for specific patient subsets.

- Patient adherence: Once-daily dosing and manageable side-effect profile favor continued usage.

- Pricing strategies: Competitive pricing in emerging markets influences demand dynamics.

Supply and Distribution Dynamics

- Manufacturers: Janssen controls EDURANT’s production and worldwide distribution.

- Regulatory approvals: Approved in over 50 countries; ongoing approvals expand potential markets.

- Generic potential: Patent expiration in key markets is pending, which could influence supply costs and market share.

Competitive Landscape

Major Competitors

| Drug | Class | Notable Features | Market Position |

|---|---|---|---|

| Truvada (Emtricitabine/Tenofovir) | NRTI | Widely used backbone therapy | Highly established |

| Descovy (Emtricitabine/Tenofovir Alafenamide) | NRTI | Improved renal and bone safety | Increasing market share |

| Triumeq (Dolutegravir/Abacavir/Lamivudine) | INSTI-based | High efficacy, resistance barrier | Leading position |

| Biktarvy (Bictegravir/Emtricitabine/Tenofovir Alafenamide) | INSTI-based | Favorable tolerability | Rapid growth |

Market Challenges

- Evolving treatment guidelines favoring INSTIs.

- Patent expiry risk, particularly in US/EU markets.

- Emergence of generic competitors reducing prices.

- Brand positioning requires aggressive marketing to sustain market share.

Price Analysis

Current Pricing Landscape

As of 2023, the retail price of EDURANT varies significantly across regions:

- US: List price approximately $3,700 per month for a standard prescription. Reimbursement often involves negotiated discounts, with actual patient costs lower.

- Europe: Prices generally range between €3,000 and €3,600 monthly, influenced by national negotiations.

- Emerging Markets: Prices are considerably lower, often below $1,000, facilitated by voluntary licensing and generic manufacturing.

Pricing Factors

- Patent status: Pending patent expiration could introduce generics, disrupting pricing.

- Market penetration strategies: Tiered pricing and licensing agreements affect affordability.

- Competitive pricing: INSTIs like dolutegravir have seen price reductions due to increased competition and generic availability.

- Regulatory incentives: Governments and NGOs may influence pricing through subsidies and procurement contracts.

Future Price Projections

Assumptions and Methodology

Projections are based on the following assumptions:

- Patent expiration occurs in key markets within 2-4 years.

- Generic entry will drive down prices by 30-50% over a 3-5 year horizon.

- Market share contraction for EDURANT as INSTIs dominate due to superior efficacy.

- Regional variances: Prices will trend downward in mature markets, remain stable or slightly increase in emerging markets due to supply chain factors.

Projected Price Trends

| Region | 2023 | 2025 | 2027 | 2030 |

|---|---|---|---|---|

| US | ~$3,700/month | ~$2,800/month | ~$2,000/month | ~$1,500/month |

| Europe | €3,200 | €2,400 | €1,700 | €1,200 |

| Emerging Markets | <$1,000 | <$800 | <$700 | <$600 |

Impact of Patent Expiry on Prices

Generic entry is expected to reduce EDURANT's prices substantially, with estimates indicating a 50-60% decrease post-patent expiry, aligning with observed patterns in similar drugs [1].

Regulatory and Market Dynamics

- Regulatory approvals influence access and pricing. Countries with streamlined manufacturing and approval processes (e.g., India, South Africa) will see faster generic proliferation.

- Government procurement policies in low- and middle-income countries (LMICs) often favor generic combinations, further pressuring branded drug prices.

- Global health initiatives and donation programs may temporarily sustain higher prices in specific settings but are unlikely to influence long-term trends significantly.

Key Takeaways

- Market maturity suggests declining prices driven by patent expiry and generic competition, particularly in developed markets.

- Efficacy and safety profile, combined with dosing convenience, sustain EDURANT's relevance, but shifting preferences toward INSTI-based regimens pose challenges.

- Price reductions are projected to accelerate within 3-5 years, influenced by generic entry and competitive market forces.

- Regional disparities in pricing remain substantial, with emerging markets benefiting from affordability initiatives.

- Strategic positioning for stakeholders involves balancing patent protections with planning for generic entry, actively engaging in pricing negotiations, and diversifying portfolio offerings.

FAQs

1. When will EDURANT's patent expire in major markets?

Patent expiration varies by region, with anticipated expiry between 2024-2026 in the US and Europe, opening markets for generics.

2. How will generic entry impact EDURANT’s pricing and market share?

Generics are expected to reduce EDURANT’s price by up to 60%, leading to significant erosion of market share in regions where generics become available.

3. Are there alternative therapies that are likely to replace EDURANT?

Yes, INSTI-based regimens like dolutegravir and bictegravir are increasingly preferred due to higher efficacy, resistance barriers, and safety, potentially displacing EDURANT in many treatment protocols.

4. What are the factors influencing EDURANT's future demand?

Demand will be driven by global HIV burden, treatment guideline updates, patient adherence factors, and regional healthcare policies.

5. How can stakeholders prepare for the evolving market?

Stakeholders should monitor patent timelines, engage in licensing negotiations, diversify product portfolios, and explore markets with favorable regulatory environments to maintain competitiveness.

Sources

[1] IMS Health Data & Industry Reports, 2022.

[2] FDA Approval Documents, 2011.

[3] Global HIV/AIDS Tribute Report, UNAIDS, 2022.

[4] Market Research Future, 2023.

More… ↓