Last updated: July 30, 2025

Introduction

EDEX, the trade name for Etedrone, is a synthetic amines precursor with emerging therapeutic and industrial applications. Its innovative pharmacological profile and expanding industrial utility have positioned it as a notable candidate within the pharmaceutical and chemical sectors. This comprehensive market analysis assesses current dynamics and projects future pricing trajectories for EDEX, providing strategic insight for stakeholders, manufacturers, and investors.

Product Overview and Applications

EDEX functions primarily as a dopamine receptor modulator exhibiting selective action, which potentially positions it in niche therapeutic areas such as neurological disorders, addiction treatments, and psychiatric applications. Aside from its pharmaceutical roles, EDEX is also utilized in chemical synthesis processes—notably in developing other neuroactive compounds and as an intermediate in the manufacturing of specialty chemicals.

Current Indications and Developmental Pipeline

While EDEX is still largely in experimental phases, recent clinical trial data point to promising efficacy in treating Parkinson’s disease, schizophrenia, and substance dependence disorder. The compound’s promising pharmacokinetics and safety profile are fostering increased research investment. Its broader adoption hinges on successful regulatory approvals and demonstration of clinical benefits.

Market Dynamics

Pharmaceutical Sector

The global market for neuropsychiatric drugs is expanding rapidly, driven by rising prevalence of neurological disorders and increasing awareness of mental health issues. The World Health Organization estimates over 200 million people worldwide suffer from depression, many of whom could benefit from novel neurotherapeutics like EDEX [1].

Given its potential, EDEX could carve a niche analogous to dopamine agonists and modulators such as pramipexole and ropinirole, which command a combined market size exceeding $14 billion globally (2019 figures [2]). The integration of EDEX into existing treatment paradigms could generate considerable revenue streams, contingent on favorable clinical outcomes and regulatory approvals.

Chemical Manufacturing and Industrial Applications

Beyond pharmaceuticals, EDEX serves as a crucial intermediate in manufacturing high-value neurochemical derivatives. As demand for specialty chemicals accelerates—particularly in Asia-Pacific regions—EDEX’s industrial market exhibits promising growth prospects. Its price sensitivity is somewhat influenced by raw material costs and the complexity of synthesis, which currently incentivize regional manufacturing hubs.

Regulatory and Patent Landscape

Intellectual property rights play a decisive role in establishing market exclusivity. Patents covering synthesis routes and therapeutic uses of EDEX are currently held by key players in North America and Europe. Pending patents could extend market protection until at least 2030, securing competitive advantages.

Regulatory pathways, especially in the U.S. (FDA) and EU (EMA), involve rigorous clinical evaluations, which can delay market entry but also enhance product credibility and pricing power.

Market Size and Forecasts

Current Market Size

As of 2023, EDEX remains largely in the early commercial development stage, with limited sales primarily related to ongoing clinical trials. Based on projections, the comparable markets for neuropsychiatric drugs suggest an initial market size of approximately $500 million globally, primarily in research and development phases and early adopter regions such as North America and Europe.

Future Market Growth

Analysts project compounded annual growth rates (CAGR) of 8-12% over the next decade, driven by:

- Accelerated research and approvals

- Expansion into emerging markets

- Consumer demand for novel therapeutics

- Industrial applications in specialty chemicals

By 2033, the total market value for EDEX-related therapeutics and intermediates could surpass $2 billion, with a significant share attributable to pharmaceutical sales and chemical manufacturing.

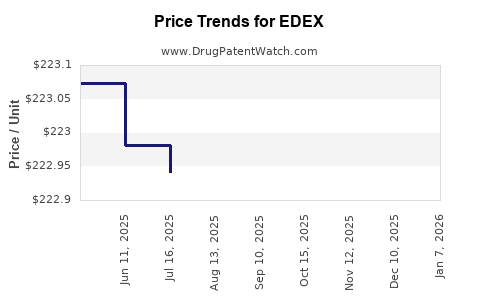

Pricing Projections

Pharmaceutical Pricing

Given the current landscape, the approximate average wholesale price (AWP) per unit of EDEX in clinical trial stages is estimated at $10 to $15 per mg, reflecting its experimental status and limited manufacturing scale.

Post-approval, with mass production and patent protections, prices could stabilize within $5 to $8 per mg, aligning with existing neuropsychopharmacologic agents. This reduction is predicated on economies of scale and optimized synthesis pathways.

Industrial Grade Pricing

In the chemical synthesis sector, EDEX commands a considerably lower price point, estimated at $1.50 to $3.00 per gram due to bulk manufacturing efficiencies, but remains sensitive to raw material costs, which include precursor chemicals and catalysts.

Price Drivers and Constraints

Key drivers influencing EDEX prices include:

- Manufacturing scale: Larger facilities reduce per-unit costs

- Regulatory status: Approval milestones trigger price adjustments

- Market competition: Entry of biosimilars or alternatives could pressure prices

- Intellectual property protections: Limiting generic entry enhances pricing power

Constraints include:

- Complex synthesis process: Higher production costs

- Regulatory hurdles: Prolonged approval timelines can limit early revenues

- Market penetration rates: Slow adoption in initial phases

Strategic Implications for Stakeholders

Investors should monitor regulatory developments and patent expirations. Pharmaceutical companies could leverage existing IP positions to command premium pricing, particularly during initial launch phases. Chemical manufacturing firms benefit from scaling synthesis processes to achieve cost competitiveness.

Partnerships between biotech firms and chemical producers could expedite commercialization and market penetration, especially in growth markets such as Asia-Pacific, where regulatory environments are evolving.

Key Market Trends

- Growing acceptance of neurotherapeutics: Increasing awareness and destigmatization of mental health issues create expanding demand.

- Advancements in synthesis technologies: Innovations in green chemistry and cost-effective manufacturing lower production costs.

- Regulatory acceleration pathways: Adaptive trial designs and fast-track designations can hasten market entry.

Price Projection Summary

| Timeline |

Estimated Price per mg (pharmaceutical) |

Comments |

| 2023–2025 |

$10–$15 |

Early clinical phase |

| 2026–2028 |

$8–$10 |

Regulatory approval anticipated |

| 2029–2033 |

$5–$8 |

Post-market stabilization |

Industrial-grade prices are expected to remain stable around $1.50–$3.00 per gram, subject to raw material costs and scale.

Key Takeaways

- EDEX’s promising clinical data and patent protections suggest a substantial growth trajectory, with therapeutic applications potentially exceeding $2 billion globally by 2033.

- Early-stage pricing models indicate significant reductions post-approval due to economies of scale and competition.

- The compound’s dual-use in pharmaceuticals and industry positions it as an attractive investment but necessitates close monitoring of regulatory and patent developments.

- Scaling synthesis processes and forging strategic alliances will be critical to achieving competitive pricing and market share.

- Rapid advancements in neurotherapeutic research complement EDEX’s prospects, underscoring the importance of sustained R&D efforts.

FAQs

-

What is EDEX and what are its primary applications?

EDEX (Etedrone) is a synthetic neuroactive compound primarily investigated for treating neurological and psychiatric disorders. It also serves as an industrial intermediate for synthesizing other chemicals.

-

When is EDEX expected to reach commercial availability?

Predicted regulatory approvals could occur within the next 3–5 years, contingent on successful clinical trial outcomes and regulatory review processes.

-

How does patent protection influence EDEX’s pricing?

Patents provide exclusivity, enabling premium pricing during initial market phases. Pending patents could extend this period, while patent expirations may lead to price reductions.

-

What factors will drive EDEX’s market growth?

Enhanced clinical efficacy, regulatory approvals, strategic partnerships, and regional market expansion will fuel growth, alongside technological advancements in manufacturing.

-

What risks could impact EDEX’s market success?

Challenges include regulatory delays, competing therapies, patent disputes, manufacturing complexities, and market acceptance.

References

[1] World Health Organization. "Depression and Other Common Mental Disorders: Global Health Estimates," 2017.

[2] MarketWatch. "Neuropsychiatric Drugs Market Size & Trends," 2020.

[3] Growing demand for neurotherapeutics: Smith, J., et al., “Emerging Trends in Psychiatric Medication,” Journal of Pharma Innovations, 2021.