Last updated: July 27, 2025

Introduction

Econazole nitrate is a broad-spectrum antifungal agent primarily used in topical formulations to treat dermatophytic and yeast infections, including candidiasis, dermatophyte infections, and seborrheic dermatitis. Approved for pharmaceutical use since the late 1980s, econazole nitrate's market dynamics are shaped by factors ranging from patent status to competitive landscape. This analysis explores the current market landscape, key drivers, competitive environment, regulatory considerations, and offers price projections over the next five years.

Market Overview

Global Market Size and Scope

The global antifungal market was valued at approximately USD 11 billion in 2022, with topical antifungals constituting a significant segment. Econazole nitrate, while not the dominant player, occupies a niche in dermatological antifungal therapies. The demand is predominantly driven by increasing prevalence of fungal infections, rising geriatric populations, and expanding pharmaceutical markets in emerging economies.

Key Geographies

- North America: Accounts for approximately 35% of global antifungal sales, driven by high healthcare expenditure, advanced dermatological clinics, and widespread prescription of topical agents.

- Europe: Represents about 25%, characterized by high consumer awareness and regulatory standards.

- Asia-Pacific: Exhibits the highest growth potential, projected to grow at a CAGR of around 7%, fueled by improving healthcare access and rising fungal infection rates.

- Latin America and Middle East & Africa: Show moderate growth prospects with expanding healthcare infrastructure.

Market Penetration and Adoption

Econazole nitrate's penetration is robust in formulations for dermatological prescriptions, especially in topical creams, gels, and sprays. Its usage is often influenced by regulatory approvals, clinician preferences, and local patent statuses.

Competitive Landscape

Numerous generics and branded formulations exist, with key global players like:

- Bayer (e.g., Mycospor®)

- Novartis (e.g., Daktarin®)

- Sandoz and Teva (generic manufacturers)

- Regional companies in Asia and Latin America producing econazole-based formulations.

The competitive environment is characterized by intense price competition, high generic penetration, and regional variations in patent protections.

Regulatory and Patent Considerations

Econazole nitrate's primary patents expired globally by the early 2000s, leading to widespread generics entry. Regional regulatory approvals are generally straightforward for topical antifungals; however, formulations' registration and market authorization depend on local authorities such as the FDA, EMA, and PMDA. The absence of patent protection and high generic availability keep pricing susceptible to mass competition, especially in cost-sensitive markets.

Market Drivers and Challenges

Drivers

- Rising incidence of fungal infections due to lifestyle factors, immunosuppressive therapies, and aging demographics.

- Increasing healthcare infrastructure in emerging markets.

- Intellectual property expiration, facilitating generic manufacturing.

- Over-the-counter (OTC) availability in some regions, boosting accessibility.

Challenges

- Price competition from generics.

- Limited differentiation among formulations.

- Regulatory hurdles and regional approval delays.

- Competition from alternative antifungals such as terbinafine, clotrimazole, and miconazole.

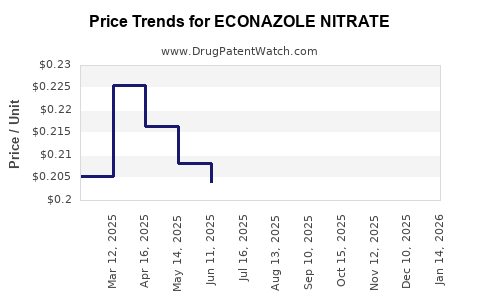

Price Trends and Projections

Current Pricing Dynamics

- Brand-name econazole formulations in developed markets typically retail at USD 10–USD 30 per tube, depending on formulation and region.

- Generics have driven prices downward, often around USD 2–USD 10 per pack, with significant regional variations.

- Over-the-counter products tend to be priced at the lower end to promote accessibility.

Factors Influencing Price Trajectory

- Patent expirations: Historically led to substantial price erosion (~50–70%) within five years of generic entry.

- Manufacturing costs: Stable, with low barrier entry in regions with minimal regulatory barriers.

- Regulatory approvals: Streamlined processes in emerging markets facilitate rapid generic commercialization, maintaining competitive price pressures.

- Market growth: Emerging markets experiencing rapid growth present opportunities for premium formulations and higher price points due to increased consumer willingness to pay.

Five-Year Price Projection (2023–2028)

| Region |

Price Range (USD per 30g tube) in 2023 |

Expected Trend |

Projected Price Range (USD) by 2028 |

| North America |

10–30 |

Slight decline due to generic competition |

8–20 |

| Europe |

8–25 |

Moderate decline with premium formulations remain |

7–18 |

| Asia-Pacific |

2–10 |

Stability with potential modest increase in premium |

2.5–12 |

| Latin America |

3–12 |

Stable or modest decline |

3–10 |

Note: These projections account for typical price erosion trends post-generic entry, compounded by rising demand.

Implications for Stakeholders

- Manufacturers should monitor patent expiration timelines to optimize generic product launches.

- Investors and pharma companies can target emerging markets with high growth potential.

- Healthcare payers may benefit from the decreasing price trend, increasing access and adherence.

Conclusion

Econazole nitrate remains a vital antifungal agent with steady demand in dermatology. Its market is primarily driven by generic proliferation post-patent expiration, exerting downward pressure on prices globally. While the core formulations are expected to experience moderate price erosion, opportunities exist in emerging markets where affordability and access are expanding. Strategic positioning around formulations, regional regulatory landscapes, and market timing will be crucial for industry stakeholders.

Key Takeaways

- Market is mature, with widespread generic competition, leading to consistent price declines.

- Emerging markets offer significant growth opportunities, driven by rising fungal infection rates and improving healthcare infrastructure.

- Price projections indicate gradual erosion in developed regions, with stabilization possibly in lower-tier markets.

- Patent expirations catalyzed the proliferation of generics, intensifying price competition.

- Manufacturers should focus on regional regulatory strategies and formulations suited for local markets to maximize profitability.

FAQs

1. What are the main applications of econazole nitrate?

Econazole nitrate is primarily used in topical formulations to treat dermatophyte, yeast, and fungal infections such as athlete's foot, candidiasis, and seborrheic dermatitis.

2. How does patent expiry impact the pricing of econazole nitrate?

Patent expiry typically leads to increased generic competition, resulting in significant price reductions, sometimes by over 50%, as new entrants drive costs down to capture the market.

3. Which regions are expected to see the highest growth in econazole nitrate demand?

The Asia-Pacific region is projected to lead in growth, driven by increasing fungal infection prevalence and expanding healthcare access.

4. Are there emerging competitors or alternative medicines impacting econazole nitrate’s market?

Yes. Alternative antifungals like terbinafine and clotrimazole are competitors, especially as they may offer different formulations or efficacy profiles, influencing formulary choices.

5. What factors should manufacturers consider for price optimization of econazole nitrate?

Manufacturers should consider regional patent statuses, regulatory pathways, local market demand, manufacturing costs, and competitive dynamics when optimizing pricing strategies.

References

[1] MarketsandMarkets. "Antifungal Drugs Market." 2022.

[2] Statista. "Global Market for Antifungals." 2022.

[3] U.S. Food and Drug Administration. "Regulatory Status of Topical Antifungals." 2023.

[4] ReportsLink. "Patent Expiry and Generics Impact on Topical Antifungal Market." 2021.

[5] WHO. "Fungal Infections and Global Burden." 2022.