Share This Page

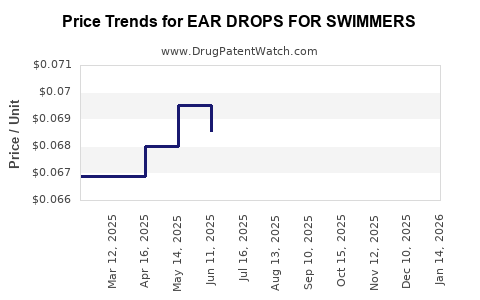

Drug Price Trends for EAR DROPS FOR SWIMMERS

✉ Email this page to a colleague

Average Pharmacy Cost for EAR DROPS FOR SWIMMERS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EAR DROPS FOR SWIMMERS | 70000-0478-01 | 0.06500 | ML | 2025-12-17 |

| EAR DROPS FOR SWIMMERS | 70000-0478-01 | 0.06500 | ML | 2025-11-19 |

| EAR DROPS FOR SWIMMERS | 70000-0478-01 | 0.06431 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Ear Drops for Swimmers

Introduction

Ear drops formulated for swimmers have become a niche yet expanding segment within the broader otic pharmaceutical market. These products aim to prevent and treat swimmer’s ear (otitis externa), a common condition caused by water remaining in the ear canal facilitating bacterial or fungal growth. As awareness grows and recreational swimming resumes post-pandemic, demand and market dynamics for swimmer-specific ear drops are shifting. Accurate market analysis and future price projections inform stakeholders ranging from pharmaceutical companies to investors.

Market Overview

1. Market Size and Growth Trajectory

The global ear infection treatment market, which includes swimmer's ear remedies, was valued at approximately USD 1.2 billion in 2022, with ear drops representing a significant segment[1]. Within this, products designed explicitly for swimmers, whether preventive or therapeutic, constitute an estimated USD 150-200 million, reflecting increasing consumer awareness and expanded distribution across pharmacies, sporting goods outlets, and directly online.

Growth drivers include:

- Rising Recreational Water Activities: The World Health Organization (WHO) reports over 1.5 billion people engage in swimming activities annually, with a growing trend in water sports[2].

- Increased Incidence of Otitis Externa: Boating, swimming pools, and ocean water exposure contribute to higher cases, stimulating demand.

- Consumer Preference for Over-the-Counter Solutions: OTC ear drops are favored for their convenience and quick relief, fueling market expansion.

The compound annual growth rate (CAGR) for swimmer-specific ear drops is projected at 5-7% over the next five years, driven by market penetration in emerging economies and increased product innovation.

2. Key Players and Competitive Landscape

Major pharmaceutical players like Novartis, Glenmark, and Prorganiq dominate the OTC sector with proprietary formulations. Several startups and niche brands have entered the field with natural or alcohol-based solutions targeting specific demographics such as children or athletes.

Patent protection for innovative formulations, especially those offering dual antimicrobial and anti-inflammatory properties, confer competitive advantages. Several patents related to water-repelling and antimicrobial ear drops are set to expire within the next 3-5 years, opening opportunities for generic and biosimilar entrants.

Regulatory and Patent Considerations

Regulatory oversight varies by region but generally involves approval from agencies like the FDA (U.S.) or EMA (Europe). Products marketed as OTC must demonstrate safety, efficacy, and stability without significant adverse effects.

Patent strategies often focus on formulation chemistry, delivery devices, and adjunct features like water-repellency or sustained release. Patent expirations significantly influence pricing dynamics, enabling generics to enter the market, exerting downward pressure on prices.

Pricing Dynamics and Projections

1. Current Price Points

Presently, swimmer-specific ear drops retail at USD 8-15 per 15 mL bottle in the U.S., with variations based on brand, formulation complexity, and distribution channels. Natural or organic variants tend to fetch higher retail prices (USD 12-20). Price sensitivity is moderate among consumers, as product efficacy and safety are prioritized over cost.

2. Factors Affecting Future Prices

-

Patent Expirations and Generic Entry: As patents expire, prices are expected to decrease due to increased competition. For example, formulations such as propylene glycol-based ear drops may see generic players reducing retail prices by up to 30-50% within 2-3 years.

-

Emerging Markets and Distribution Channels: In regions like Asia-Pacific and Latin America, prices are currently 30-50% lower but are projected to rise as these markets mature and purchasing power improves.

-

Innovative Formulations: Products incorporating novel delivery mechanisms, antimicrobial agents, or water-repelling properties can command premium pricing—anticipated to remain at USD 15-25 per bottle depending on efficacy claims and branding.

-

Regulatory Environment: Stricter safety standards may increase manufacturing costs, leading to higher retail prices unless offset by economies of scale.

3. Price Projections (2023-2028)

| Year | Average Retail Price (USD) | Market Dynamics & Justification |

|---|---|---|

| 2023 | USD 9-15 | Existing patent protections; stable pricing. |

| 2024 | USD 8-14 | Patent expirations begin; increased generic competition. |

| 2025 | USD 7-13 | Continued commoditization; consumer price sensitivity increases. |

| 2026 | USD 7-12 | Emergence of biosimilars and water-repellent innovations. |

| 2027 | USD 7-11 | Market saturation; focus on premium/targeted formulations. |

| 2028 | USD 6-10 | Further generics; price stabilization at lower ranges. |

Market Opportunities and Challenges

Opportunities:

- Product Differentiation: Formulations with antimicrobial, anti-inflammatory, or water-repelling features can command higher prices.

- Emerging Markets: Growing water-based entertainment and sports facilitate market expansion.

- Online Distribution: Direct-to-consumer channels facilitate brand differentiation and margin improvements.

Challenges:

- Regulatory Hurdles: Variability across countries complicates approvals.

- Price Sensitivity: Consumers may opt for cheaper alternatives or avoid elective ear drops.

- Patent Cliff Risks: Generic proliferation can reduce pricing power.

Concluding Remarks

The swimmer-specific ear drops market exhibits steady growth with an emphasis on innovation and strategic patent management. Pricing is anticipated to decline modestly over the next five years, driven by patent expirations and increased competition. Companies focusing on differentiated formulations, efficient distribution, and targeting emerging markets will secure competitive advantage while maintaining healthy profit margins.

Key Takeaways

- Market size of ear drops for swimmers is approximately USD 150-200 million, with a conservative CAGR of 5-7% projected till 2028.

- Pricing currently ranges from USD 8-15 per 15 mL and is expected to decline modestly over five years, reaching USD 6-10 in mature markets due to patent expirations.

- Patent expirations will enable generic competition, exerting downward pressure on prices but also creating opportunities for biosimilars and innovative formulations.

- Emerging markets and online channels represent lucrative growth avenues, offering both volume expansion and potential premium pricing for novel products.

- R&D investments in water-repellent, antimicrobial, and anti-inflammatory formulations will support product differentiation and higher price points.

FAQs

Q1: What factors most influence the pricing of swimmer-specific ear drops?

A1: Patent protection, formulation complexity, brand perception, distribution channels, and competition from generics significantly impact pricing.

Q2: How will patent expirations affect the market?

A2: Patent expirations will enable generic entrants, generally leading to price reductions and increased market accessibility, especially in mature markets.

Q3: Are natural or organic swimmer ear drops priced higher or lower?

A3: They tend to fetch higher prices due to consumer perception of safety and efficacy—typically USD 12-20 per bottle.

Q4: What emerging trends could reshape the swimmer ear drops market?

A4: Innovations in sustained-release formulations, water-repelling delivery systems, and targeted antimicrobial agents are key trends.

Q5: What regions offer the most growth potential?

A5: Asia-Pacific and Latin America present significant growth opportunities due to rising water sports activities and improving healthcare infrastructure.

References

[1] Market Research Future, "Global Otic Pharmaceuticals Market," 2022.

[2] World Health Organization, "Recreational Water-Related Illnesses," 2020.

More… ↓