Share This Page

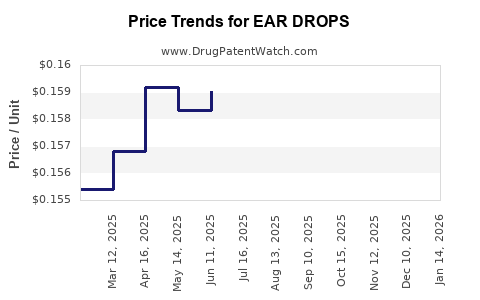

Drug Price Trends for EAR DROPS

✉ Email this page to a colleague

Average Pharmacy Cost for EAR DROPS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EAR DROPS 6.5% | 00904-6627-35 | 0.15705 | ML | 2025-12-17 |

| EAR DROPS FOR SWIMMERS | 70000-0478-01 | 0.06500 | ML | 2025-12-17 |

| EAR DROPS 6.5% | 00904-6627-35 | 0.16037 | ML | 2025-11-19 |

| EAR DROPS FOR SWIMMERS | 70000-0478-01 | 0.06500 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Ear Drops

Introduction

Ear drops constitute a vital segment within the pharmaceutical industry, primarily used for treating infections, wax removal, pain relief, and other otic conditions. The global market for ear drops has demonstrated steady growth driven by rising prevalence of ear-related ailments, advancements in formulation, and expanding healthcare access. This analysis explores current market dynamics, key drivers, competitive landscape, and provides price projections to assist stakeholders in strategic decision-making.

Market Overview

The ear drops market is segmented based on product type, application, end-user, and geography. Product categories include antibiotics, antifungals, corticosteroids, analgesics, and others. Applications encompass bacterial and fungal infections, wax removal, pain management, and allergies, among others. End-users range from hospitals and clinics to retail pharmacies and online platforms.

The global ear drops market was valued at approximately USD 1.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 5.2% through 2028. Factors underpinning this growth encompass increasing incidences of otitis media and externa, demand for minimally invasive treatment options, and the rising geriatric population with heightened vulnerability to ear conditions.

Market Drivers

Rising Prevalence of Ear Disorders

Otitis media and externa are among the most common ear ailments worldwide. According to WHO estimates, over 60% of children experience at least one episode of otitis media before age 10. Adult cases, often linked to infections, allergies, or environmental factors, further expand market demand for over-the-counter (OTC) and prescription ear drops.

Aging Population

The global demographic shift towards an aging population fuels demand, as older adults are more susceptible to ear infections, hearing loss, and chronic otic conditions, necessitating consistent treatment options like ear drops.

Advancements in Formulation

Innovations such as sustained-release formulations, preservative-free drops, and combination therapies enhance therapeutic efficacy and patient compliance, stimulating market growth.

Increasing Healthcare Access and Awareness

Improved access to healthcare services and increased awareness about ear health promote diagnosis and treatment, escalating demand for ear drops.

Competitive Landscape

The market features prominent pharmaceutical entities such as Johnson & Johnson, GlaxoSmithKline, Sanofi, and local manufacturers across emerging markets. Trademarked products like Otiprio (ciprofloxacin otic), and generic formulations constitute major offerings. Market entry barriers include regulatory approval processes and the need for specialized formulations.

Emerging players focus on biologics and innovative drug delivery systems, aiming to capture niche segments. Strategic collaborations, mergers, and acquisitions are prevalent strategies to enhance market share.

Price Dynamics and Forecasts

Current Pricing Trends

Ear drop prices vary significantly based on formulation complexity, brand positioning, and regional factors. Prescription formulations, such as Otiprio, retail at approximately USD 150–200 per bottle (10 mL), driven by formulation sophistication and clinical trial costs. OTC options, including generic antibiotics or wax removal drops, typically retail for USD 5–15 per bottle.

The pricing landscape exhibits regional disparities. In developed markets like the U.S. and Europe, higher regulatory costs, quality standards, and marketing expenses contribute to elevated prices compared to emerging markets where lower manufacturing and operational costs result in more affordable options.

Future Price Projections (2023–2028)

Based on market trends, regulatory environments, and manufacturing cost dynamics, the following projections are made:

-

Premium Prescription Ear Drops: Prices are expected to stabilize or slightly increase (~2%) annually due to inflation, ongoing R&D, and regulatory compliance costs. By 2028, the average price of a 10 mL bottle could range between USD 180–220.

-

Generic Prescription Ear Drops: Anticipated to experience gradual price decreases (~1-2% annually) driven by increased competition, with prices possibly dropping to USD 120–150 per 10 mL by 2028.

-

OTC Ear Drops: Prices are expected to remain stable or decrease marginally (~1%) annually, influenced by product commoditization and market saturation. Forecasted retail price by 2028 ranges from USD 4–12.

-

Region-specific influences: Regulatory harmonization, especially in emerging markets adopting international standards, may influence prices, with prices in Asia-Pacific possibly decreasing due to increased local manufacturing.

Impact of Regulatory and Patent Changes

Patent expiries on branded formulations are likely to usher in generics, intensifying price competition and potentially reducing prices by 10–20% within the next 3–5 years. Conversely, new formulations approved via expedited pathways might command higher prices temporarily.

Influence of Biosimilars and Advanced Delivery Systems

Although biosimilars are less relevant for traditional ear drops, nanotechnology-based delivery systems and sustained-release formulations could command premium pricing, supporting higher margins and slightly elevating overall market averages.

Regional Market Considerations

-

North America: Largest market, driven by high healthcare expenditure and awareness. Prices remain high due to stringent regulatory processes and premium formulations.

-

Europe: Similar to North America, with stringent regulations but potentially lower prices on generics.

-

Asia-Pacific: Fastest-growing, driven by large populations and increasing healthcare investments. Prices are lower but expected to rise with quality improvements.

-

Latin America & Middle East: Moderate growth rates, with price sensitivity influencing market dynamics.

Key Challenges

-

Regulatory Barriers: Navigating diverse approval processes hampers rapid market expansion and influences pricing strategies.

-

Generic Competition: Deters premium pricing, especially post-patent expirations.

-

Reimbursement Policies: Variations impact pricing strategies and profit margins.

-

Patient Acceptance: Preference for OTC items and home remedies can limit prescription market growth.

Conclusion

The ear drops market presents resilient growth prospects bolstered by demographic shifts, rising ear disorder prevalence, and ongoing innovations. Price projections suggest a stable or slightly declining trend for generics and OTC products, with premium formulations maintaining higher price points. Strategic positioning in regional markets, product innovation, and navigating regulatory landscapes will be vital for stakeholders aiming to optimize profitability.

Key Takeaways

-

Market Growth: Expected CAGR of ~5.2% through 2028, driven by demographic and technological factors.

-

Pricing Trends: Premium prescribed ear drops will remain priced around USD 180–220 by 2028; generics may see prices drop below USD 150, with OTC formulations stable or slightly decreasing.

-

Regional Variations: North America and Europe maintain premium pricing; Asia-Pacific offers growth opportunities with lower initial prices.

-

Competitive Dynamics: Patent expirations and new formulations create volatility, but also opportunities for innovators and generic manufacturers.

-

Strategic Focus: Firms should prioritize regulatory compliance, innovation in delivery systems, and regional market tailoring to maximize revenue.

FAQs

-

What factors influence ear drop pricing across different regions?

Regional regulatory standards, manufacturing costs, healthcare infrastructure, market maturity, and competitive landscape primarily determine ear drop prices regionally. -

How will patent expirations impact the ear drops market?

Patent expiries typically lead to increased generic competition, resulting in price reductions of 10–20%, and stimulate market entry of more affordable options. -

Are premium ear drops likely to see price increases in the coming years?

While general inflation and R&D expenses may exert upward pressure (~2%), the trend for premium formulations will likely stabilize, barring significant regulatory or technological shifts. -

What role does innovation play in shaping future market prices?

Advancements like sustained-release delivery systems and biosimilar-like innovations can command higher prices, creating niche premium segments and influencing overall pricing strategies. -

Which markets hold the most growth potential for ear drops?

Emerging markets in Asia-Pacific, Latin America, and the Middle East are poised for rapid growth due to expanding healthcare access and increasing ear health awareness.

Sources:

[1] Transparency Market Research, "Ear Care Market Size, Share & Trends Analysis Report," 2022.

[2] World Health Organization, "Ear and Hearing Disorders Data," 2021.

[3] MarketWatch, "Global Otic Drug Market Outlook," 2023.

More… ↓