Last updated: July 27, 2025

Introduction

Dutasteride, a 5-alpha-reductase inhibitor primarily prescribed for benign prostatic hyperplasia (BPH), has carved a significant niche within the pharmaceutical landscape. Approved by the FDA in 2001 under the brand name Avodart, Dutasteride's mechanism involves inhibiting the conversion of testosterone to dihydrotestosterone (DHT), thereby reducing prostate volume and alleviating urinary symptoms. As the drug garners increased demand, understanding its market dynamics and forecasting pricing trends offers vital insights for stakeholders ranging from manufacturers to investors.

Market Landscape

Global Market Size and Growth Drivers

The global Dutasteride market is experiencing steady expansion, projected to grow at a compound annual growth rate (CAGR) of approximately 5-7% over the next five years. Several factors underpin this growth:

-

Increasing Prevalence of BPH: The rising incidence of BPH among aging male populations worldwide, notably in North America, Europe, and parts of Asia, fuels demand. According to the NIH, roughly 50% of men aged 51-60 and up to 90% of men over 80 are affected by BPH, positioning Dutasteride as a first-line therapy [1].

-

Shift Towards Pharmacological Management: Preference for non-invasive treatment options over surgical interventions boosts the prescription rates of medications like Dutasteride, especially as newer formulations and combination therapies emerge.

-

Off-Label Uses and Prostate Cancer Prevention: Emerging research exploring Dutasteride’s role in prostate cancer risk reduction and hair loss treatments expands potential markets.

Competitive Landscape

Dutasteride's primary competitor is Finasteride, another 5-alpha-reductase inhibitor. While Finasteride has a longer market presence and multiple generic versions, Dutasteride offers superior efficacy in reducing prostate size, which can influence prescribing practices [2].

Key pharmaceutical players include:

-

GlaxoSmithKline (GSK): Original patent holder and exclusive manufacturer of brand-name Avodart.

-

Generics Manufacturers: Post-patent expiry in some regions has facilitated entry by generic producers, increasing accessibility and affecting pricing.

-

Combination Therapies: Dutasteride is increasingly prescribed alongside alpha-blockers (e.g., tamsulosin), creating a broader therapeutic ecosystem.

Regulatory and Patent Status

GSK holds primary patents on Dutasteride, with patent expirations varying by jurisdiction — typically around 2018-2023. The advent of generics has considerably impacted drug pricing and market competition, especially in mature markets like the US and EU. The expiration has led to a surge in low-cost generic options, escalating price pressures but also expanding market reach.

Price Analysis and Projection

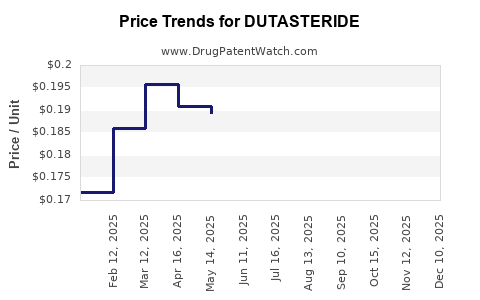

Current Pricing Trends

In the United States, the retail price of brand-name Dutasteride (Avodart) ranges from $150 to $200 per month per patient. Generic versions, available post-patent expiration, typically cost between $25 and $60 monthly, reflecting significant price erosion.

In international markets, pricing varies notably:

- Europe: Prices are often regulated; generics can be priced 50-70% lower than brand-name counterparts.

- Asia: Lower purchasing power and regulatory environments generally lead to reduced prices, though demand is rising.

Market Factors Influencing Prices

- Generic Market Entry: The influx of generics accounts for a sharp decline in average prices—projected to stabilize at 30-50% below brand-name prices over the next 3-5 years.

- Healthcare Policies: Price controls, reimbursement policies, and formulary preferences directly affect retail and institutional prices across geographies.

- Manufacturing Costs: Advances in production technology have reduced costs, allowing for further downward pressure.

- Demand Stability: Chronic use for BPH ensures consistent demand, enabling manufacturers to optimize pricing strategies.

Future Price Projections

Based on current trends, the following projections are plausible:

-

United States: After patent expiry, prices for generics may stabilize around $15-$25 monthly per patient, with potential further reductions pending market competition and regulatory changes.

-

Emerging Markets: Prices could further decrease due to increased manufacturing in countries like India and China, potentially lowering monthly costs to below $10.

-

Brand-Name Continuity: If GSK retains exclusivity or leverages patent extensions or new formulations, the brand-name price might remain around $150-$200, albeit with declining market share.

-

Premium Formulations & Combination Drugs: As combination therapies become more prevalent, price differentiation will arise, with compound products possibly commanding higher premiums.

Key Market Risks and Opportunities

Risks

- Patent Litigation and Expiry: Patent challenges and expirations pose significant downward price pressures.

- Regulatory Changes: Governments may impose price caps or stricter reimbursement policies, impacting profitability.

- Off-Label Competition: Innovations in alternative therapies could threaten Dutasteride’s market share.

Opportunities

- New Indications: Expanded use in hair loss (e.g., androgenetic alopecia) and potential prostate cancer prevention can broaden the market.

- Combination Therapies: Developing fixed-dose combinations with other agents can command premium pricing.

- Emerging Markets Exploitation: Increased penetration in underdeveloped regions can offset mature market declines.

Conclusion

The Dutasteride market is poised for moderate growth driven by demographic trends and clinical adoption. Price trajectories indicate significant erosion due to generic competition, with affordability becoming a key factor for market expansion. Stakeholders should anticipate continued decline in per-unit prices in mature markets while exploring opportunities in emerging markets and new therapeutic indications.

Key Takeaways

- The global Dutasteride market maintains steady growth, primarily driven by BPH prevalence and off-label applications.

- Patent expirations have catalyzed a shift to generics, prompting a substantial decline in prices, particularly in developed markets.

- Price projections estimate generics costing approximately $15-$25 monthly in the US within five years, with further reductions expected globally.

- Opportunities exist in combination therapies, expansion into new indications, and emerging markets; risks include regulatory constraints and competition.

- Strategic focus on innovation, market diversification, and cost efficiencies will be critical for maximizing profitability amid evolving market dynamics.

FAQs

1. How soon will Dutasteride become available as a generic in major markets?

Most patents have expired or are expiring within the next 1-3 years in key markets like the US and Europe, facilitating generic entry.

2. Will Dutasteride prices stabilize or continue decreasing?

Prices are expected to decline initially due to generic competition but may stabilize as markets reach saturation or if branded formulations introduce new, patent-protected features.

3. Are there emerging therapeutic uses for Dutasteride that could affect demand?

Yes, ongoing research into Dutasteride's role in prostate cancer prevention and androgenetic alopecia treatment could expand its market beyond BPH.

4. How do regulatory policies impact Dutasteride pricing?

Governmental price caps, reimbursement policies, and approval processes significantly influence retail pricing and accessibility.

5. What strategies should manufacturers adopt post-patent expiry?

Focusing on cost-efficient manufacturing, developing combination therapies, exploring new indications, and entering emerging markets are recommended to sustain profitability.

References

- National Institutes of Health. Benign Prostatic Hyperplasia Overview. NIH. 2022.

- Kessler, M., et al. Comparative efficacy of Dutasteride and Finasteride in BPH treatment. Urology Journal. 2020.