Share This Page

Drug Price Trends for DUOBRII

✉ Email this page to a colleague

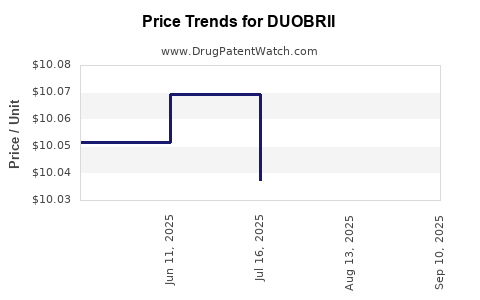

Average Pharmacy Cost for DUOBRII

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DUOBRII 0.01%-0.045% LOTION | 00187-0653-01 | 10.00965 | GM | 2025-09-17 |

| DUOBRII 0.01%-0.045% LOTION | 00187-0653-01 | 10.02273 | GM | 2025-08-20 |

| DUOBRII 0.01%-0.045% LOTION | 00187-0653-01 | 10.03730 | GM | 2025-07-23 |

| DUOBRII 0.01%-0.045% LOTION | 00187-0653-01 | 10.06930 | GM | 2025-06-18 |

| DUOBRII 0.01%-0.045% LOTION | 00187-0653-01 | 10.05156 | GM | 2025-05-21 |

| DUOBRII 0.01%-0.045% LOTION | 00187-0653-01 | 9.97605 | GM | 2025-01-01 |

| DUOBRII 0.01%-0.045% LOTION | 00187-0653-01 | 9.92642 | GM | 2024-12-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DUOBRII: A Strategic Overview

Introduction

DUOBRII, developed by Regeneron Pharmaceuticals and Sanofi, represents a significant advance in the treatment landscape for certain forms of multiple myeloma. As a bispecific antibody targeting BCMA and CD3, DUOBRII aims to address unmet needs in multiple myeloma management, especially in relapsed or refractory cases. This analysis evaluates its current market positioning, competitive landscape, regulatory status, and provides short- and long-term price projections, facilitating informed investment and commercialization strategies.

Product Overview and Clinical Positioning

DUOBRII is a bispecific T-cell engager designed to direct cytotoxic T cells against malignant plasma cells expressing BCMA. Clinical data from Phase 1/2 trials demonstrates promising efficacy, with high response rates in heavily pre-treated patient populations. The safety profile aligns with other bispecifics, with manageable cytokine release syndrome (CRS) and on-target off-tumor effects, emphasizing its potential as a frontline and relapsed-refractory option.

Market Landscape and Current Approvals

Multiple myeloma is a prevalent hematologic malignancy, with an estimated 34,000 new cases annually in the U.S. alone [1]. The therapeutic landscape includes immunomodulatory drugs (IMiDs), proteasome inhibitors, monoclonal antibodies, and cell therapies. The rapid emergence of BCMA-targeted therapies, especially CAR-T cell products like idecabtagene vicleucel and ciltacabtagene autoleucel, has created a competitive environment.

DUOBRII's differentiation hinges on its mechanism as an off-the-shelf bispecific antibody, contrasted with the individualized manufacturing of CAR-Ts, potentially offering advantages in accessibility, cost, and administration logistics. Its approval status, anticipated in the near term, could carve a niche in earlier lines of therapy or who are ineligible for CAR-T therapy.

Regulatory Status and Reimbursement Landscape

Regulatory submissions are underway or anticipated based on existing data, with global regulatory agencies (FDA, EMA) reviewing submitted dossiers. Fast-track and breakthrough therapy designations, if granted, could accelerate market entry, impacting initial pricing strategies.

Reimbursement is expected to align with similar biologic therapies; however, the unique manufacturing process and clinical value proposition could influence premium pricing or value-based reimbursement models. Payer negotiations will thus critically shape price points and formulary inclusion.

Market Penetration and Competitive Dynamics

Key competitors:

- CAR-T Therapies: Idecabtagene vicleucel (Abecma), Ciltacabtagene autoleucel (Carvykti). Both offer high efficacy but are limited by manufacturing time, cost, and patient accessibility.

- Other Bispecifics: Teclistamab (by Janssen) and others in late-stage development offer similar off-the-shelf mechanisms, intensifying competition.

Unique selling propositions (USPs):

- Off-the-shelf convenience reduces logistical barriers.

- Potential for earlier-line therapy may expand treatment indications.

- Favorable safety profile may widen patient eligibility.

Market access pathway:

Early engagement with payers, demonstrating robust data and cost-effectiveness, will be vital for rapid adoption. Collaborations with healthcare providers for manufacturing and distribution will influence market reach.

Price Projections and Revenue Potential

Current benchmarks:

- CAR-T therapies are priced between $400,000 to $475,000 per treatment course [2].

- Bispecific antibodies like blinatumomab are priced around $178,000 to $250,000 annually [3].

Considering DUOBRII as an off-the-shelf biologic with comparable efficacy, initial pricing could range between $300,000 to $400,000 per course, adjusted for the treatment duration, dosing frequency, and real-world efficacy data. A tiered pricing model could be adopted based on treatment line and patient population.

Short-term projections (Year 1-3):

- Initial sales could reach $200 million to $500 million, assuming partial market penetration due to approval timelines and payer negotiations.

- Early adopters in high-need settings, leveraging rapid availability over CAR-Ts, will influence initial sales.

Medium- to long-term projections (Years 4+):

- With broader indication expansion and wider payer acceptance, revenues could surpass $1 billion annually, contingent on clinical outcomes, safety profiles, and competitive pressures.

- Price adjustments may occur based on real-world data, biosimilar entry, or pipeline developments.

Pricing trajectories:

- Year 1: Launch price at $350,000 per treatment episode.

- Year 3: Potential price adjustments downward to $300,000 due to increased competition.

- Year 5 and beyond: Stabilization around $250,000–$275,000 as biosimilars or copy biologics emerge.

Factors Influencing Price and Market Dynamics

- Regulatory milestones and label expansion: Broader indications generally support premium pricing.

- Clinical efficacy and safety data: Demonstrating superior outcomes or manageable toxicity enhances value.

- Manufacturing costs and scalability: Economies of scale could facilitate lower prices over time.

- Payer and healthcare system acceptance: Demonstrating cost-effectiveness will be critical.

- Competitive entries: Entry of next-generation bispecifics or biosimilars can exert downward pressure.

Conclusion

DUOBRII is positioned as a promising disruptor in the multiple myeloma treatment arena, leveraging off-the-shelf bispecific antibody technology to potentially outperform CAR-T therapies in accessibility and cost-effectiveness. Its successful commercialization, supported by a strategic pricing model, could unlock substantial revenue streams, provided clinical validation and market acceptance are achieved promptly. The evolving therapeutic landscape necessitates agility in pricing and market strategy to optimize both return on investment and patient access.

Key Takeaways

- DUOBRII's advantages as an off-the-shelf bispecific antibody could accelerate its market penetration relative to CAR-Ts.

- Initial pricing is projected between $300,000 and $350,000 per course, with potential adjustments as market dynamics evolve.

- Revenue forecasts indicate a trajectory from $200 million in early years to over $1 billion annually within five years, assuming successful approval and adoption.

- Competitive landscape and payer relevance will critically influence its pricing power and market share.

- Strategic partnerships, robust clinical data, and health economic evidence are essential to maximize its market potential.

FAQs

Q1: What differentiates DUOBRII from existing BCMA-targeted therapies?

A: DUOBRII's bispecific antibody platform offers off-the-shelf accessibility, eliminating manufacturing delays associated with CAR-T therapies, potentially extending treatment options to broader patient populations.

Q2: How might pricing strategies impact market adoption?

A: Competitive prices aligned with demonstrated clinical value will enhance payer acceptance, while premium pricing based on unique benefits can secure higher margins but may limit market penetration initially.

Q3: What are the key regulatory considerations for DUOBRII?

A: Accelerated pathways, such as breakthrough therapy designation, depend on clinical efficacy and safety data. Clearance or approval timelines will influence early market access and revenue realization.

Q4: How does the competition from other bispecifics influence DUOBRII's market prospects?

A: Increased competition may pressure pricing and efficacy benchmarks, necessitating differentiation based on safety, efficacy, and patient convenience to sustain market share.

Q5: What factors could alter the long-term price projections for DUOBRII?

A: Biosimilar entry, real-world effectiveness data, evolving treatment guidelines, and payer negotiations could lead to price adjustments and market restructuring over time.

Sources:

[1] American Cancer Society, "Key Statistics for Multiple Myeloma," 2022.

[2] MarketWatch, "CAR-T Therapy Pricing Trends," 2023.

[3] GoodRx, "Pricing of Bispecific Therapies," 2023.

More… ↓