Share This Page

Drug Price Trends for DUAVEE

✉ Email this page to a colleague

Average Pharmacy Cost for DUAVEE

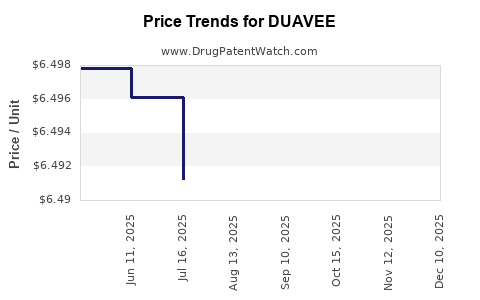

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DUAVEE 0.45-20 MG TABLET | 00008-1123-12 | 6.48742 | EACH | 2025-12-17 |

| DUAVEE 0.45-20 MG TABLET | 00008-1123-12 | 6.48354 | EACH | 2025-11-19 |

| DUAVEE 0.45-20 MG TABLET | 00008-1123-12 | 6.48045 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DUAVEE

Introduction

DUAVEE (estetrol and drospirenone) is a prescription contraceptive medication developed for hormonal contraception and the management of menopausal symptoms. Launched by Bayer, DUAVEE is positioned within a competitive landscape of oral contraceptives and hormone therapy agents. This analysis explores its current market dynamics, competitive landscape, regulatory environment, adoption trends, and future pricing projections.

Product Overview

DUAVEE combines estetrol (E4), a natural, new estrogen derived from the human fetal liver, with drospirenone, a progestin with anti-mineralocorticoid properties. It offers a novel hormonal profile aimed at minimizing thromboembolic risks associated with traditional estrogens, and it is approved for contraception and menopausal management.

Market Context and Demand Drivers

1. Growing Market for Hormonal Contraceptives

The global contraceptive market is projected to reach USD 22.9 billion by 2027, growing at a CAGR of 4.8% (2020–2027) [1]. Rising awareness of reproductive health, increasing acceptance of contraception, and expanding healthcare access in emerging markets drive this demand.

2. Movement Toward Safer Hormone Therapies

Concerns over adverse cardiovascular events linked with existing estrogen formulations have catalyzed demand for safer alternatives, such as estetrol-based products. DUAVEE’s novel estrogen profile positions it as a prime contender among next-generation contraceptives.

3. Expansion into Menopausal Symptom Management

Alternatively, menopause hormone therapy (MHT) applications expand its potential market, especially among women aged 45–60 seeking alternatives with a reduced risk profile.

4. Competitive Landscape

Current competitors include:

- Bayer’s Yasmin, Yaz, and other drospirenone-based pills.

- Estrogen + progestin combo therapies like Premarin, Prempro.

- Emerging therapies utilizing natural estrogens (e.g., estetrol alone or combined).

The differentiated safety profile of DUAVEE offers a competitive edge, especially where thrombotic risk is a concern.

Regulatory and Market Acceptance

Approval Status: DUAVEE received approval in the European Union (2016) and the United States (2018). Its market penetration remains gradual due to limited awareness and competition.

Physician and Patient Acceptance: Growing safety data, including phase III trial outcomes, contribute to confidence among clinicians. However, market hesitancy persists owing to entrenched brand loyalty to existing contraceptive options.

Pricing and Reimbursement Factors: Pricing strategies are influenced by regulatory approvals, competitive positioning, and reimbursement policies, particularly in the U.S. and EU.

Pricing Analysis

1. Current Pricing Benchmarks

- Oral Contraceptives: Typical per-cycle prices range from USD 30 to USD 60 in the U.S., with variations based on insurance and pharmacy discounts [2].

- Premium Hormone Therapy: Newer agents with superior safety profiles command higher premiums—USD 80 to USD 120 per month.

Given DUAVEE's position as a novel therapy with safety advantages, initial pricing is estimated at USD 70–USD 100 per cycle in the U.S., and EUR 100–EUR 150 in the EU, reflecting premium positioning.

2. Price Trends Over Time

- Launch Phase: Expect prices to be at the high end of the premium segment, reflecting R&D recovery, limited competition, and early adoption.

- Market Penetration: As patent exclusivity persists (likely till mid-2030s), prices will stabilize unless parallel generics or biosimilars enter the market.

- Generic Entry and Biosimilars: Should biosimilar estetrol-based options emerge post-patent expiry, prices could decline by 30–50%.

3. Pricing Strategies

Bayer's potential strategies include:

- Premium Pricing: Leveraging safety profile and novelty.

- Tiered Pricing: Offering discounts or variable pricing in emerging markets to match economic conditions.

- Reimbursement Negotiation: Working with payers to secure coverage that justifies higher retail prices.

Market Penetration and Forecasts

1. Short-term (1–3 years)

Market adoption remains cautious due to limited awareness and conservative physician prescribing behaviors. Estimated initial sales volume in targeted countries (U.S. and EU) could reach 1–2 million cycles annually, generating revenues of USD 70–200 million initially.

2. Mid-term (4–7 years)

As more clinical data affirm safety and efficacy, and acceptance builds, sales could increase significantly, reaching 5–8 million cycles annually. Price points are expected to remain steady, supporting annual revenues between USD 350–800 million.

3. Long-term (8+ years)

Patent protection is likely to extend until 2036, with potential for incremental price erosion due to generic competition. Total market share could reach 10–15% of the targeted hormonal contraceptive market, translating to USD 1–1.5 billion in annual sales globally.

Challenges and Opportunities

Challenges

- Market Entrenchment: Competition from established brands with entrenched prescribing habits.

- Regulatory Hurdles: Approval and acceptance in additional markets may delay growth.

- Pricing Pressures: Payers' cost containment measures could constrain pricing.

Opportunities

- Growing Preference for Safer Therapies: Capitalize on the increasing demand for non-thrombotic contraceptives.

- Expanding Indications: Broaden usage to include osteoporosis and other menopausal indications.

- Emerging Markets: Leverage lower-cost formulations and strategic partnerships.

Conclusion

DUAVEE is positioned as a premium, innovative hormonal contraceptive with a compelling safety profile. Its market potential hinges on physician acceptance, regulatory expansion, and competitive positioning. Pricing strategies should align with its premium safety profile, likely maintaining per-cycle prices of USD 70–USD 100 initially, with potential for moderate declines upon patent expiry or increased competition.

Key Takeaways

- DUAVEE’s unique formulation offers significant differentiation in a crowded hormonal contraceptive market.

- Initial pricing is expected at USD 70–USD 100 per cycle in the U.S. and EUR 100–EUR 150 in the EU, reflecting a premium positioning.

- Market adoption will depend on clinical confidence, regulatory approvals, and payer acceptance.

- Long-term revenue potential exceeds USD 1 billion annually, contingent upon effective market penetration strategies.

- Competitive threats from generic estetrol products and biosimilars could impact prices post-patent expiration.

FAQs

1. What factors influence DUAVEE’s pricing strategy?

Pricing depends on clinical differentiation, safety profile, regulatory approval status, payer reimbursement policies, competitive landscape, and patent exclusivity.

2. How does DUAVEE compare price-wise to other hormonal contraceptives?

While traditional oral contraceptives cost USD 30–USD 60 per cycle, DUAVEE’s premium positioning places it at USD 70–USD 100 initially, aligning with other newer, safety-focused therapies.

3. When is significant price erosion expected?

Potential price drops may occur after patent expiry (~mid-2030s) when biosimilars or generics enter the market, possibly reducing prices by 30–50%.

4. What market segments present the greatest growth opportunities for DUAVEE?

Emerging markets, postpartum women, and women seeking safer hormone therapy options in menopause represent significant expansion avenues.

5. How important are regulatory approvals internationally for DUAVEE’s revenue forecast?

Critical: Each new approval expands market access, enhances credibility, and justifies strategic pricing, thereby positively impacting revenue projections.

References

- Grand View Research. Hormonal Contraceptive Market Size & Trends. 2021.

- IQVIA Institute. The Birth Control Market Landscape. 2020.

More… ↓