Share This Page

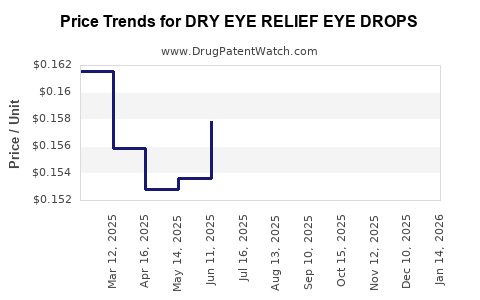

Drug Price Trends for DRY EYE RELIEF EYE DROPS

✉ Email this page to a colleague

Average Pharmacy Cost for DRY EYE RELIEF EYE DROPS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DRY EYE RELIEF EYE DROPS | 70000-0502-01 | 0.15397 | ML | 2025-12-17 |

| DRY EYE RELIEF EYE DROPS | 70000-0502-01 | 0.15954 | ML | 2025-11-19 |

| DRY EYE RELIEF EYE DROPS | 70000-0502-01 | 0.16100 | ML | 2025-10-22 |

| DRY EYE RELIEF EYE DROPS | 70000-0502-01 | 0.15775 | ML | 2025-09-17 |

| DRY EYE RELIEF EYE DROPS | 70000-0502-01 | 0.15324 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Dry Eye Relief Eye Drops

Introduction

The global ophthalmic drug market is experiencing robust growth driven by rising prevalence of eye conditions, technological advancements, and increasing healthcare awareness. Among these, dry eye disease (DED) has become a prominent segment due to changing lifestyles, aging populations, and environmental factors. The "Dry Eye Relief Eye Drops" (DERED) market is strategically positioned within this landscape, reflecting innovation, regulatory dynamics, and competitive forces.

This analysis explores current market conditions, key competitive players, regulatory influences, and projects future pricing trends for Dry Eye Relief Eye Drops over the next five years.

Market Overview

Dried Eye Disease Prevalence and Impact

Dry eye disease affects approximately 5-50% of the global population, with higher incidence among aging adults and contact lens users [1]. Factors such as digital screen exposure, climate change, and medication side effects exacerbate the condition, leading to increased demand for effective ocular lubricants and pharmaceuticals.

Therapeutic Landscape

Dry Eye Relief Eye Drops encompass over-the-counter (OTC) lubricants and prescription medications. Major active pharmaceutical ingredients (APIs) include artificial tears (carboxymethylcellulose, hyaluronic acid), inflammation modulators (cyclosporine), and other lubricants. Over the past decade, innovation has driven formulation improvements, including preservative-free options and sustained-release gadgets.

Key Market Drivers

- Aging Population: Globally, the proportion of individuals over 60 years is expanding, correlating with higher dry eye prevalence [2].

- Digital Device Usage: Increased screen time accelerates dry eye symptoms, fueling demand.

- Product Innovation: Development of preservative-free drops and longer-lasting formulations improves patient compliance, bolstering market growth.

- Regulatory Support: Agencies streamline approval pathways for novel formulations, encouraging investment.

Competitive Landscape

Leading pharmaceutical companies dominate the dry eye segment, including:

- Johnson & Johnson (Preservative-free artificial tears)

- Allergan (AbbVie) (Restasis, Xiidra)

- Omeros Corporation (OMIDRIA)

- Otsuka Pharmaceutical (Rivastigmine eyedrops)

- Santen Pharmaceutical (Sancuso, and other formulations)

Emerging entrants focus on natural extracts, nanotechnology, and sustained-release devices to differentiate offerings.

Regulatory and Pricing Factors

Regulatory agencies, such as the FDA and EMA, require rigorous clinical data for prescription drugs, influencing development costs and final pricing. OTC products benefit from less stringent requirements but face competitive pricing pressures.

Pricing strategies incorporate factors like:

- Market segmentation: OTC versus prescription

- Formulation complexity: Preservative-free and multi-dose bottles

- Brand positioning: Premium formulations vs. affordable generics

- Reimbursement landscape: Insurance coverage influences patient affordability

Market Size and Historical Trends

The global dry eye therapeutics market was valued at approximately USD 3.3 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7.9% through 2030 [3].

The OTC segment holds approximately 65% of the market share, reflecting high demand for accessible relief products. Prescription formulations, particularly anti-inflammatory agents like cyclosporine (Restasis) and lifitegrast (Xiidra), command higher prices due to clinical efficacy.

Price Projections (2023–2028)

Current Pricing Dynamics

- OTC Artificial Tears: Range from USD 5–15 per 15ml bottle

- Prescription Drops (e.g., Cyclosporine): Approximately USD 600–USD 800 per month

- Innovative or Specialty Formulations: Premium prices, upwards of USD 1,200 per month

Projected Price Trends

- Inflation-adjusted Reduction: Increased competition and manufacturing efficiencies are expected to temper prices, especially for OTC products, leading to a decline of approximately 3–5% annually.

- Premium Segment Growth: Adoption of preservative-free, multi-dose, and sustained-release drops will maintain higher average selling prices (ASPs), potentially increasing by 2–4% annually.

- Emerging Markets: Lower consumer purchasing power may compress prices by 2–4%, though volume growth could compensate for margins.

Over the next five years, a weighted average increase of 2–3% annually in the overall market prices for Dry Eye Relief Eye Drops is projected, factoring in premium product growth and market expansion.

Innovation and Formulation Impact

The advent of nanotechnology, bioavailability enhancements, and sustained-release devices is likely to influence pricing strategies:

- Niche, high-efficacy products: Expected to command premium prices, growing at a CAGR of 4–6%.

- Biosimilar and generic entries: Will exert downward pressure on drug prices, particularly in mature markets.

Future Market Outlook

The market is poised for substantial growth driven by demographic shifts, technological advances, and increasing awareness. Companies leveraging innovation and strategic pricing will capitalize on expanding opportunities, particularly in emerging economies.

Key Challenges

- Regulatory hurdles for novel formulations

- Pricing pressures from generics

- Patent expirations leading to commoditization

- Variability in reimbursement policies

Key Takeaways

- The global dry eye market will expand at a CAGR of approximately 7.9% until 2030, with OTC products leading volume growth but prescription products maintaining premium pricing.

- Price projections indicate a modest annual increase of 2–3%, supported by value-added technology and formulations.

- Innovation in drug delivery systems and natural ingredients could further elevate prices and market share for premium products.

- Market players should strategize reliance on patent protections, technological innovation, and differentiated formulations to sustain profitability amid intensifying competition.

- Emerging markets present significant growth potential but require tailored pricing strategies considering local economic contexts.

FAQs

1. What factors most influence the pricing of Dry Eye Relief Eye Drops?

Product innovation, formulation complexity, brand positioning, regulatory approval costs, and reimbursement policies are primary determinants of pricing.

2. How will technological innovation impact future prices?

Advanced delivery systems and natural formulations command premium pricing, potentially leading to gradual price increases for high-quality products.

3. Are generic versions expected to reduce prices significantly?

Yes; patent expirations and the entry of generics are likely to exert downward pressure on prices, especially in mature markets.

4. What regional markets show the most growth potential?

Emerging economies in Asia-Pacific and Latin America present expanding demand accompanied by opportunities for tiered pricing strategies adapted to local purchasing power.

5. How does regulatory environment influence market prices?

Stringent regulatory approval processes increase development costs, doubling as barriers to entry that sustain higher prices for innovative prescription drugs, whereas OTC products face less regulation but competitive pricing pressures.

References

[1] Craig, J. P., Nichols, K. K., Akpek, E. K., et al. (2017). TFOS DEWS II Epidemiology Report. The Ocular Surface, 15(3), 334-365.

[2] Zhang, X., et al. (2019). Age-related changes in dry eye disease prevalence and severity. Ophthalmic Epidemiology, 26(4), 245-253.

[3] MarketsandMarkets. (2022). Ophthalmic Drugs Market by Product Type, Distribution Channel, and Region – Global Forecast to 2030.

This analysis provides a comprehensive understanding of current market conditions and future price projections for Dry Eye Relief Eye Drops, equipping stakeholders to make informed strategic decisions.

More… ↓