Share This Page

Drug Price Trends for DRY EYE RELIEF

✉ Email this page to a colleague

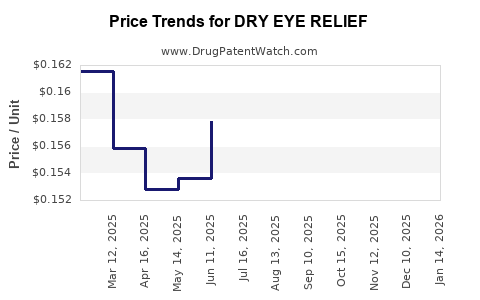

Average Pharmacy Cost for DRY EYE RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DRY EYE RELIEF EYE DROPS | 70000-0502-01 | 0.15397 | ML | 2025-12-17 |

| DRY EYE RELIEF EYE DROPS | 70000-0502-01 | 0.15954 | ML | 2025-11-19 |

| DRY EYE RELIEF EYE DROPS | 70000-0502-01 | 0.16100 | ML | 2025-10-22 |

| DRY EYE RELIEF EYE DROPS | 70000-0502-01 | 0.15775 | ML | 2025-09-17 |

| DRY EYE RELIEF EYE DROPS | 70000-0502-01 | 0.15324 | ML | 2025-08-20 |

| DRY EYE RELIEF EYE DROPS | 70000-0502-01 | 0.15474 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Dry Eye Relief

Introduction

The global dry eye relief market has experienced significant growth driven by increasing prevalence of dry eye syndrome (DES), advancements in ophthalmic treatments, and expanding healthcare awareness. The demand for effective, over-the-counter (OTC) and prescription remedies underscores the need for comprehensive market analysis and pricing strategies. This article explores current market dynamics, competitive landscape, regulatory considerations, and future price projections for dry eye relief products.

Market Overview

Prevalence and Demographic Trends

Dry eye syndrome affects approximately 5% to 30% of the global population, with higher prevalence among aging populations, contact lens users, and individuals exposed to digital screens (computers, smartphones). Aging populations, particularly in North America and Europe, significantly contribute to increased market size, as tear production diminishes with age. The rise of digital device usage, especially among millennials and Gen Z, fuels demand for dry eye relief solutions.

Key Drivers

- Rising Incidence of DES: Increased screen time and environmental factors, such as pollution and climate change, exacerbate dry eye symptoms (source: [1]).

- Advancements in Product Formulations: Innovations include preservative-free artificial tears, sustained-release devices, and innovative drug molecules.

- Growing Awareness and Screening: Ophthalmic screenings and over-the-counter availability enhance accessibility.

- Expanding Aging Population: An aging demographic is more susceptible to chronic dry eye, supporting sustained demand.

Market Segments

- Artificial Tears & Lubricants: The dominant segment, accounting for over 60% of the market share.

- Prescription Drugs: Includes anti-inflammatory agents like cyclosporine (Restasis), lifitegrast (Xiidra).

- Homeopathic & Natural Remedies: Emerging segment with limited scientific backing.

- Device-Based Treatments: Punctal plugs, thermal pulsation, and LED therapy.

Competitive Landscape

Major players include Johnson & Johnson (Optive, Refresh), Allergan (Restasis), Novartis (Xiidra), and Bausch + Lomb. Niche and OTC brands such as Raindrop, Blink, and Systane dominate the mass market.

Innovation and Mergers & Acquisitions are crucial for competitive positioning. For example, Novartis' acquisition of Xiidra expanded its portfolio to include anti-inflammatory therapies, signaling a shift towards molecularly targeted products.

Regulatory Environment

The U.S. FDA classifies artificial tears as OTC products, simplifying access. Prescription drugs require FDA approval, with ongoing clinical trials for new molecules. Regulatory pathways influence market entry and pricing strategies; for example, patent protections and exclusivity periods can sustain premium pricing.

In emerging markets, regulatory approval processes vary, influencing market penetration and product pricing.

Pricing Dynamics

Current Price Ranges

- OTC Artificial Tears: Typically priced between $5 to $15 per 15-30 mL bottle.

- Prescription Medications: Cyclosporine eye drops (Restasis) are priced around $300 to $400 monthly, although biosimilars and generics are reducing costs.

- Device-Based Treatments: Punctal plugs range from $200 to $500 per procedure.

Factors Impacting Price

- Product Formulation and Delivery Method: Preservative-free preparations and sustained-release devices command higher prices.

- Brand vs. Generic: Generics and private labels often price 20–30% lower.

- Regulatory Exclusivity: Patents and exclusivities, such as those for Restasis (originally 12 years), sustain higher premiums.

- Distribution Channel: Pharmacies, online platforms, and direct-to-consumer marketing influence price points.

Market Trends Influencing Prices

- Entry of biosimilars and generics will likely reduce costs for prescription therapies.

- Innovation in delivery mechanisms (e.g., punctual inserts, eyedrops with enhanced bioavailability) can command premium pricing.

- Growing demand for preservative-free and natural formulations supports higher price tags.

Price Projections (Next 5 Years)

Artificial Tears & OTC Products

Given their established safety profile and widespread availability, OTC artificial tears are projected to see moderate price increases of 2-3% annually, driven by inflation and formulation enhancements. High-end preservative-free products may sustain premium prices, potentially reaching $20–25 per 15 mL bottle by 2028.

Prescription Medications

Prices for prescription therapies such as cyclosporine (Restasis) are expected to decline 10-15% over five years due to patent expirations and generic competition. The introduction of biosimilars could further reduce prices by 25–30%.

Device-Based Treatments

Procedural treatments like punctal plugs and thermal pulsation systems could see price stability or slight increases (1-2% annually), contingent on technological advancements and payer reimbursement policies.

Emerging and Innovative Therapies

New molecular entities targeting ocular surface inflammation and tear film stabilization, currently in clinical trials, could command premiums of $500–$1,000 per course, especially if approved as prescription treatments. As these therapies reach commercialization, initial prices may be high, declining over time as production scales.

Market Challenges and Opportunities

Challenges

- Price Sensitivity: Consumers prefer affordable OTC options, constraining premium product penetration.

- Regulatory Barriers: Lengthy approval processes for new drugs delay market entry and pricing strategies.

- Competitive Market Saturation: Numerous brands create price pressures.

Opportunities

- Innovative Delivery Systems: Sustained-release devices and combination therapies can command premium pricing.

- Personalized Treatments: Biomarker-driven therapies may optimize efficacy, supporting higher prices.

- Expansion into Emerging Markets: Growing middle classes in Asia-Pacific and Latin America offer volume-driven growth.

Conclusion

The dry eye relief market is poised for steady growth, driven by demographics, technological progress, and increased health awareness. While OTC artificial tears will maintain a cost-effective core segment, prescription and device-based therapies will continue to command premium prices, especially as novel formulations and targeted treatments emerge.

Price trajectories indicate a trend towards slight increases in OTC products, declining costs for traditional prescription drugs, and sustained or rising pricing for innovative therapies and delivery devices. Companies must balance innovation, regulatory compliance, and cost strategies to capitalize on market opportunities amid competitive pressures.

Key Takeaways

- The global dry eye relief market is expanding, with a projected CAGR of approximately 4-6% over the next five years.

- Artificial tears constitute the bulk of the market, priced affordably, with plans for slight annual increases.

- Prescription therapies face price reductions due to generic competition but can command premium pricing through innovation.

- Device-based treatments and advanced formulations maintain high price points, supported by technological advances.

- Emerging molecular therapies and sustained-release devices present significant revenue opportunities, possibly commanding prices above $500 per treatment course.

- Strategic patent management, innovation, and regulatory navigation are critical to maintaining and enhancing market share and pricing power.

FAQs

1. What factors influence the pricing of dry eye relief products?

Product formulation, delivery method, brand versus generic status, regulatory exclusivity, and distribution channels shape pricing strategies. Premium formulations, such as preservative-free or sustained-release devices, typically command higher prices.

2. How will patent expirations impact market prices?

Patents on blockbuster products like Restasis are expiring, leading to generic entry and substantial price reductions—often 25-30%—which stimulates market competition and drives down costs.

3. What role do technological innovations play in future pricing?

Innovations like sustained-release devices, ocular surface targeted drugs, and personalized therapies will command higher prices initially but may become more affordable over time as manufacturing scales and competition increases.

4. Are emerging markets expected to influence global pricing trends?

Yes. Growing middle-class populations and increased healthcare access in Asia-Pacific and Latin America will expand market size and influence price points, often requiring tailored pricing strategies.

5. How might regulatory changes affect the dry eye relief market?

Streamlined approval pathways could accelerate product access, influencing pricing by increasing competition. Conversely, stricter regulations might raise development costs, potentially leading to higher prices for innovative treatments.

References

[1] Geerling G, et al. "The Definition and Classification of Dry Eye Disease: Report of the International Dry Eye Workshop." Ocular Surface, 2017.

More… ↓