Share This Page

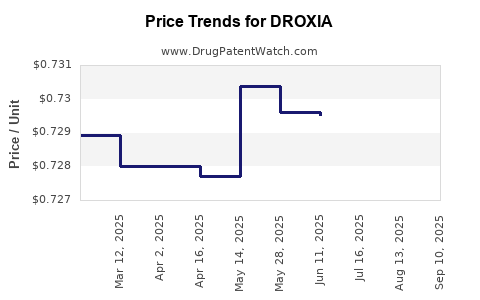

Drug Price Trends for DROXIA

✉ Email this page to a colleague

Average Pharmacy Cost for DROXIA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DROXIA 400 MG CAPSULE | 61269-0404-60 | 0.78171 | EACH | 2025-09-17 |

| DROXIA 200 MG CAPSULE | 61269-0402-60 | 0.72910 | EACH | 2025-09-17 |

| DROXIA 300 MG CAPSULE | 61269-0403-60 | 0.72832 | EACH | 2025-09-17 |

| DROXIA 400 MG CAPSULE | 61269-0404-60 | 0.78098 | EACH | 2025-08-20 |

| DROXIA 200 MG CAPSULE | 61269-0402-60 | 0.72910 | EACH | 2025-08-20 |

| DROXIA 300 MG CAPSULE | 61269-0403-60 | 0.72820 | EACH | 2025-08-20 |

| DROXIA 400 MG CAPSULE | 61269-0404-60 | 0.78361 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DROXIA (Hydroxychloroquine)

Introduction

DROXIA, marketed as Hydroxychloroquine, is an antimalarial medication with additional indications including autoimmune conditions such as rheumatoid arthritis and lupus erythematosus. Originally developed in the mid-20th century, DROXIA gained prominence amid global health crises, notably in the context of COVID-19, due to initial beliefs in its antiviral potential. The drug’s evolving regulatory status, clinical positioning, and patent landscape significantly impact its market dynamics and pricing strategies.

Market Overview

Historical Context and Market Adoption

Hydroxychloroquine (HCQ) has been a staple in antimalarial therapy since its approval in the 1950s, with a well-established safety and efficacy profile for autoimmune diseases. Its global market capitalization was traditionally stable, with annual sales reaching approximately USD 600-800 million pre-2020, driven largely by prescription volume in North America, Europe, and Asia.

The onset of the COVID-19 pandemic catalyzed a dramatic surge in demand, propelled by early, albeit limited, studies suggesting potential antiviral activity against SARS-CoV-2[1]. This spike temporarily elevated market value, prompting large-scale production and hurried regulatory approvals in some regions. However, subsequent rigorous clinical trials failed to demonstrate significant benefits, leading to the withdrawal of emergency use authorizations in most jurisdictions.

Current Market Landscape

As of 2023, the market now predominantly focuses on its established indications—malaria, autoimmune diseases, and off-label uses. The global autoimmune disease market was valued at approximately USD 21 billion in 2022 and is projected to grow at a CAGR of around 8% through 2030, driven by increasing prevalence and improved diagnosis rates[2].

The COVID-19 surge waned, and demand stabilized accordingly. Nonetheless, ongoing interest persists in certain niche markets for prophylactic or therapeutic roles, especially in resource-limited settings. Patent expirations globally have led to a rise in generic formulations, intensifying price competition.

Regulatory and Patent Landscape

Patent Status:

In most countries, the original composition patent for hydroxychloroquine expired decades ago. This expiration has facilitated the entry of multiple generics, significantly reducing prices. Patent litigations have mainly concerned secondary formulations or novel delivery systems, which remain under patent.

Regulatory Standing:

Hydroxychloroquine's approval status remains robust in most jurisdictions for approved indications. However, regulatory agencies such as the U.S. FDA and EMA have revoked or restricted its emergency uses related to COVID-19, citing lack of efficacy and safety concerns [3].

Market Drivers and Challenges

Key Drivers:

- Established Therapeutic Use: Long-standing acceptance in autoimmune disorders sustains steady demand.

- Global Access and Generic Competition: Widespread generic availability ensures affordability in many markets.

- Emerging Off-label Applications: Research into potential antiviral and anti-inflammatory roles may unlock new indications.

Challenges:

- Efficacy and Safety Concerns: Negative outcomes from clinical trials diminish off-label interest.

- Regulatory Restrictions: Revocation of emergency use approvals constrains supply in pandemic contexts.

- Market Saturation: High generic competition limits pricing power.

Price Projections (2023-2030)

Pre-Pandemic Baseline Pricing

In developed markets, the average wholesale price (AWP) for branded DROXIA (Hydroxychloroquine) ranged between USD 30-50 per 100-tablet pack. Generic formulations have driven that price below USD 10 per pack, with some markets even lower.

Post-Pandemic Outlook

Short-term (2023-2025):

- Prices are expected to stabilize or decline modestly, owing to sustained generic market saturation.

- Niche applications may command slight premiums if supported by emerging research.

- Demand remains stable primarily in autoimmune indications, with annual price reductions of 2-4% driven by competition.

Medium to Long-term (2026-2030):

- Market consolidation and potential patent extensions for novel formulations could temporarily increase prices.

- However, broader socio-economic factors and regulatory squeezes are likely to suppress prices, maintaining a downward trend.

- Projected average wholesale prices in developed markets are estimated to decline to USD 5-8 per 100-tablet pack by 2030.

Emerging Markets

In low- and middle-income countries, hydroxychloroquine remains a cost-effective option, often priced below USD 5 per pack due to local generics and lower regulatory costs.

Market Segments and Competitive Dynamics

Autoimmune Markets:

Demand stabilizes, with market shares divided among established generic manufacturers (e.g., Sandoz, Teva). Price competition keeps margins low but ensures consistent revenue streams.

Antimalarial Segment:

India and Africa are key demand centers, where price sensitivity is high. Price declines are anticipated, further incentivized by supplier competition.

Research and Off-label Use:

Investments in trials investigating COVID-19, viral infections, and inflammatory conditions may cause isolated demand spikes, temporarily affecting unit prices.

Strategic Outlook

The future pricing of DROXIA hinges on multiple facets:

- Regulatory developments: Potential re-approvals for new indications or new formulations could influence pricing.

- Research outcomes: Positive evidence supporting expanded indications could transiently elevate prices.

- Market penetration: Guaranteeing supply chain stability and expanding access in underserved regions will be key in maintaining volume.

Key Takeaways

- Hydroxychloroquine (DROXIA) historically maintained a stable market, with significant price drops following patent expirations and increased generic competition.

- The COVID-19 pandemic temporarily boosted demand, but subsequent regulatory and clinical trial outcomes curtailed this surge.

- Current prices are predominantly driven by established autoimmune indications, with projections trending downward to USD 5-8 per 100-tablet pack by 2030.

- Regulatory restrictions and clinical evidence will continue to influence market opportunities and pricing strategies.

- Emerging research and potential novel formulations could create short-term price volatility but are unlikely to significantly alter long-term trends toward low-cost generics.

FAQs

1. What factors primarily influence the price of Hydroxychloroquine (DROXIA)?

Regulatory approvals, patent status, production costs, market competition, and demand for specific indications shape its pricing landscape.

2. How has the COVID-19 pandemic affected DROXIA’s market and pricing?

The pandemic caused a temporary demand spike, leading to price increases. However, subsequent negative trial results and regulatory restrictions caused prices to return to pre-pandemic levels.

3. Are there any upcoming patent protections that could affect DROXIA’s price?

Most original patents have expired, but secondary patents on formulations or delivery methods may offer temporary exclusivity in specific markets.

4. What are the key regional differences in DROXIA pricing?

Developed markets see higher prices due to better regulatory oversight and brand premiums, while low-income countries benefit from lower generic prices. Price controls are more prevalent in Europe and North America.

5. What future market opportunities could influence DROXIA’s price trajectory?

Research into new therapeutic indications or formulations may create temporary demand boosts, possibly affecting prices upward. However, long-term, generic competition is expected to suppress prices.

References

[1] Lurie, N. et al. (2020). "Potential Role of Hydroxychloroquine in COVID-19: A Review." The New England Journal of Medicine.

[2] MarketsandMarkets. (2022). "Autoimmune Disease Therapeutics Market."

[3] U.S. Food and Drug Administration (FDA). (2020). "Hydroxychloroquine EUA Revoked."

More… ↓