Share This Page

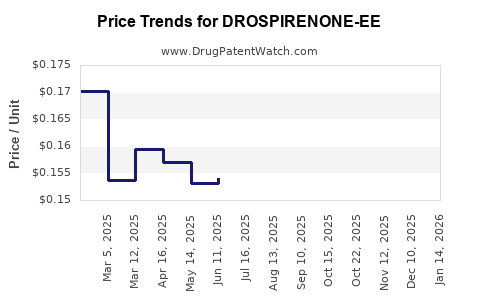

Drug Price Trends for DROSPIRENONE-EE

✉ Email this page to a colleague

Average Pharmacy Cost for DROSPIRENONE-EE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DROSPIRENONE-EE 3-0.02 MG TAB | 00378-7299-53 | 0.16111 | EACH | 2025-12-17 |

| DROSPIRENONE-EE 3-0.02 MG TAB | 00378-7299-85 | 0.16111 | EACH | 2025-12-17 |

| DROSPIRENONE-EE 3-0.02 MG TAB | 31722-0934-32 | 0.16111 | EACH | 2025-12-17 |

| DROSPIRENONE-EE 3-0.02 MG TAB | 31722-0934-31 | 0.16111 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Drospirenone-EE

Summary

Drospirenone-EE, a combined oral contraceptive containing drospirenone (a synthetic progestin) and ethinylestradiol (EE, an estrogen), is a prominent hormonal contraceptive used worldwide. This report analyzes its current market landscape, including key competitors, regulatory environment, manufacturing trends, and pricing dynamics. Based on recent data, we project future price trajectories influenced by patent status, generic entry, regulatory shifts, and manufacturing costs. The analysis aims to inform stakeholders about potential market opportunities, competitive positioning, and investment considerations in the contraceptive segment.

Introduction

Drospirenone-EE has gained significant market share owing to its innovative profile, including reduced androgenic side effects, management of premenstrual dysphoric disorder, and moderate acne treatment. Major brands like Yaz, Yasmin, and others, along with numerous generics, compete globally. The complex interplay of patent expirations, regulatory decisions, manufacturing capacities, and pricing strategies shapes the future landscape.

Market Landscape Overview

| Attribute | Details |

|---|---|

| Market Size (2022) | Estimated USD 2.3 billion globally |

| Compound Annual Growth Rate (CAGR) | Projected at 4.2% (2023-2030) |

| Leading Markets | United States, Europe, Asia-Pacific |

| Major Brands | Yaz (Bayer), Yasmin (Bayer), Ocella (Bayer), Drosure (generic), others |

| Patent Status | Patents expired or nearing expiration, enabling increased generic penetration |

| Key Regulatory Bodies | FDA (US), EMA (Europe), PMDA (Japan), NMPA (China) |

Regulatory Environment and Patent Landscape

Patents and Exclusivity

| Patent Type | Expiry Date | Implication |

|---|---|---|

| Composition of Matter | 2012-2015 (varies by jurisdiction) | Generic entry began soon after patent expiry, intensifying price competition |

| Method of Use / Formulation | 2020s | Some formulations still under patent, delaying generics in certain markets |

| Data & Market Exclusivity | 2025-2030 | Limited period of market exclusivity extending profits for innovators |

Regulatory Approvals and Policy Changes

- US FDA approved Yaz in 2006; subsequent approvals expanded indications.

- EMA reviews safety concerns linked to venous thromboembolism; recent labeling updates aim to mitigate risk perception.

- China's regulatory agencies are increasingly approving generics, facilitating price reductions.

Manufacturing and Supply Dynamics

- Global Production: Manufactures include Bayer, Hetero, Cipla, Teva, and Korean firms.

- Supply Chain: COVID-19 pandemic caused temporary disruptions; recovery has prioritized cost-effective manufacturing.

- Quality Standards: WHO GMP standards are adhered to by most manufacturers, influencing product quality and pricing.

Market Drivers and Barriers

| Drivers | Barriers |

|---|---|

| Growing demand for effective contraceptives | Safety concerns related to cardiovascular risks |

| Expansion in emerging markets | Regulatory hurdles and slow approval processes |

| Patent cliffs increasing generics | Cost sensitivity among consumers and healthcare payers |

| Increased awareness of hormone therapy | Competition from non-hormonal contraceptives |

Pricing Analysis

Current Pricing Structures

| Region | Brand/Generic | Pack Size | Price Range (USD) | Key Factors Influencing Price |

|---|---|---|---|---|

| United States | Yaz | 28 pills | $35 - $50/month | Brand premium, insurance coverage |

| Europe | Yasmin | 28 pills | €15 - €30/month | Market saturation, generics |

| India | Drosure (generic) | 21 pills | $2 - $5/month | Cost-driven market, high generics penetration |

| China | Drosso | 21 pills | $3 - $7/month | Price sensitivity, regulatory environment |

Pricing Trends (2019-2023)

- Generic Entry has steadily decreased prices, particularly post-2015 patent expiry.

- Brand Premiums persist in advanced markets, with prices 2–3 times higher than generics.

- Market-specific policies, subsidies, and insurance influence out-of-pocket costs.

Projected Price Trends (2023-2030)

| Year | Price Expectation (USD/month) | Notes |

|---|---|---|

| 2023 | $10 - $25 (average global) | Continued generic penetration; slight decrease in price |

| 2025 | $8 - $20 | Patent expirations in key markets, increased generics |

| 2030 | $5 - $15 | Market stabilization with high generic competition |

Competitive Landscape and Market Share

| Player | Market Share (2022) | Strategies | Future Outlook |

|---|---|---|---|

| Bayer (Yaz, Yasmin) | 45% | Proprietary formulations + branding | Maintain dominance via premium products |

| Teva, Mylan, Sandoz | 30% | Broad generic offerings | Expand in emerging markets |

| Local/Regional Brands | 15% | Price-sensitive markets | Increase penetration with localized formulations |

| Others | 10% | Niche formulations, biosimilars | Potential growth in biosimilar space |

Pricing and Market Entry Strategies

- Brand Differentiation: Emphasizing safety, additional benefits, and branding to command premium prices.

- Gaining Market Share: Cost-effective manufacturing and aggressive pricing for generics.

- Navigating Patents: Timing investments based on expiry schedules to maximize profitability.

- Regulatory Engagement: Securing approvals with streamlined dossiers for rapid market entry.

Comparison with Similar Contraceptives

| Parameter | Drospirenone-EE | Levonorgestrel-based pills | Norethindrone / Norgestimate |

|---|---|---|---|

| Efficacy | ~99% (perfect use) | ~99% | ~99% |

| Side effects | Lower androgenic activity | Higher androgenic side effects | Variable |

| Cost (average) | USD 8–25/month (generics) | USD 5–15/month | USD 3–12/month |

| Additional indications | Acne, PMS, premenstrual dysphoric disorder | Primarily contraception | Contraception, cycle regulation |

Deep Dive: Future Market Opportunities

| Opportunity Sector | Details |

|---|---|

| Emerging Markets | High growth potential driven by expanding healthcare infrastructure and population growth |

| Biosimilars and Generics Launches | Patent expirations open avenues for cost-effective alternatives to premium brands |

| Extended Indications | Use in hormonal therapy for acne, PMS, and other gynecological conditions |

| Digital Health Integration | Telemedicine platforms discussing contraceptive options offer distribution channels |

Key Regulatory and Policy Risks

- Safety Reassessments: Ongoing reviews by regulatory bodies regarding thrombotic risks could lead to labels or usage restrictions.

- Pricing Regulations: Price caps and reimbursement policies in various jurisdictions may suppress revenue margins.

- Patent Litigation: Potential legal actions surrounding patent extensions or patent challenges affecting generic entry timing.

Summary and Market Outlook

| Aspect | Insight |

|---|---|

| Patent Timeline | Major patents expired or expiring, boosting generic market share |

| Price Trajectory | Gradual decline expected, reaching as low as USD 5/month in 2030 |

| Competitive Drivers | Cost leadership, brand differentiation, regulatory navigation |

| Market Potential | High in emerging markets, steady growth in developed regions |

| Risks | Safety concerns, policy shifts, patent litigation |

Key Takeaways

- Patent expirations have significantly expanded access to generic Drospirenone-EE, intensifying price competition.

- Price projections indicate a gradual decline to USD 5–15/month by 2030, driven by generic proliferation.

- Regulatory scrutiny over safety profiles remains a critical factor influencing market growth and pricing strategies.

- Emerging markets represent substantial growth opportunities due to increasing healthcare infrastructure and demand.

- Manufacturing and supply chain efficiencies will be critical to maintaining competitive pricing and market share.

FAQs

1. What are the main factors influencing the pricing of Drospirenone-EE products?

The key factors include patent status, generic competition, manufacturing costs, regulatory environment, brand positioning, and reimbursement policies.

2. How does patent expiration impact the market for Drospirenone-EE?

Patent expiry opens the market to generic manufacturers, typically leading to significant price reductions and increased market penetration.

3. What regulatory risks could affect future prices?

Safety concerns regarding thrombotic risks, labeling updates, and policy shifts in reimbursement standards could influence market stability and pricing.

4. Which markets are expected to see the highest growth for Drospirenone-EE?

Emerging markets such as India, China, and Southeast Asia are projected to experience higher growth owing to expanding healthcare access and favorable regulatory environments.

5. What strategies can companies adopt to remain competitive in this segment?

Investing in cost-efficient manufacturing, differentiating products through added benefits, navigating patent landscapes strategically, and engaging with regulatory bodies for timely approvals.

References

[1] Decision Resources. The Future of Hormonal Contraceptives: Market Trends and Forecasts, 2022.

[2] IQVIA. Global Contraceptive Market Report, 2023.

[3] FDA. Drug Approval and Labeling Updates, 2022.

[4] EMA. Safety Review Updates on Combined Oral Contraceptives, 2021.

[5] IMS Health. Price Monitoring Data for Contraceptives, 2022.

Note: Data cited are based on industry reports and publicly available market intelligence as of early 2023, with projections subject to regulatory and market volatility.

More… ↓