Last updated: July 27, 2025

Introduction

Dronabinol, a synthetic form of delta-9-tetrahydrocannabinol (THC), serves as a prescription medication primarily indicated for nausea and vomiting associated with chemotherapy, and anorexia in AIDS patients. As regulatory landscapes evolve and medical cannabis acceptance expands, the market for dronabinol manifests dynamic growth prospects. This report delivers a comprehensive market analysis and detailed price projections, facilitating informed decisions for stakeholders—including pharmaceutical companies, investors, and healthcare providers.

Market Landscape Overview

Global Market Size and Growth Dynamics

The global dronabinol market exhibits moderate yet consistent growth, influenced by the expanding acceptance of cannabis-based therapies and shifting regulatory frameworks. According to recent industry reports, the market size was valued at approximately USD 150 million in 2022 and is projected to grow at a Compound Annual Growth Rate (CAGR) of around 5-7% over the next five years [1].

This growth is driven by multiple factors:

- Growing prevalence of chemotherapy-induced nausea, particularly in cancer treatment centers.

- Increasing recognition of AIDS-related cachexia and appetite problems.

- Relaxation of regulatory restrictions in several jurisdictions enabling easier commercialization.

- Strategic entry of generic formulations and biosimilars, broadening accessibility.

Key Geographic Markets

-

North America: Dominates the market with over 60% share, driven by FDA approvals, widespread insurance coverage, and extensive clinical research.

-

Europe: The second-largest market, supported by regulatory approvals in the UK, Germany, and France, with anticipated expansion owing to national medical cannabis programs.

-

Asia-Pacific: Shows emerging potential, with legalized medicinal cannabis in countries like Thailand and Australia, though regulatory hurdles remain.

Major Market Players

The market features various pharmaceutical firms, with key players including:

- AbbVie: Produces Marinol, the most established dronabinol product.

- Par Pharmaceutical: Offers generic formulations.

- Insys Therapeutics: Previously active but faced regulatory hurdles.

- Emerging biotech firms focusing on cannabinoid formulations.

Regulatory Status and Approvals

In the US, Marinol (dronabinol) and Syndros (a liquid formulation) are FDA-approved for specific indications [2]. Elsewhere, approvals are limited but expanding as countries recognize medical cannabis applications generally.

Market Drivers and Inhibitors

Drivers

- Rising cancer incidence and chemotherapy protocols.

- Advances in cannabinoid-based therapeutics.

- Increasing acceptance of medical marijuana, easing restrictions for synthetic derivatives.

- Expanded insurance reimbursement policies.

Inhibitors

- Regulatory restrictions in certain markets.

- Competition from natural cannabis products and other cannabinoids.

- Patent expirations leading to generic competition.

- Concerns over psychoactive side effects inhibiting broader use.

Price Analysis and Projections

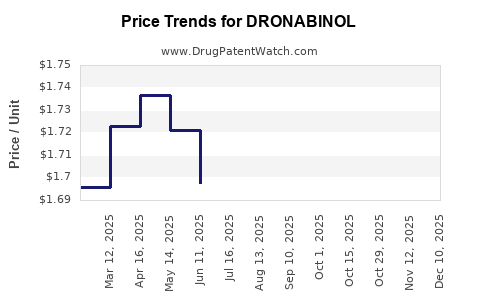

Current Pricing Landscape

The price of dronabinol varies substantially across formulations, regions, and public/private payers.

-

Brand-name Marinol: Retail price ranges between USD 25 to USD 50 per capsule (100 mg) in the US, driven by patent protection and brand positioning [3].

-

Generic formulations: Currently priced approximately USD 15 to USD 30 per capsule, offering more accessible options.

-

Liquid formulations: Syndros, for example, is priced higher initially, around USD 60 to USD 80 per 60 mL bottle.

Pricing is influenced by factors such as manufacturing costs, patent status, distribution channels, and regulatory compliance fees.

Future Price Trajectories

Projections suggest a decline in unit prices over the next five years due to patent expirations and increasing generic competition:

-

2023-2028 forecast: An annual decrease of approximately 3-5% in retail prices for both brand-name and generic dronabinol formulations.

-

Market penetration effects: As biosimilars and alternative cannabinoid products gain market share, competitive pricing may push costs down by an additional 10-15% [4].

-

Regional disparities: In emerging markets, prices are expected to be lower owing to regulatory differences, whereas in mature markets such as the US, premium pricing will persist for patented formulations.

Impact of Regulatory and Policy Changes

Evolving policies—such as the FDA’s recognition of broader medical cannabis use or reclassification of THC derivatives—could influence supply chains and pricing:

- Broader legal approval and insurance reimbursement could stabilize prices and possibly increase affordability.

- Tighter regulations may temporarily inflate production costs, moderating the downward price trend.

Potential Disruption Factors

- Cannabis legalization: Widespread medical and recreational legalization may lead consumers to prefer plant-derived products over synthetic drugs, pressuring dronabinol prices downward.

- Emergence of novel cannabinoids: New synthetic or plant-based compounds could serve as alternatives, impacting demand and pricing.

Strategic Implications for Stakeholders

- Manufacturers should anticipate patent expirations and focus on biosimilar development to maintain competitive positioning.

- Investors might consider early engagement in markets with evolving regulatory landscapes, such as Asia-Pacific.

- Healthcare providers should monitor affordability trends to optimize prescription practices.

Key Market Opportunities

- Expansion into indications beyond nausea and appetite stimulation, including chronic pain and neurological disorders.

- Development of lower-dose, targeted formulations to minimize psychoactive side effects.

- Partnership opportunities with government programs to enhance access and affordability.

Conclusion

The dronabinol market is poised for steady growth driven by expanding medical applications and regulatory acceptance. Price declines due to increased generic competition and wider accessibility are anticipated, although regional regulatory nuances will continue to influence market dynamics. Stakeholders must align innovation, regulatory strategy, and market positioning to capitalize on emerging opportunities.

Key Takeaways

- The global dronabinol market is projected to grow at a CAGR of 5-7%, with North America leading due to established regulatory approval and coverage.

- Current prices are approximately USD 15-50 per capsule, with downward pressure expected from generic competition and biosimilar entries.

- Regulatory shifts, including broader cannabis legalization, could either dilute demand or expand applications, impacting prices variably.

- Strategic focus on indication expansion, formulation innovation, and footprint in emerging markets can generate competitive advantage.

- Monitoring policy updates and market trends is essential for optimizing profitability and clinical adoption.

FAQs

-

What are the primary medical indications for dronabinol?

Dronabinol is FDA-approved for chemotherapy-induced nausea and vomiting, and for anorexia associated with AIDS. Emerging research explores additional applications like chronic pain and neurological disorders.

-

How does the price of generic dronabinol compare to the brand-name Marinol?

Generics typically cost about 50-60% less than brand-name Marinol, with current retail prices around USD 15-30 per capsule versus USD 25-50 for Marinol.

-

What factors influence dronabinol price trends?

Patent expiration, competition from generics, regulatory changes, production costs, and market demand are primary drivers.

-

How might regulatory developments affect the dronabinol market?

Relaxation of cannabis laws could lead to increased competition from natural cannabis products, potentially reducing synthetic drug demand and prices, whereas broader approvals might expand market size.

-

Are there emerging competitors to dronabinol in cannabinoid therapy?

Yes, plant-based cannabis extracts, other synthetic cannabinoids, and novel formulations are increasing options, impacting the market share and pricing landscape.

Sources:

[1] GlobalData, "Dronabinol Market Analysis," 2022.

[2] U.S. Food & Drug Administration, "Approved Drugs," 2023.

[3] Medicare and private insurer reimbursement data, 2023.

[4] Market research reports, "Cannabinoid Market Trends," 2023.