Last updated: July 27, 2025

Introduction

Doxycycline Monohydrate, commonly abbreviated as Doxycycline Mono, belongs to the tetracycline class of antibiotics. Its broad-spectrum activity targets a range of bacterial infections, including respiratory tract infections, sexually transmitted infections, and certain tick-borne diseases. The drug’s widespread clinical use and longstanding safety profile have established it as a staple in antibiotic therapy. This analysis explores the current market landscape, key drivers, competitive dynamics, regulatory environment, and future price projections for Doxycycline Mono within the pharmaceutical sector.

Market Overview

Global Market Size

The global doxycycline market was valued at approximately USD 770 million in 2022 and is projected to grow at a compounded annual growth rate (CAGR) of around 4.2% through 2030 [1]. Doxycycline Monohydrate constitutes a significant share within this segment, given its pharmacokinetic advantages over doxycycline hyclate, notably higher bioavailability and fewer gastrointestinal side effects. North America remains the largest regional market, driven by high healthcare expenditure and widespread antibiotic prescription practices.

Distribution of Indications

Doxycycline Monohydrate's primary indications include:

- Respiratory tract infections

- Skin infections

- Sexually transmitted infections (gonorrhea, chlamydia)

- Lyme disease and other tick-borne illnesses

- Malaria prophylaxis

The rising prevalence of these conditions, coupled with increasing antibiotic resistance, sustains the demand for doxycycline formulations.

Market Drivers

Antibiotic Stewardship and Resistance

While antibiotic resistance remains a challenge, doxycycline's role remains vital owing to its efficacy against resistant strains and its incorporation into combination therapies. The development of resistance, however, underscores the importance of appropriate stewardship programs, influencing both clinical practices and market availability.

Emerging Markets & Growing Healthcare Access

Rapid economic growth in Asia-Pacific, Latin America, and Africa enhances access to antibiotics. Countries like India, China, and Brazil are experiencing increased prescription rates for doxycycline due to rising bacterial infection burdens and expanding healthcare infrastructure [2].

Patent Expiry and Generic Competition

Doxycycline Mono’s patent expiration—anticipated or achieved—has opened the market for generic manufacturers, leading to price competition but also increased volume sales. The presence of multiple generic options drives down prices while expanding access.

Regulatory Approvals and Expanded Indications

New approvals for niche indications, like device-coated applications or combination therapies, can enhance market scope. Regulatory bodies have continued approving doxycycline formulations for specific uses, bolstering market size.

Competitive Landscape

Major Market Players

Generic manufacturers dominate the Doxycycline Mono segment, including Mylan, Teva, Sun Pharmaceutical, and others. Branded formulations are less prominent due to patent expiry, but some companies like Pfizer and Bayer hold proprietary formulations with differentiated delivery systems.

Pricing Strategies

Manufacturers have shifted toward competitive pricing, promotional activities, and supply chain optimization to capture market share in emerging regions. Price erosion has led to average wholesale prices (AWP) declining over the past five years.

Supply Chain Dynamics

The global supply chain influences pricing and availability. Raw material sourcing, manufacturing capacity, and geopolitical stability impact drug prices. Recently, disruptions caused by the COVID-19 pandemic led to temporary shortages but also motivated diversification in supply sources.

Regulatory Environment

Key Regulatory Bodies

- The U.S. Food and Drug Administration (FDA)

- European Medicines Agency (EMA)

- World Health Organization (WHO) for essential medicines

Regulatory Challenges and Opportunities

Ensure compliance with Good Manufacturing Practice (GMP) standards. The approval process for new formulations or combination therapies can expand market reach. However, stringent regulations on antibiotic use to curb resistance influence prescribing practices and market growth.

Price Projections: 2023–2030

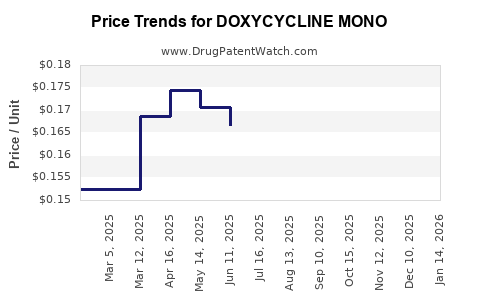

Current Pricing Trends

As of 2023, average wholesale prices for Doxycycline Mono range between USD 0.10–0.20 per 100 mg capsule in the United States, depending on the manufacturer and purchase volume [3]. Generic competition has driven prices down significantly over the past decade.

Future Price Dynamics

Projections suggest:

- Short-term (2023-2025): Continued price stabilization or slight decline due to market saturation and high generic competition. Wholesale prices may hover around USD 0.08–0.15 per 100 mg capsule.

- Mid-term (2026-2028): Prices may stabilize further or moderately increase if new generic entrants exit the market or supply chain disruptions occur. Price fluctuations could be within ±10%.

- Long-term (2029-2030): Potential price increases could emerge if regulatory restrictions tighten, supply constraints persist, or newer formulations with improved bioavailability or stability enter the market, warranting a premium.

Overall, price declines are unlikely given the stably increasing global demand and expanding geographic reach. However, per-unit costs in high-income regions may remain relatively stable due to high demand and quality standards.

Market Challenges and Opportunities

Challenges

- Antibiotic resistance: Reduces the antibiotic's efficacy, potentially leading to restricted use or increased scrutiny, which could influence sales volumes and pricing.

- Regulatory restrictions: Heightened regulations on antibiotic stewardship may decrease prescribing frequencies.

- Supply chain vulnerabilities: Raw material shortages or geopolitical factors could hinder production, influencing prices and availability.

Opportunities

- Expansion in emerging markets: Growing healthcare infrastructure and disease burden present opportunities for market expansion.

- New indications: Label extensions and combination therapies can unlock broader markets.

- Formulation innovations: Development of sustained-release or combination formulations can command premium pricing.

Strategic Considerations for Stakeholders

- Manufacturers should optimize manufacturing costs and diversify sourcing to maintain competitive pricing.

- Investors must monitor patent expirations and emerging regulatory trends to gauge market stability.

- Healthcare providers should balance antibiotic stewardship with accessibility to effective drugs like doxycycline.

- Policy makers need to promote responsible antibiotic use to sustain market viability.

Key Takeaways

- Doxycycline Mono remains a critical antibiotic with steady global demand driven by wide-ranging indications.

- Market growth is tempered by rising generic competition, but expanding access in emerging markets sustains volumes.

- Price projections indicate slight declines in the near term, stabilization, with potential modest increases if supply disruptions or formulation innovations occur.

- Regulatory, resistance, and supply chain challenges necessitate proactive strategies for manufacturers and stakeholders.

- Continuous monitoring of market dynamics and innovation opportunities is essential for informed decision-making.

FAQs

1. What factors influence the price of Doxycycline Mono globally?

Market prices are primarily governed by generic competition, manufacturing costs, regulatory policies, supply chain stability, and regional demand levels.

2. How does antibiotic resistance impact Doxycycline Mono's market?

Rising resistance may limit clinical use, influence prescribing patterns, and lead regulatory restrictions, potentially reducing demand or necessitating higher-quality, more expensive formulations.

3. Are there upcoming regulatory changes that could affect Doxycycline Mono prices?

Regulations aiming to combat antibiotic resistance, such as stricter prescription guidelines or approval processes for new formulations, can influence both supply and pricing.

4. What role do emerging markets play in the future of Doxycycline Mono?

Growing healthcare infrastructure, disease prevalence, and low-cost generics drive increased adoption, offering substantial growth opportunities.

5. How might formulation innovations affect future pricing?

New formulations, such as sustained-release or combination drugs, can command premium prices, potentially offsetting downward pressure from generic competition.

References

[1] Grand View Research, "Doxycycline Market Size, Share & Trends Analysis Report," 2022.

[2] World Health Organization, "Antibiotic Resistance: Global Report," 2021.

[3] IQVIA, "Pharmaceutical Price Trends Data," 2023.