Share This Page

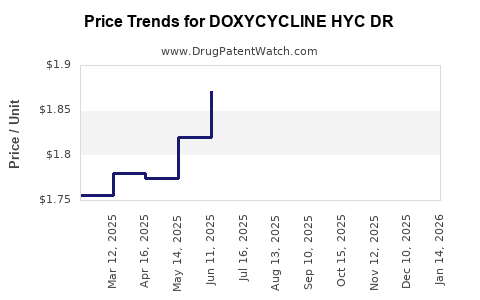

Drug Price Trends for DOXYCYCLINE HYC DR

✉ Email this page to a colleague

Average Pharmacy Cost for DOXYCYCLINE HYC DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DOXYCYCLINE HYC DR 100 MG TAB | 62332-0482-31 | 1.79001 | EACH | 2025-12-17 |

| DOXYCYCLINE HYC DR 100 MG TAB | 23155-0142-01 | 1.79001 | EACH | 2025-12-17 |

| DOXYCYCLINE HYC DR 50 MG TAB | 43547-0462-12 | 1.37409 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Doxycycline HYC DR

Introduction

Doxycycline HYC DR (Delayed Release) represents a significant segment within the tetracycline antibiotic market, primarily used for bacterial infections, including respiratory tract infections, Lyme disease, and acne. As a sustained-release formulation, it offers improved pharmacokinetics, potentially enhancing patient compliance. This report assesses the current market landscape, growth drivers, competitive environment, and provides price projection insights for Doxycycline HYC DR over the next five years.

Market Overview

The global doxycycline market, valued at approximately USD 563 million in 2022, is projected to reach USD 721 million by 2027, growing at a CAGR of 4.9% (source: MarketsandMarkets). Doxycycline HYC DR, a branded or generic delayed-release formulation, constitutes a notable share owing to its pharmacological advantages over immediate-release counterparts. The increasing prevalence of bacterial infections and rising antibiotic consumption underpin market expansion.

Key Factors Influencing Market Dynamics:

- Medical Demand: Growing incidences of bacterial infections, including respiratory and sexually transmitted infections, bolster doxycycline use.

- Patient Compliance: The delayed-release formulation improves adherence due to reduced dosing frequency.

- Regulatory Approvals: Standardized approvals in major markets like the US, EU, and emerging economies facilitate widespread adoption.

- Antibiotic Resistance: Rising resistance challenges future growth but also prompts innovation in dosing and formulations.

Competitive Landscape

Leading Players:

- Pfizer Inc. (generic and branded formulations)

- Teva Pharmaceuticals

- Mylan (now part of Viatris)

- Hetero Labs

- Sun Pharmaceutical Industries

While Doxycycline HYC DR is largely available as a generic, branded versions may command premium pricing, especially during initial market entries or in regions with limited generic penetration. The market’s competitive nature exerts downward pressure on prices, but patent protections or formulation exclusivity can briefly stabilize premium pricing.

Pricing Dynamics

Historically, doxycycline has been a low-cost generic antibiotic, with oral tablet prices trending downward due to increased production and market competition. Delayed-release formulations like Doxycycline HYC DR are generally priced 15-25% higher than immediate-release equivalents owing to manufacturing complexity and patented delivery mechanisms in some regions.

Current Price Points (USD):

| Region | Approximate Price per 30-day Supply | Note |

|---|---|---|

| US | $12 - $18 | Brand vs. generic differentiation |

| EU | €10 - €14 | Regional variance |

| India | ₹150 - ₹220 | Significant price variance |

The price variance is attributed to local market dynamics, regulatory policies, and healthcare infrastructure.

Factors Impacting Price Projections

1. Competitive Pressures:

Increased generic entry continues to drive prices downward. However, patent protections on delayed-release technology may delay generic proliferation, supporting premium prices temporarily.

2. Manufacturing Costs:

Advances in manufacturing technology and scale economies are likely to reduce production costs, exerting downward pressure on prices.

3. Regulatory Environment:

Strict regulatory controls and approval processes may influence market entry timings, creating temporary price premiums for approved formulations.

4. Market Penetration in Emerging Economies:

Growing markets like India, China, and Latin America are expected to see significant price reductions due to high competition, but with an initial phase of higher pricing for branded versions.

Price Projections (2023–2028)

Short-Term (2023–2025):

The price per 30-day supply is expected to stabilize at approximately USD 14–16 in mature markets like the US and Europe, with slight fluctuations depending on supply chain dynamics and patent protection status.

Mid-Term (2026–2028):

Increased generic competition and manufacturing efficiencies could reduce prices by 10–20%. By 2028, the average price may decline to USD 10–12 per 30-day supply in mature markets. In emerging economies, prices might drop to USD 8–10, driven by local manufacturing.

Key variables influencing these projections include:

- Patent lifespan and legal challenges

- Market entry of biosimilars or innovator alternatives

- Regulatory shifts affecting drug approval and reimbursement policies

- Global economic factors influencing healthcare budgets

Implications for Market Participants

Manufacturers:

Innovation in formulation and early entry into emerging markets can secure market share and premium pricing temporarily. Cost optimization will be pivotal for competitiveness as generics flood the market.

Investors:

The sustainability of premium prices hinges on patent protections and regulatory exclusivity periods. Entry of generics accelerates price erosion but also expands market volume.

Healthcare Providers:

The availability of cost-effective generic options underscores the importance of formulary decisions and antibiotic stewardship programs to prevent resistance.

Conclusion

Doxycycline HYC DR stands at a strategic crossroads, influenced by the broader trends affecting antibiotics and sustained-release formulations. While current prices reflect a competitive, cost-sensitive market, technological advantages and patent protections can temporarily preserve higher price points. Over the next five years, market forces, legislative changes, and innovation will likely lead to sustained price declines, especially in high-volume emerging markets.

Key Takeaways

- The global doxycycline market is projected to grow moderately at a CAGR of 4.9%, driven by infection prevalence and improved formulations like Doxycycline HYC DR.

- Pricing will remain competitive, with a downward trend expected by 2028, especially as generic manufacturing scales.

- Premium pricing for delayed-release formulations will diminish over time, replaced by volume-driven revenue models.

- Regulatory, patent, and competitive factors are critical determinants of short- and mid-term pricing dynamics.

- Strategic positioning in emerging markets offers lucrative growth potential amidst pricing compression in developed regions.

FAQs

Q1: How does Doxycycline HYC DR differ from immediate-release doxycycline formulations?

Delayed-release formulations like Doxycycline HYC DR improve pharmacokinetics by providing more stable plasma concentrations, reducing dosing frequency, and potentially improving patient compliance.

Q2: What factors influence the price decline of doxycycline HYC DR?

Major factors include increased generic competition, manufacturing efficiencies, regulatory approvals, and market penetration in emerging economies.

Q3: Are patents protecting Doxycycline HYC DR?

While the basic doxycycline molecule is off-patent globally, specific delayed-release technologies may be protected under formulations patents, influencing pricing and market entry.

Q4: Which regions are expected to experience the highest price reductions?

Emerging markets like India and China will see the most significant price declines due to high manufacturing competition and healthcare infrastructure expansion.

Q5: What is the outlook for branded versus generic versions of Doxycycline HYC DR?

Branded versions may command premium pricing during initial market entry or patent protection periods, but generics will dominate the supply and price landscape over the longer term.

References

[1] MarketsandMarkets. Antibiotics Market - Global Trends & Forecast to 2027.

[2] IQVIA. Global Antibiotic Market Data 2022.

[3] European Medicines Agency. Approval and Market Data for Doxycycline Formulations.

[4] U.S. FDA. Antibiotics and Medical Devices - Regulatory Review.

More… ↓