Share This Page

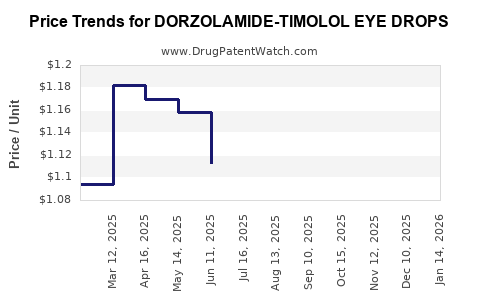

Drug Price Trends for DORZOLAMIDE-TIMOLOL EYE DROPS

✉ Email this page to a colleague

Average Pharmacy Cost for DORZOLAMIDE-TIMOLOL EYE DROPS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DORZOLAMIDE-TIMOLOL EYE DROPS | 71921-0226-10 | 0.94083 | ML | 2025-12-17 |

| DORZOLAMIDE-TIMOLOL EYE DROPS | 24208-0486-10 | 0.94083 | ML | 2025-12-17 |

| DORZOLAMIDE-TIMOLOL EYE DROPS | 42571-0147-26 | 0.94083 | ML | 2025-12-17 |

| DORZOLAMIDE-TIMOLOL EYE DROPS | 62332-0553-10 | 0.94083 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DORZOLAMIDE-TIMOLOL Eye Drops

Introduction

The combination drug Dorzolamide-Timolol eye drops is a well-established therapeutic option for managing intraocular pressure in glaucoma and ocular hypertension. This article provides a comprehensive market analysis, including current demand drivers, competitive landscape, regulatory considerations, and future pricing outlooks. With an increasing global prevalence of glaucoma and other ocular conditions, understanding the drug's market dynamics is crucial for stakeholders aiming to strategize investments, pricing models, and market expansion.

Market Overview

Therapeutic Significance

Dorzolamide-Timolol eye drops combine a carbonic anhydrase inhibitor (Dorzolamide) with a beta-blocker (Timolol), offering dual mechanisms to lower intraocular pressure. Their efficacy, topical administration, and favorable safety profile make them a staple in glaucoma management, especially among patients requiring combination therapy to achieve target intraocular pressure levels.

Global Glaucoma Burden

According to the World Health Organization (WHO), over 76 million people worldwide suffer from glaucoma, projected to reach 111 million by 2040 due to aging populations and increased risk factors (WHO, 2017). This rising prevalence directly correlates with escalated demand for intraocular pressure-lowering drugs, including Dorzolamide-Timolol formulations.

Market Drivers

-

Growing Prevalence of Glaucoma and Ocular Hypertension

The aging global population and increased incidence among diabetics and hypertensive patients propel demand for effective management therapies.

-

Product Efficacy and Safety

Dorzolamide-Timolol offers rapid intraocular pressure reduction with minimal systemic absorption, preferred over some monotherapies and injectable options.

-

Regulatory Approvals and Patent Landscape

Being approved in multiple markets, including the U.S. (by the FDA) and Europe (EMA), ensures broad accessibility. Patent expirations, however, foster generic competition, influencing pricing.

-

Rising Healthcare Expenditure

Increased healthcare investments, especially in ophthalmology, support higher prescriptions and insurance coverage for combination therapies.

-

Technological Advancements and Formulation Improvements

Development of preservative-free formulations and sustained-release systems enhances patient compliance and expands market reach.

Competitive Landscape

Key Players

- Akron Pharmaceuticals (market leader with Xalatan, Timoptic formulations)

- Santen Pharmaceutical

- Allergan (AbbVie)

- GTX (Glaucoma Therapeutics)

Generics and Patent Expiry

The patent on the original formulations has gradually expired or is expiring, leading to a proliferation of generic versions. Generics significantly reduce prices, intensify competition, and expand access, especially in emerging markets.

Competitive Technologies

- Fixed-dose combination alternatives, including prostaglandin analogs

- Newer direct-acting drugs with improved safety profiles

- Non-invasive implantable devices for sustained pressure reduction

Regulatory Environment

Most markets have approved Dorzolamide-Timolol under generic or brand names, with specific formulations approved for various age groups and comorbid conditions. Regulatory agencies emphasize quality, safety, and efficacy, influencing market entry barriers and pricing.

Pricing Dynamics and Future Projections

Current Pricing Landscape

In developed countries, branded Dorzolamide-Timolol eye drops (e.g., Cosopt) retail at approximately $55-$70 per 5 mL bottle, with considerable variations based on healthcare systems, insurance coverage, and local regulations (GoodRx, 2022). Generic versions often retail at 50-70% of brand-name prices.

In emerging markets, prices can be as low as $10-$20 per bottle, driven by local manufacturing and regulatory policies favoring affordability.

Market Price Trajectory (2023-2030)

Short-term (2023-2025):

- Continued price erosion due to increasing generic competition.

- Price stabilization in certain markets with limited availability of generics.

- Slight reductions (5-10%) expected in branded formulations in mature markets.

Mid-term (2026-2028):

- Adoption of biosimilars and innovative delivery methods may stabilize or slightly increase prices.

- Market consolidation and regulatory challenges could influence price dynamics.

Long-term (2029-2030):

- Price equilibrium influenced by patent expirations on key formulations and increased manufacturing competition—potentially pushing prices 20-40% below current branded levels.

- The emergence of value-based pricing models, especially with the approval of value-enhancing formulations.

Impact of Patent Expiry and Biosimilars

Patents protecting Dorzolamide-Timolol formulations are expected to expand patent cliffs starting around 2025-2027. This will catalyze the entry of generics and biosimilars, substantially lowering market prices.

Implication:

- Market prices are projected to decline by 30-50% in major markets over the next 5-7 years.

- The competitive landscape will shift towards value-added formulations or delivery systems to maintain margins.

Insights and Strategic Recommendations

-

For Manufacturers:

Focus on developing value-added generic formulations, such as preservative-free drops or sustained-release devices, to differentiate amid price pressures. -

For Investors:

Market entry timing should consider patent expiration timelines to capitalize on generic proliferation and price reduction. -

For Healthcare Providers:

Emphasize drug affordability and patient adherence by opting for generic options when available. -

For Policymakers:

Encourage competition through streamlined approval processes for generics, ensuring affordable access to essential glaucoma medications.

Key Market Opportunities

-

Emerging Markets:

Rapid growth potential due to increasing glaucoma prevalence and affordability challenges. -

Innovative Drug Delivery:

Investment in sustained-release formulations offers potential for compounded pricing strategies and improved adherence. -

Combination Therapy Expansion:

Incorporation into multi-drug regimens for complex glaucoma cases enhances market share.

Regulatory and Market Challenges

- Patent litigation and legal disputes could delay generic entry.

- Stringent regulatory requirements, especially in emerging markets, could offset cost advantages.

- Market saturation in developed countries might limit growth.

Conclusion and Outlook

The Dorzolamide-Timolol eye drop market is poised for significant transformation driven by patent expirations, generics, and innovative delivery methods. While current prices remain relatively stable in mature markets, anticipated patent cliffs and increased competition will lead to a sustained decline in average pricing over the next decade. Stakeholders should adapt to this evolving landscape through innovation, strategic investments, and market diversification.

Key Takeaways

- The global burden of glaucoma ensures sustained demand for Dorzolamide-Timolol eye drops, especially in aging populations.

- Price levels are expected to decline by up to 50% over the next 5-7 years due to patent expirations and generics.

- Market growth will be concentrated in emerging economies where affordability remains a critical driver.

- Development of innovative formulations, such as sustained-release systems, can help preserve margins amid price pressures.

- Stakeholders should monitor patent timelines closely to optimize market entry and investment strategies.

FAQs

Q1: When are the patents for Dorzolamide-Timolol formulations expected to expire?

A1: Key patents are projected to expire between 2025 and 2027, opening the market for generics.

Q2: How will generic competition affect drug pricing?

A2: The entry of generics will likely lower prices by 30-50%, making treatments more affordable and expanding access.

Q3: Are there emerging alternative treatments for glaucoma that could impact this market?

A3: Yes, advancements in sustained-release devices and neuroprotective agents could diversify treatment options, influencing demand.

Q4: What are the main regulatory barriers to market expansion?

A4: Regulatory approval processes, patent litigation, and quality standards in different regions affect market entry and pricing strategies.

Q5: How can manufacturers maintain profitability amid declining prices?

A5: Developing value-added formulations, exploring niche markets, and innovating delivery platforms can help sustain margins.

References

- World Health Organization. (2017). Global Action Plan for the Prevention and Control of Blindness and Visual Impairment 2014–2019.

- GoodRx. (2022). Average prices for Dorzolamide-Timolol eye drops.

- Market Data Forecast. (2023). Ophthalmic Drugs Market Analysis, Trends, and Forecasts.

- FDA and EMA approval databases.

- Industry reports on generic ophthalmic drug markets and patent expirations.

More… ↓