Share This Page

Drug Price Trends for DOCUSATE SODIUM

✉ Email this page to a colleague

Average Pharmacy Cost for DOCUSATE SODIUM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DOCUSATE SODIUM 100 MG SOFTGEL | 24689-0130-01 | 0.02885 | EACH | 2025-12-17 |

| DOCUSATE SODIUM MINI ENEMA | 00904-6920-93 | 0.47540 | ML | 2025-12-17 |

| DOCUSATE SODIUM 100 MG SOFTGEL | 00904-7280-80 | 0.02885 | EACH | 2025-12-17 |

| DOCUSATE SODIUM 100 MG SOFTGEL | 00904-7183-61 | 0.02885 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Docusate Sodium

Introduction

Docusate sodium, an FDA-approved stool softener primarily used to treat constipation, maintains a significant position within the gastrointestinal therapeutics market. As a widely prescribed generic drug, its market dynamics are subject to various influences including patent status, manufacturing trends, healthcare policies, and competitive landscape shifts. This analysis provides a comprehensive outlook on current market conditions and forward-looking price projections, vital for stakeholders investing or operating within the pharmaceutical sector.

Pharmacological Profile and Therapeutic Use

Docusate sodium functions as a laxative that enhances intestinal fluid absorption, softening stool to facilitate easier bowel movements. Its safety profile and over-the-counter (OTC) availability have cemented its popularity, especially among vulnerable demographics such as the elderly, pregnant women, and patients with chronic constipation conditions (1). The drug's long-standing approval status has resulted in a mature and low-cost manufacturing process, fostering widespread accessibility.

Market Landscape

Global Market Size and Growth Trajectory

The global stool softeners market, dominated by docusate sodium, was valued at approximately USD 1.2 billion in 2022. It is projected to grow at a compound annual growth rate (CAGR) of around 3.2% through 2027 (2). This modest growth stems from high OTC availability, stable demand driven by demographic factors, and the entrance of generic manufacturers.

Key Regional Markets

-

United States: As the largest market owing to a high prevalence of constipation and an aging population, the U.S. accounts for nearly 45% of the global sales volume. The OTC status ensures consistent demand, with minimal impact from prescription regulations.

-

Europe: Growth is steady, supported by aging populations and increasing awareness around gastrointestinal health. Regulatory frameworks favor generics, driving affordability and sustained consumption.

-

Asia-Pacific: Emerging markets like China and India show rapid growth potential, fueled by urbanization, improving healthcare infrastructure, and increased health consciousness. However, regulatory hurdles and market penetration disparities temper immediate expansion.

Industry Participants and Competitive Landscape

The market comprises numerous generic pharmaceutical companies, with prominent players including Teva Pharmaceuticals, Mylan, and Apotex. The high level of market saturation and minimal innovation barriers keep pricing pressure intense, favoring affordability over premium pricing strategies.

Regulatory and Patent Environment

Docusate sodium has long transitioned from patent exclusivity to a generic-dominated domain, resulting in minimal patent-related barriers to manufacturing. This scenario sustains a competitive environment conducive to price erosion but also stabilizes the supply chain.

Pricing Trends and Factors Influencing Prices

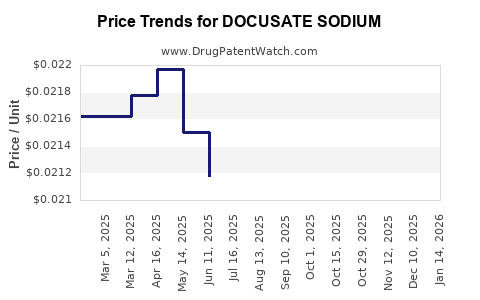

Historical Price Movements

Historically, docusate sodium's retail price per unit has declined steadily since the late 2000s, primarily driven by generic competition and high production efficiency. Current retail prices in the U.S. hover around USD 0.05 to USD 0.15 per capsule, reflecting its status as an inexpensive OTC medication (3).

Supply Chain and Manufacturing Factors

- Raw Material Costs: Variability in raw material prices, including surfactants and excipients, moderately influences manufacturing costs but often has muted effects given the high-volume, low-margin nature of the trade.

- Manufacturing Capacity: Excess manufacturing capacity among generic companies exerts downward pressure on prices, further incentivized by prevalent price competition.

Market Access and Reimbursement

In markets with insurance coverage or government pharmacy programs, reimbursement policies influence consumer prices minimally; instead, manufacturer pricing strategies dictate retail costs.

Price Projections for the Next 5 Years

Forecast Assumptions

- Market Mature State: Given the established status of docusate sodium as a generic OTC medication, significant price increases are unlikely absent regulatory or supply disruptions.

- Competitive Dynamics: Continued price competition among generic suppliers will maintain downward pressure.

- Regulatory Environment: No notable patent litigations or exclusivities emerge, preserving the status quo.

- Demand Stability: The aging population and chronic constipation prevalence sustain consistent demand.

Projected Price Trends

Based on current trajectories, retail prices are expected to trend downward marginally over the next five years, with an average annual decrease of approximately 1-2%. Prices per capsule are forecasted to stabilize between USD 0.02 and USD 0.05 by 2028, primarily in highly competitive markets like the U.S. and Europe.

In emerging markets, price stabilization or slight reductions may occur as local manufacturing scales up; however, logistical and regulatory factors will influence the pace.

Implications for Stakeholders

- Manufacturers: Need to focus on cost-efficient production and expanding distribution channels to maintain margins amidst shrinking prices.

- Distributors and Retailers: Price competition demands operational efficiencies to sustain profitability.

- Investors: The outlook indicates limited revenue growth opportunities; however, consistent cash flow remains feasible due to stable demand.

- Healthcare Providers: The low-cost profile sustains high accessibility, but formulary decisions might be affected by shifting generic competition and emerging alternatives like newer therapeutics.

Key Drivers and Risks

Drivers

- Demographic aging increasing chronic constipation prevalence.

- Widespread OTC availability and insurance coverage.

- Regulatory certainty affording predictable manufacturing and distribution.

Risks

- Emergence of novel, potentially more effective constipation treatments.

- Regulatory changes affecting OTC status or manufacturing practices.

- Supply chain disruptions, e.g., raw material shortages.

Conclusion

Docusate sodium's market displays characteristics of a mature, highly competitive OTC therapeutic with limited growth potential in pricing. The ongoing competitive pressures underscore a trend toward slight price erosion, maintaining affordability but constraining revenue expansion. Stakeholders should position themselves to optimize operational efficiencies and leverage established demand patterns.

Key Takeaways

- The global docusate sodium market was approximately USD 1.2 billion in 2022, with moderate growth prospects.

- Prices have steadily declined due to intense generic competition, stabilizing at low retail levels.

- Future price projections indicate marginal decreases (~1-2% annually) over the next five years, driven by market saturation and high manufacturing capacity.

- Regional variations exist, with North America and Europe maintaining stable demand, while Asia-Pacific shows growth potential.

- Potential risks include regulatory shifts, emergence of alternatives, and supply chain vulnerabilities.

FAQs

1. How does patent status influence the pricing of docusate sodium?

Since docusate sodium is now off-patent and predominantly manufactured by generic firms, patent expiration has led to increased competition, significantly reducing prices and limiting potential for patent-driven price elevations.

2. What are the main factors driving the stability of docusate sodium prices?

The combination of high generic competition, consistent demand due to OTC availability, and low production costs underpin the price stability and slight downward trend.

3. Will new formulations or delivery methods impact the market?

Currently, no advanced delivery or formulation innovations are prevalent for docusate sodium. Its established low-cost oral capsule form is unlikely to be displaced unless new therapeutics demonstrate superior efficacy or safety.

4. Are there regional pricing disparities for docusate sodium?

Yes. Developed markets like the U.S. and Europe benefit from mature distribution channels and insurance coverage leading to consistent pricing, whereas emerging markets may experience variable prices influenced by local manufacturing and regulatory factors.

5. What strategic advice should manufacturers consider?

Manufacturers should prioritize cost optimization, diversify distribution networks, and monitor regulatory trends to sustain margins. Investing in awareness campaigns can also support demand stability in competitive markets.

References

-

Food and Drug Administration. FDA Drug Database: Docusate Sodium. [Online] Available at: [FDA website].

-

MarketsandMarkets. Gastrointestinal Therapeutics Market by Disease Type and Geography. 2022.

-

GoodRx. Docusate sodium OTC price history. 2022.

More… ↓