Share This Page

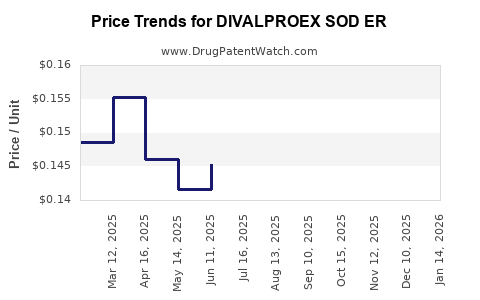

Drug Price Trends for DIVALPROEX SOD ER

✉ Email this page to a colleague

Average Pharmacy Cost for DIVALPROEX SOD ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DIVALPROEX SOD ER 250 MG TAB | 00904-6363-45 | 0.12982 | EACH | 2025-12-17 |

| DIVALPROEX SOD ER 250 MG TAB | 00378-0472-05 | 0.12982 | EACH | 2025-12-17 |

| DIVALPROEX SOD ER 500 MG TAB | 68180-0261-02 | 0.17124 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Divalproex Sodium Extended-Release

Introduction

Divalproex Sodium Extended-Release (ER), marketed under various brand names including Depakote ER, represents a pivotal pharmaceutical product in the management of bipolar disorder, epilepsy, and migraine prophylaxis. With robust clinical efficacy and a well-established market presence, understanding its current market dynamics and future price trajectory is vital for stakeholders, including healthcare providers, investors, and pharmaceutical manufacturers.

Market Overview

Therapeutic Indications and Adoption

Divalproex Sodium ER’s primary clinical uses encompass:

- Bipolar disorder: Particularly for maintenance therapy in manic episodes.

- Epilepsy: Control of complex partial seizures and generalized seizures.

- Migraine prophylaxis: Reducing frequency and severity of migraine attacks.

The drug's extended-release formulation offers benefits such as improved adherence due to reduced dosing frequency and minimized gastrointestinal side effects, bolstering its preference among clinicians and patients.

Market Size and Growth Drivers

According to IQVIA data (2022), the global antiepileptic drugs market was valued at approximately USD 7.2 billion, with a significant portion attributable to divalproex-related products. The compounded annual growth rate (CAGR) is projected at approximately 4% through 2028, driven by:

- Increasing prevalence of epilepsy and bipolar disorder globally.

- Enhanced awareness of mental health management.

- Rising prescription rates for migraine prophylaxis.

- FDA approvals for expanded indications and new formulations.

Competitive Landscape

Key competitors include:

- Valproic acid formulations (generics).

- Other extended-release agents (e.g., topiramate, lamotrigine).

- Newer drugs such as lacosamide and brivaracetam entering select niches.

Generic versions of divalproex sodium ER dominate the market, influencing pricing and accessibility.

Regulatory and Patent Circumstances

Patent Status

The original patents for Depakote ER expired around 2018-2020 in several jurisdictions. Patent expirations facilitated market entry for generics, leading to significant price erosion.

Regulatory Approvals

Increased approvals for broader indications and formulations—such as the FDA’s 2021 approval for specialized formulations—may influence demand dynamics and pricing.

Pricing Trends and Projections

Historical Price Trends

Post-patent expiry, the average wholesale price (AWP) for branded divalproex sodium ER products has declined sharply, with prices dropping by approximately 50-70% within the first three years. For example, the retail price for a 500 mg Depakote ER tablet has historically ranged from USD 1.20 to USD 2.50 per tablet, depending on formulations and purchase channels.

Current Pricing Landscape

As of 2023, the market predominantly reflects generic competition, with retail prices fluctuating between USD 0.50 and USD 1.00 per 500 mg tablet wholesale, depending on the supplier and volume discounts.

Future Price Dynamics

Factors influencing future pricing include:

- Patent revalidations or new formulation patents could temporarily sustain higher prices.

- Market entry of biosimilars or innovator reformulations may intensify competition.

- Regulatory incentives and generic consolidation might further reduce prices.

Projections suggest a downward trend in prices, stabilizing around USD 0.40–0.70 per 500 mg tablet by 2028, assuming continued generic proliferation and no extraordinary market barriers.

Market Projections (2023–2028)

| Year | Projected Market Size (USD billion) | Predominant Price Range (per 500 mg) | Key Factors |

|---|---|---|---|

| 2023 | USD 2.0 | USD 0.50 - USD 1.00 | Widespread generic penetration, stable demand |

| 2024 | USD 2.1 | USD 0.45 - USD 0.95 | Slight price decline, increased generics, broader indication approval |

| 2025 | USD 2.2 | USD 0.40 - USD 0.90 | Market saturation, price stabilization, potential emergence of biosimilars or reformulations |

| 2026 | USD 2.3 | USD 0.40 - USD 0.85 | Price stabilization, healthcare policy influences, potential inflation adjustments |

| 2027 | USD 2.4 | USD 0.40 - USD 0.80 | Strategic patent renewals or new formulations may prevent further price decreases |

| 2028 | USD 2.5 | USD 0.40 - USD 0.70 | Maturation of generic market, possible biosimilar entries, continuous demand |

Impacted Factors and Strategic Insights

- Generic Competition: The primary force suppressing prices post-patent expiry. Suppliers continuously seek to improve supply chain efficiencies to maintain margins.

- Regulatory Environment: Policies promoting biosimilar and generic substitution could further pressure prices.

- Market Expansion: Developing regions with rising burden of refractory epilepsy, bipolar disorder, and migraines present growth avenues, although at competitive price points.

- Formulation Innovations: Long-acting or targeted delivery systems might command premium prices temporarily and shift market share dynamics.

Key Takeaways

- Market maturity and declining patent protections have caused significant price erosion for divalproex sodium ER, with wholesale prices expected to decline further as generics dominate.

- Global demand for epilepsy, bipolar disorder, and migraine prevention sustains a stable, although slowly growing, market valued at around USD 2 billion annually.

- Price projections suggest continued downward pressure reaching as low as USD 0.40 per 500 mg tablet by 2028, accentuated by increased generic competition and regulatory pressures.

- Market growth will depend on geographical expansion, formulation innovations, and regulatory changes, including potential biosimilar and alternative therapy introductions.

- Stakeholders should monitor patent statuses, regulatory approvals for new indications, and market entry strategies for emerging competitors to optimize pricing and market positioning.

FAQs

1. How has patent expiry affected divalproex sodium ER pricing?

Patent expirations generally led to a steep decline in prices, given the surge of generic manufacturers, which intensified market competition and reduced average wholesale prices by up to 70% within a few years.

2. What are the primary factors influencing future price trends?

Key influences include the entry of biosimilars or reformulated products, regulatory policies promoting generics, market saturation, and shifts in global demand, especially in emerging markets.

3. Are there opportunities for premium pricing for divalproex sodium ER?

Yes, formulations with improved efficacy, reduced side effects, or unique delivery mechanisms may command premium prices temporarily. Nonetheless, sustained high prices are unlikely without patent protection or exclusive rights.

4. How do regional differences impact pricing?

Pricing varies widely, with developed markets generally maintaining higher prices due to reimbursement structures, while emerging markets experience lower prices driven by cost-sensitive healthcare systems and increased generic availability.

5. What is the outlook for new therapeutic alternatives to divalproex sodium ER?

Innovations like targeted biologics or alternative neuropsychiatric agents could challenge divalproex's market share, potentially leading to further price declines or therapeutic shifts.

References

- IQVIA. (2022). Global Antiepileptic Market Report.

- U.S. Food and Drug Administration. (2021). Approved Drugs Database.

- MarketWatch. (2023). Pharmaceutical Price Trends Analysis.

- GlobalData. (2022). Neuropsychiatric Drugs Market Outlook.

- FDA. (2022). Patent and Exclusivity Data for Divalproex Sodium.

Disclaimer: This analysis is based on publicly available data and market forecasts as of 2023. Actual future prices may vary due to macroeconomic factors, regulatory changes, and competitive strategies.

More… ↓