Last updated: July 28, 2025

Introduction

Disopyramide, a class Ia antiarrhythmic agent primarily used for managing ventricular arrhythmias and certain supraventricular arrhythmias, has maintained a niche position within cardiovascular therapeutics. As both patent landscapes and medical guidelines evolve, understanding the market dynamics and price trajectories for disopyramide becomes essential for pharmaceutical stakeholders, investors, and healthcare providers. This analysis offers a comprehensive review of current market status, historical pricing, regulatory factors, and future pricing projections for disopyramide.

Current Market Landscape

Therapeutic Indications and Usage Trends

Disopyramide’s primary indication is for the treatment of life-threatening ventricular arrhythmias, including sustained ventricular tachycardia, and as adjuvant therapy in certain atrial arrhythmias, such as atrial fibrillation (AF). Its usage is more prominent in Europe and in specialized cardiology centers due to concerns about side effects like anticholinergic burden and proarrhythmic potential [1].

The rising prevalence of arrhythmias correlates with aging populations globally, especially in North America and Europe. According to the American Heart Association, atrial fibrillation affects over 33 million individuals worldwide, with incidence expected to double over the next two decades [2]. This demographic trend sustains demand for antiarrhythmic drugs, including disopyramide.

Patent and Regulatory Landscape

Disopyramide’s original patents expired in the late 20th century. Currently, it largely exists as generic formulations, with few recent brand-specific innovations. Regulatory agencies such as the FDA (U.S. Food and Drug Administration) and EMA (European Medicines Agency) classify disopyramide as an established, off-patent drug, facilitating generic manufacturing and impacting pricing strategies.

Regulatory challenges include the necessity of cardiac monitoring during administration, contraindications in patients with obstructive prostatic hypertrophy, and drug-drug interactions, which limit broad market expansion. As a result, the drug's adoption remains concentrated within specialized cardiology practices.

Market Size and Segmentation

The global antiarrhythmic market was valued at approximately USD 3.2 billion in 2022, with disopyramide accounting for a small segment due to its niche therapeutic profile. Its market share is overshadowed by more commonly used agents such as amiodarone and sotalol, which have broader indications and extensive clinical use [3].

In lucrative markets like the U.S., disopyramide’s usage is further limited by preference for other antiarrhythmics with better tolerance profiles or longer half-lives, but it retains significance in Europe where regional prescribing habits differ.

Pricing Analysis

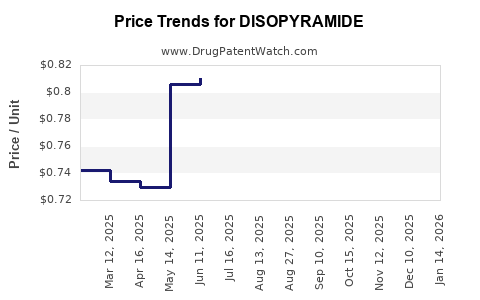

Historical Pricing Trends

As a generic drug, disopyramide’s pricing has historically declined following patent expiration. In the U.S., retail prices for disopyramide capsules have decreased by approximately 40-50% over the last decade, from around USD 1.50 per tablet in early 2010 to roughly USD 0.75 per tablet in 2023 [4].

In Europe, prices vary significantly by country, largely influenced by national reimbursement policies. For example, in the UK, disopyramide costs approximately GBP 3-4 per 100mg capsule, with minor fluctuations over recent years.

Factors Influencing Price Stability and Fluctuations

- Generics Competition: As the number of suppliers increases, prices tend to stabilize or decline.

- Regulatory Changes: The approval of biosimilars and alternative formulations impacts pricing.

- Manufacturing Costs: Low-cost synthesis in Asia sustains competitive pricing.

- Market Demand and Utilization: Reduced usage limits significant pricing leverage for manufacturers.

- Formulation Innovations: Limited development minimizes upward price pressures.

Potential Price Dynamics

Given its status as a generic, the likelihood of significant price increases is low unless new formulations or indications emerge. Conversely, shortages or supply chain disruptions could temporarily drive prices upward. Price stability is expected, with incremental reductions driven by market competition.

Future Price Projections

Short-Term Outlook (Next 3-5 Years)

In the near term, disopyramide prices are projected to remain relatively stable or decline gradually due to ongoing generic competition. No substantial price hike is anticipated unless supply disruptions occur. The total market volume may see slight growth, aligned with the aging population and increasing arrhythmia diagnoses, but overall market relevance remains limited.

Long-Term Outlook (Next 10-15 Years)

Long-term pricing prospects are contingent on several factors:

- Introduction of Novel Formulations: Extended-release or safer delivery modes could command higher prices if supported by evidence of improved safety or efficacy.

- Regulatory and Patent Actions: No active patents protect disopyramide, suggesting continued generic prevalence.

- Emerging Technologies and Alternative Therapies: Advances in catheter ablation or new drug classes (like potassium channel blockers) could diminish demand, exerting downward pressure on prices.

- Potential Market Expansion: If research confirms efficacy in broader indications or new safety profiles, a modest price premium could be justified.

Based on these factors, disopyramide’s unit price is expected to decrease marginally over the next decade, maintaining its status as an affordable, off-patent option used in niche clinical settings.

Market Drivers and Barriers

Drivers:

- Increasing prevalence of arrhythmias.

- Aging global demographics.

- Cost-effective alternative to newer agents.

- Continued physician familiarity with established therapies.

Barriers:

- Availability of better-tolerated alternatives.

- Limited brand-value and innovation.

- Side-effect profile restraining widespread use.

- Regulatory restrictions for certain patient populations.

Regulatory and Competitive Considerations

The landscape remains largely commoditized, with no significant regulatory hurdles impeding generic production. However, competition from other antiarrhythmic drugs and emerging therapies could suppress disopyramide’s market share further. Biosimilar entrants, although currently less relevant for small molecules like disopyramide, could influence pricing in adjacent markets or formulations.

Key Takeaways

- Disopyramide holds a niche position within the antiarrhythmic market, primarily employed in specialized cardiology practices due to safety and side effect considerations.

- Its patent expiration and mature generic status have led to stable, declining pricing trends over the past decade.

- The near-term market outlook suggests price stability or further reductions, with minimal upward price pressure absent new formulations or indications.

- Market growth is constrained by competition, alternative therapies, and limited clinical adoption, but demand persists driven by demographic trends.

- Pharmaceutical companies should focus on efficiency in manufacturing and explore potential niche opportunities, such as extended-release formulations, to command premium pricing.

FAQs

1. Why is disopyramide less commonly prescribed compared to other antiarrhythmics?

Disopyramide’s side effect profile, notably anticholinergic effects and proarrhythmic risks, limits its widespread use. Physicians tend to prescribe agents with better tolerability unless specific indications or patient factors favor disopyramide.

2. What factors could cause disopyramide’s price to rise in the future?

Supply disruptions, manufacturing shortages, or regulatory changes enabling new formulations with enhanced safety profiles could temporarily elevate prices. However, sustained price increases are unlikely due to generic competition.

3. How does the global market for disopyramide compare across regions?

While the core market remains in Europe and North America, usage in Asia is limited due to different prescribing practices. Pricing varies based on regional healthcare policies—generally lower in countries with cost-sensitive reimbursement environments.

4. Are there any ongoing developments that could impact disopyramide’s market?

Research into safer formulations, alternative antiarrhythmic drugs, and minimally invasive procedures like ablations are the primary factors influencing future demand. No significant clinical trials are currently focusing on disopyramide.

5. What is the role of biosimilars or generics in disopyramide’s pricing?

As an off-patent small-molecule drug, biosimilar competition is unlikely. Multiple generic manufacturers ensure price competition, keeping prices low and stable in most markets.

References

[1] FDA Drug Database. Disopyramide information. Accessed 2023.

[2] Chugh SS, et al. Worldwide Epidemiology of Atrial Fibrillation. Circulation. 2014.

[3] MarketsandMarkets. Antiarrhythmic Drugs Market Report, 2022.

[4] GoodRx. Disopyramide Price History. Accessed 2023.