Last updated: July 27, 2025

Introduction

Dipyridamole, a phosphodiesterase inhibitor primarily used for its antiplatelet effects, continues to hold a strategic position within cardiovascular therapy and diagnostic imaging. As healthcare landscapes evolve with increasing emphasis on preventive medicine and personalized treatment, understanding the current market dynamics and future pricing trajectories for dipyridamole becomes crucial for stakeholders, including pharmaceutical companies, healthcare providers, and investors. This analysis presents a comprehensive review of the dipyridamole market, examining current demand, competition, regulatory environment, and projected pricing trends.

Market Overview

Historical and Current Use Cases

Dipyridamole has been utilized mainly in two contexts: as an antiplatelet agent to prevent thromboembolic events post-cardiovascular procedures (e.g., after heart valve replacement) and as a pharmacological adjunct in diagnostic imaging, notably in radionuclide ventriculography (MUGA scans) and myocardial perfusion imaging. Its well-established safety profile and generic status have contributed to consistent demand, though the market share remains relatively niche compared to dominant antithrombotic drugs like aspirin and clopidogrel.

Market Size and Growth Drivers

The global dipyridamole market was valued at approximately USD 300 million in 2022, with projections indicating a compound annual growth rate (CAGR) of about 3-4% through 2030. Growth drivers include:

- Rising cardiovascular disease (CVD) prevalence: According to the World Health Organization, CVD remains the leading cause of mortality worldwide, increasing demand for antithrombotic agents.

- Expanding use in diagnostic procedures: Advances in nuclear medicine and increased adoption of myocardial imaging techniques expand the utility of dipyridamole.

- Generic drug availability: The availability of cost-effective generic dipyridamole has supported steady adoption, especially in emerging markets.

Regional Market Dynamics

- North America: Dominant due to high CVD prevalence and advanced healthcare infrastructure, capturing approximately 40% of the market.

- Europe: Similar market share with robust diagnostic imaging markets.

- Asia-Pacific: Fastest growth driven by increasing healthcare access, urbanization, and rising CVD burden, with CAGR estimates around 5-6%.

- Latin America and Africa: Emerging markets with slower growth due to infrastructure constraints but increasing adoption.

Competitive Landscape

Dipyridamole faces limited direct competition given its specific applications. However, alternatives and substitutes influence pricing and market share:

- Other antiplatelet agents: Clopidogrel and aspirin dominate preventive therapy due to better oral bioavailability and broad indications.

- Diagnostic alternatives: Adenosine and regadenoson are increasingly used for myocardial perfusion imaging, potentially supplanting dipyridamole in certain regions.

Major pharmaceutical companies involved include generic manufacturers such as Teva Pharmaceuticals, Mylan, and local players across Asia. Patent expiry in the early 2000s facilitated widespread generic manufacturing, stabilizing prices but reducing profit margins for originators.

Regulatory and Patent Environment

Dipyridamole’s patent protections expired over a decade ago, primarily fostering generic proliferation. Regulatory challenges are minimal; however, increasing emphasis on safety data and standardized manufacturing processes accentuate the importance of maintaining good manufacturing practice (GMP) compliance.

Recent regulatory trends focus on ensuring bioequivalence and quality consistency, influencing manufacturing costs and, consequently, pricing. Any formulation innovations or new delivery mechanisms would alter this landscape.

Price Trends and Projections

Historical Pricing

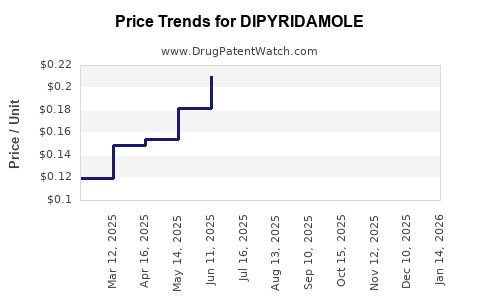

Generic dipyridamole prices have experienced significant reductions over the past decade. As of 2022, wholesale acquisition costs (WAC) for a standard 25 mg tablet ranged from USD 0.05 to USD 0.10, with retail prices varying based on healthcare systems and regional markups.

Projected Pricing Trends (2023-2030)

- Short-term outlook (2023-2025): Prices are expected to stabilize or decline marginally due to extensive generic supply, with modest inflation-adjusted increases driven by raw material costs and manufacturing efficiencies.

- Mid to long-term outlook (2026-2030): Prices may remain stable unless disruptive factors occur, such as formulation innovations or shifts in demand following emerging therapies.

Influencing Factors

- Raw material costs: Key starting materials are sourced globally; volatile prices impact manufacturing costs.

- Regulatory costs: Stricter quality standards may raise production expenses.

- Market demand: Steady demand from diagnostic imaging markets supports consistent pricing, but substitution by newer agents could exert downward pressure.

- Competition intensity: Widespread generic competition continues to suppress prices.

Emerging Trends Impacting the Market

- Formulation innovations: Development of sustained-release formulations or combination therapies could command premium pricing, potentially reversing current downward trends.

- Digital health integration: Use of dipyridamole in conjunction with advanced imaging software may increase its valuation.

- Regulatory developments: Stringent quality and safety requirements might increase manufacturing costs, potentially elevating prices marginally.

Strategic Recommendations for Stakeholders

- Investors: Focus on emerging markets where growth prospects outweigh current pricing pressures.

- Manufacturers: Prioritize cost-efficient production and explore formulation innovations to differentiate offerings.

- Healthcare providers: Continue integrating dipyridamole into diagnostic workflows where its profile offers advantages over alternatives.

Key Takeaways

- The dipyridamole market remains relatively stable, supported by its niche roles in cardiovascular management and diagnostics.

- Price stability prevails in mature markets due to extensive generic competition, with prices remaining around USD 0.05-0.10 per tablet.

- Emerging markets show potential for increased demand, though pricing pressures persist.

- Technological and formulational innovations offer opportunities to command premium pricing and extend market reach.

- Regulatory compliance and raw material cost management are vital for maintaining profitability and price competitiveness.

Conclusion

While the dipyridamole market’s growth is modest, its strategic importance in specific medical niches sustains a steady demand. Price projections suggest a long-term trend of stabilization with potential mild fluctuations driven by manufacturing costs, regional demand shifts, and innovation trajectories. Stakeholders should align their strategies with regional market nuances and technological trends to optimize competitive positioning.

FAQs

1. What factors are most influential in determining dipyridamole prices?

Pricing is primarily affected by raw material costs, manufacturing efficiencies, patent status, and the level of competition among generic manufacturers.

2. How does the availability of substitutes impact dipyridamole’s market and pricing?

Substitutes like adenosine and regadenoson in imaging applications can reduce demand and exert downward pressure on prices, especially where they are clinically equivalent.

3. Are there any recent innovations in dipyridamole formulations?

Currently, most formulations remain standard; however, research into sustained-release formulations or combination therapies is ongoing, which could influence future pricing.

4. How significant is regional variation in dipyridamole pricing?

Regional differences are notable, with higher prices in developed countries due to higher healthcare costs, while emerging markets benefit from lower prices driven by generic competition.

5. What are the prospects for dipyridamole in emerging markets?

Growing cardiovascular disease burden and expanding diagnostic infrastructure create positive prospects, though pricing pressures remain a challenge due to price sensitivity.

Sources

- World Health Organization. Global Status Report on Noncommunicable Diseases 2014.

- Market Research Future. Dipyridamole Market Research Report — Forecast to 2030.

- IQVIA. Global Market Insights on Cardiovascular Drugs.

- U.S. Food and Drug Administration (FDA) Databases.

- National Pharmaceutical Regulatory Agencies’ Reports.