Last updated: July 29, 2025

Introduction

Diphenhydramine, a first-generation antihistamine, is widely used for allergy relief, sleep aid, and motion sickness prevention. Its longstanding presence in the pharmaceutical market, combined with ongoing demand, underscores its relevance. This analysis evaluates the current market landscape and projects future pricing trends for diphenhydramine, considering manufacturing dynamics, competitive interventions, regulatory influences, and broader healthcare patterns.

Market Overview

Global Market Size and Segments

Diphenhydramine remains integral in both over-the-counter (OTC) and prescription formulations globally. The OTC segment dominates thanks to its wide consumer accessibility for allergy and sleep disorder relief. According to recent industry reports, the global antihistamine market was valued at approximately USD 4.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 3.5% from 2023 to 2030, with diphenhydramine accounting for a significant share due to its age-old efficacy and low cost (source: [1]).

Leading Markets

- United States: The largest market, driven by high OTC sales and over 60 domestic manufacturers.

- Europe: Slightly more regulated but still significant, with key markets including Germany, UK, and France.

- Asia-Pacific: Growing markets, driven by increasing allergy prevalence and expanding healthcare infrastructure.

Market Drivers

- Consumer awareness of allergy and sleep disorders.

- Price sensitivity in low- and middle-income countries.

- Regulatory approvals for OTC sales.

- Expansion into emerging markets, with increasing preference for affordable medications.

Key Players

Major manufacturers include Johnson & Johnson, Sanofi, and Teva Pharmaceuticals. These companies primarily produce generic formulations, maintaining competitive pricing. New entrants face barriers such as patent expirations and regulatory compliance but benefit from sustained demand.

Pricing Landscape

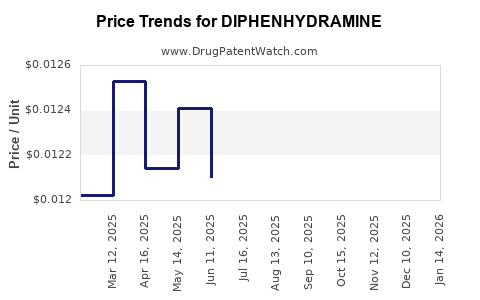

Current Pricing Dynamics

- OTC formulations: Typically retail at USD 2–5 per package (often containing 30–50 tablets). Bulk purchasing can reduce per-unit cost.

- Generic competition: Maintains price stability, often pushing prices downward.

- Brand vs. generic: Brand-name products command a slight premium (approximately 10–15%), but generics dominate sales due to affordability.

Manufacturing and Supply Chain Factors

- Raw Materials: The cost of key ingredients, such as diphenhydramine hydrochloride, remains steady, with minor fluctuations linked to crude chemical markets.

- Manufacturing costs: Largely influenced by regulatory compliance, quality assurance, and distribution logistics.

- Patent status: Since diphenhydramine's patents expired decades ago, generic proliferation keeps prices competitive.

Regulatory and Market Challenges

- Regulatory scrutiny increases costs for manufacturing facilities, but these expenses are largely absorbed by large producers.

- Supply chain disruptions: The COVID-19 pandemic exposed vulnerabilities but were largely mitigated; ongoing geopolitical tensions can impact raw material availability.

Price Projection Outlook (2023–2030)

Short-term (2023–2025)

Market prices are expected to remain relatively stable, buoyed by consistent demand and mature generics market dynamics. Slight downward pressure may occur due to further generic entries. OTC product prices could see minor reductions, especially in commoditized markets as competition intensifies.

Medium-term (2025–2027)

Potentially, regulatory modifications or increased focus on quality standards could marginally elevate manufacturing costs, translating into modest price increases, particularly in regions with evolving drug approval processes. Elsewhere, the sustained scale of manufacturing should keep unit prices stable.

Long-term (2027–2030)

Emerging trends such as biosimilar-like competition or new formulation innovations are unlikely to disrupt pricing significantly. However, market saturation and a plateau in growth could compress margins, primarily affecting small manufacturers. Global pricing may see slight declines due to enhanced supply chain efficiencies and increased patent expirations.

Impact of Patent Law and Regulatory Changes

While diphenhydramine's patent has long expired, potential regulatory shifts—such as stricter OTC labeling standards or reclassification—may influence pricing strategies, especially if formulations are reformulated or restricted.

Emerging Alternatives and Competitive Displacement

Newer antihistamines with fewer side effects, such as cetirizine or loratadine, could take market share from diphenhydramine, suppressing prices in certain segments. However, due to its cost-effectiveness, diphenhydramine is likely to maintain a niche, especially in budget-conscious markets.

Market Opportunities and Risks

Opportunities

- Expanding use in developing markets.

- Developing combination products for multi-symptom relief.

- Innovations in delivery forms (e.g., liquid gels, dissolvable tablets).

Risks

- Regulatory restrictions, especially targeting OTC status.

- Substitution by newer antihistamines with superior safety profiles.

- Consumer shifts towards natural or alternative remedies.

Key Takeaways

- Diphenhydramine's mature market and patent expiry position it as a low-cost, broad-use drug with stable demand.

- Pricing will likely remain stable or decline marginally over the near term, driven by intense generic competition.

- Supply chain resilience and regulatory landscapes will be primary influences on future pricing.

- Emerging markets present growth opportunities, although local regulatory hurdles could moderate expansion.

- Competitive pressure from newer antihistamines may constrain future price increases.

Frequently Asked Questions

1. Will diphenhydramine prices increase due to regulatory changes?

While possible, significant price increases are unlikely unless regulations restrict OTC availability or impose substantial compliance costs. Historically, patent expirations and generics dominance keep prices low.

2. How does the growth of generic manufacturers influence diphenhydramine prices?

Increased competition among generic manufacturers exerts downward pressure on prices, sustaining affordability while maintaining supply stability.

3. Are there significant regional differences in diphenhydramine pricing?

Yes. Developed markets like the US and Europe tend to have marginally higher prices due to regulatory standards and market maturity. Emerging markets offer lower prices due to less strict regulations and competitive generic pricing.

4. Could innovations in delivery or formulations impact the price of diphenhydramine?

Potentially. New delivery formats or combination therapies may command premium pricing, but such innovations currently represent a small market segment.

5. What are the prospects for diphenhydramine in the global allergy and sleep aid markets?

Its longstanding efficacy and cost advantage ensure stable demand. However, competition from newer drugs with improved safety profiles may impact market share in certain segments.

References

[1] Market Data Forecast. "Antihistamines Market Size, Share & Trends Analysis Report," 2022.