Last updated: July 28, 2025

Introduction

Diltiazem, a calcium channel blocker primarily used for angina, hypertension, and certain arrhythmias, commands a significant presence within cardiovascular pharmaceuticals. Its patent status varies globally, influencing market dynamics, pricing, and competitive strategies. This analysis explores current market conditions, key drivers, competitive landscape, pricing trends, and future projections to inform stakeholders’ decision-making processes.

Market Overview

Diltiazem’s pivotal role in cardiovascular therapy stems from its efficacy in vasodilation and anti-arrhythmic properties. Globally, the drug accounts for a substantial portion of the calcium channel blocker segment, with a diverse manufacturing base comprising branded, generics, and biosimilars. The increasing prevalence of hypertension and cardiovascular diseases (CVDs) amplifies demand, underscoring the drug’s utility in primary and secondary care settings.

Global Market Size and Growth

Recent estimates place the global calcium channel blocker market, with Diltiazem as a leading constituent, at approximately USD 6.2 billion in 2022, with a compound annual growth rate (CAGR) of around 4.2% projected through 2028 [1]. The rising burden of hypertension in developing nations, coupled with aging populations in developed economies, is propelling market expansion.

Segment Breakdown

The Diltiazem market comprises immediate-release formulations, extended-release tablets, and intravenous preparations. Extended-release forms dominate due to improved adherence and fewer dosing frequency concerns. Geographically, North America constitutes the largest share, influenced by high disease prevalence and well-established healthcare infrastructure. Asia-Pacific witnesses rapid growth, driven by increasing healthcare access and patent expiries creating avenues for generics.

Market Drivers

Rising Cardiovascular Disease Incidence

According to WHO, approximately 17.9 million deaths annually are attributable to CVDs, with hypertension being a major modifiable risk factor—fueling sustained demand for antihypertensive agents like Diltiazem.

Patent Expiry and Generics Expansion

Several key patents on Diltiazem formulations have expired, enabling the proliferation of high-quality generics that drive down prices and expand accessibility. The consequent price competition stimulates market penetration in emerging economies.

Healthcare Infrastructure and Unmet Needs

Improvements in healthcare infrastructure and awareness campaigns have increased diagnosis and treatment rates. Additionally, the drug’s versatility in managing multiple cardiovascular conditions consolidates its market position.

Regulatory Approvals and Innovation

Regulatory bodies approving new formulations, combination therapies, or biosimilars enhance market scope and therapeutic options, fostering competitive variation.

Competitive Landscape

Major Manufacturers

- Sandoz (Novartis): Prominent global producer of generic Diltiazem, providing cost-effective options.

- Teva Pharmaceuticals: Extensive portfolio of cardiovascular generics, including Diltiazem.

- Mylan (now part of Viatris): Significant market presence through widespread availability.

- Aurobindo Pharma and Sun Pharma: Key players focusing on generics, particularly in India and emerging markets.

- Pfizer and Merck: Though primarily branded, they still influence the branded segment in specific markets.

Market Entry Barriers

Stringent regulatory standards, manufacturing quality requirements, and patent litigations pose barriers for new entrants. However, patent expiries mitigate these barriers for generics.

Pricing Strategies

Manufacturers leverage tiered pricing, discounts, and bundled offerings to gain market share, especially in price-sensitive markets.

Price Trends and Projections

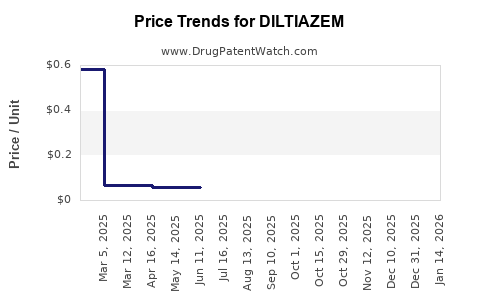

Historical Pricing Patterns

Price erosion has been a prominent trend post-patent expiry, with cases showing reductions of 40-60% over five years for generic Diltiazem products [2]. Branded formulations accrue premiums, but generics dominate volume-driven sales.

Current Price Range

- United States: Oral Diltiazem extended-release 180mg costs approximately USD 20-25 per month (generic), versus USD 150-200 for branded versions.

- India: Prices for generic Diltiazem in oral forms hover around USD 1-2 per month, reflecting high market competition.

- Europe: Prices vary significantly among countries, with generics priced roughly 50-70% below branded equivalents.

Future Price Trajectory

Based on current patent expiries and market trends:

-

Short-term (1-3 years): Prices will stabilize or decline marginally due to increased competition from existing generics; expect reductions of 10-15%.

-

Medium-term (4-7 years): Entry of biosimilars and potential for improved formulations could influence prices variably, either stabilizing or marginally increasing due to innovation.

-

Long-term (8+ years): Saturation of generics and increased adoption in emerging markets could exert downward pressure, potentially reducing prices by an additional 15-25%, especially if healthcare policies aim for cost containment.

Impact of Regulatory and Market Factors

Changes in formulary preferences, negotiating power of payers, and trade policies could accelerate or slow these trends. Market consolidation may also influence pricing dynamics, favoring more competitive pricing strategies.

Regulatory and Patent Landscape

Patents and Exclusivities

The primary patents covering Diltiazem formulations expired in many jurisdictions between 2010 and 2015, fostering generics competition. Nonetheless, secondary patents on specific formulations or delivery mechanisms may extend exclusivity, affecting pricing and market entry.

Regulatory Approvals

Regulatory authorities, including FDA, EMA, and counterparts worldwide, continually approve new Diltiazem formulations, influencing market diversification and older product pricing.

Market Challenges

- Pricing pressures: Intensity of competition among generics limits margins.

- Regulatory hurdles: Variations among regions in approval processes delay drug access.

- Therapeutic alternatives: Availability of other antihypertensive agents and combination therapies threaten Diltiazem’s market share.

- Healthcare policies: Shift towards value-based care and cost containment pressures may influence pricing and utilization.

Opportunities

- Emerging markets: Low penetration rates present expansion opportunities.

- Combination therapies: Incorporating Diltiazem into fixed-dose combinations can enhance adherence and create premium markets.

- Patent algorithms: Exploiting secondary patents or formulations to extend exclusivity periods.

- Biosimilars and advanced formulations: Innovations can command premium pricing and market share.

Conclusion

Diltiazem remains a cornerstone in cardiovascular therapy, underpinned by persistent demand driven by aging populations and rising CVD prevalence. The expired patents and ensuing generics proliferation have created a competitive, price-sensitive environment, with future prices trending downward owing to heightened competition. Strategic positioning—focusing on emerging markets, formulation innovation, and regulatory navigation—can foster growth amid price pressures. Stakeholders must monitor patent landscapes, regulatory developments, and evolving healthcare policies to optimize market opportunities.

Key Takeaways

- The global Diltiazem market was valued at approximately USD 6.2 billion in 2022 and is projected to grow at a CAGR of 4.2% through 2028.

- Patent expiries have spurred a surge in generic options, leading to significant price declines and expanded access.

- Price reductions of up to 60% have been observed for generics in mature markets; similar or greater reductions are anticipated in the coming years.

- Emerging markets represent substantial growth opportunities due to increasing CVD burdens and lower drug prices.

- Innovation in formulations and combination therapies offers avenues to sustain profitability despite inevitable price erosions.

FAQs

1. How do patent expiries affect Diltiazem pricing?

Patent expiries allow multiple manufacturers to produce generics, significantly increasing market competition and resulting in substantial price reductions—often between 40-60% within a few years.

2. What markets present the highest growth potential for Diltiazem?

Emerging economies in Asia and Africa exhibit considerable growth potential owing to increasing hypertension prevalence, expanding healthcare access, and lower generic drug prices.

3. Are branded Diltiazem products still relevant in the current market?

Yes, branded products retain premiums in certain markets due to patient loyalty, perceived quality, or formulation differences. However, generics dominate volume and price-sensitive segments.

4. What impact do regulatory policies have on Diltiazem’s market outlook?

Regulatory nuances, including approval processes and patent laws, influence market entry timelines, pricing strategies, and the potential for biosimilar development.

5. How might future innovations influence Diltiazem pricing?

Advanced formulations, combination therapies, and biosimilars could allow premium pricing and market differentiation, offsetting downward price pressures from generics.

Sources:

[1] Market Research Future. Calcium Channel Blockers Market Size & Share. 2022.

[2] IMS Health. Price Trends for Generic Cardiovascular Drugs. 2021.