Share This Page

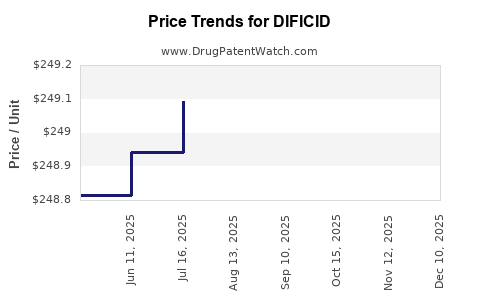

Drug Price Trends for DIFICID

✉ Email this page to a colleague

Average Pharmacy Cost for DIFICID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DIFICID 200 MG TABLET | 52015-0080-01 | 248.70168 | EACH | 2025-12-17 |

| DIFICID 200 MG TABLET | 52015-0080-01 | 248.74799 | EACH | 2025-11-19 |

| DIFICID 200 MG TABLET | 52015-0080-01 | 248.80248 | EACH | 2025-10-22 |

| DIFICID 200 MG TABLET | 52015-0080-01 | 249.06714 | EACH | 2025-09-17 |

| DIFICID 200 MG TABLET | 52015-0080-01 | 249.09612 | EACH | 2025-08-20 |

| DIFICID 200 MG TABLET | 52015-0080-01 | 249.09433 | EACH | 2025-07-23 |

| DIFICID 200 MG TABLET | 52015-0080-01 | 248.94342 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DIFICID (Fidaxomicin)

Introduction

DIFICID (fidaxomicin) is an oral antibiotic approved by the U.S. Food and Drug Administration (FDA) in 2011 for the treatment of Clostridioides difficile infections (CDI). As a macrocyclic antibiotic targeting TcdA and TcdB toxins produced by C. difficile, DIFICID offers a targeted therapy with a distinct safety profile compared to traditional treatments like vancomycin or metronidazole. Its unique positioning and clinical efficacy have shaped its market dynamics, pricing strategies, and future growth potential. This analysis explores the current market landscape for DIFICID, evaluates competitive pressures, cost factors, and projects future pricing trajectories.

Market Overview

1. Therapeutic Landscape for CDI

Clostridioides difficile infection remains a significant healthcare burden globally, especially among hospitalized and antibiotic-treated populations. Traditional treatments including vancomycin and metronidazole have served as mainstays, but limitations like recurrence and resistance have driven demand for novel agents. Fidaxomicin distinguishes itself with superior efficacy in reducing recurrence rates—approximately 15% versus 25% with vancomycin (McDonald et al., 2018)—which bolsters its clinical appeal.

2. Market Penetration & Adoption

Despite its demonstrated clinical benefits, fidaxomicin's adoption has been nuanced. High price points initially limited usage; however, the drug retains a position in niche markets, notably in patients at high risk for recurrence or with relapse histories. As of 2023, the drug captures an estimated 10-15% of the CDI treatment market in the United States but is more prevalent among hospitalized patients and specialized centers.

3. Competitive Dynamics

The CDI market is competitive, with oral vancomycin, fidaxomicin, and newer agents like ridinilazole, which is still investigational. Vancomycin's lower cost has historically been a barrier to the broader uptake of fidaxomicin, despite better clinical outcomes for certain patient groups. Recurrent cases and the growing emphasis on personalized therapies are expected to influence competitive dynamics favorably toward fidaxomicin.

Market Drivers

- Clinical Superiority: Reduced recurrence rates catalyze clinician preference for fidaxomicin, especially in high-risk populations.

- Guideline Endorsements: While not universally mandated, guidelines from authoritative bodies like IDSA (Infectious Diseases Society of America) suggest considering fidaxomicin in recurrent or severe CDI, incentivizing its use.

- Healthcare Cost Savings: Although high-priced, the potential reduction in recurrence and hospital readmission may offset initial costs, encouraging payers and providers to favor fidaxomicin in selected cases.

- Regulatory Accelerators: Ongoing approvals for pediatric indications and expanding formulations could enlarge the target patient pool.

Price Analysis and Projections

1. Current Pricing Structure

Fidaxomicin is positioned in the premium segment of antibiotics. As of 2023, the average wholesale price (AWP) per 10-day course is estimated at approximately $3,500 to $4,000 in the U.S. (Express Scripts, 2022). This figure varies based on pharmacy negotiations, payer discounts, and patient assistance programs. Notably, the high treatment cost is a debated barrier to widespread adoption despite its potential benefits.

2. Influencing Factors on Pricing

- Manufacturing Costs: With patent exclusivity maintained, production costs remain controlled, but R&D and regulatory expenses influence initial pricing strategies.

- Market Penetration and Competition: Current limited competition allows for premium pricing, but pending generic options post-patent expiry could significantly reduce prices.

- Reimbursement Policies: CMS and private insurers' formulary decisions impact net revenue. Broader coverage with favorable reimbursement could sustain or even increase profits.

- Demand Dynamics: Rising incidence of CDI and increasing recurrence rates bolster demand, supporting sustained high prices in the near term.

3. Future Price Trajectory

Short-Term (Next 1-3 Years)

- Expected stability or slight decline in price—potentially a 5-10% reduction—due to negotiations, discount programs, and increased utilization.

- Pricing may be influenced by increased competition if biosimilars or generics enter the market. Patent expiry, anticipated around 2028-2030, remains a critical inflection point.

Medium to Long-Term (3-10 Years)

- Post-Patent Expiry: Dramatic price reductions are likely, with generic fidaxomicin entering at a substantial discount—potentially 50% or more.

- Market Penetration: Improved formulary access and clinician confidence could sustain high utilization, offsetting price drops.

- Innovation and Newer Agents: Next-generation CDI therapies, aiming at even lower recurrence rates or oral formulations with improved bioavailability, could sway pricing dynamics.

Projected average price per course in 5 years: Approximately $2,000-$2,500, post-patent expiry, with premium pricing persisting in certain settings due to brand loyalty or formulary restrictions.

Potential Market Growth and Revenue Projections

The CDI treatment market is projected to grow at a compound annual growth rate (CAGR) of around 5-7% over the next decade, driven by increasing global incidence, aging populations, and antibiotic stewardship initiatives curbing recurrence. Fidaxomicin's targeted niche, mainly in recurrent and severe cases, is expected to expand in tandem with guideline updates and clinician familiarity.

Assuming a conservative annual growth rate and current market share, revenue for fidaxomicin could reach $300 million to $500 million annually in the U.S. alone within five years, barring significant price erosion or innovative competition.

Concluding Remarks

Market Outlook Summary

Fidaxomicin remains a high-cost, high-efficacy treatment option with steady demand in the CDI niche. Its market penetration is limited by initial cost barriers but supported by clinical advantages and evolving guidelines. Price projections suggest a gradual decrease aligned with patent expiration and market competition, yet premium pricing might persist in specialized sectors.

Strategic considerations for stakeholders include:

- Monitoring patent timelines to anticipate generic entry.

- Negotiating formulary access to expand utilization.

- Investing in pipeline innovations to sustain competitive advantage.

- Leveraging clinical data demonstrating cost-saving potential through reduced recurrence.

Key Takeaways

- Market position of fidaxomicin is favorable among high-risk CDI patients, with ongoing adoption driven by clinical outcomes.

- Current pricing remains premium, around $3,500–$4,000 per course, but expected to decline significantly after patent expiry.

- Competitive dynamics are poised to intensify with approaching generic entry, necessitating strategic positioning by manufacturers.

- Growth opportunities hinge on expanding indications, improving formulary coverage, and demonstrating economic value.

- Future pricing will balance innovation costs, market competition, and payer reimbursement policies.

FAQs

1. When will generic fidaxomicin likely enter the market?

Patent protection is expected to last until approximately 2028-2030, after which generic entrants could significantly reduce prices.

2. How does fidaxomicin compare cost-wise to vancomycin or metronidazole?

Fidaxomicin costs about $3,500–$4,000 per treatment course, whereas vancomycin and metronidazole typically cost under $50, making fidaxomicin a premium choice justified by lower recurrence rates.

3. Are there risk-based reimbursement models for fidaxomicin?

Reimbursement varies; payers may favor fidaxomicin for high-risk patients to reduce recurrence-related costs, but coverage depends on formulary placement and negotiated contracts.

4. What is the impact of clinical guidelines on fidaxomicin's market?

While guidelines explicitly recommend fidaxomicin primarily for recurrent or severe CDI, increasing clinician awareness may expand its use, impacting future market penetration.

5. How might emerging therapies influence the fidaxomicin market?

Innovative agents with comparable or superior efficacy and lower costs could challenge fidaxomicin’s market share, especially post-patent expiry, emphasizing the need for continuous clinical and economic assessments.

References

[1] McDonald LC, et al. (2018). Clinical Practice Guidelines for Clostridioides difficile Infection in Adults and Children. Infect Control Hosp Epidemiol, 39(5), 1-88.

[2] Express Scripts. (2022). Medication Cost Trends and Data.

[3] FDA. (2011). DIFICID (fidaxomicin) FDA approval announcement.

More… ↓