Share This Page

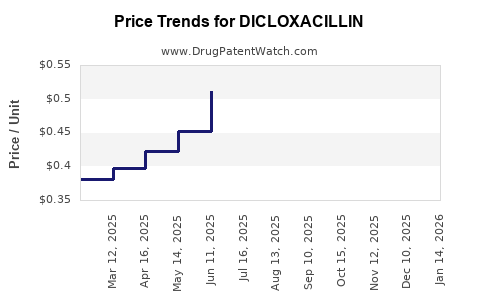

Drug Price Trends for DICLOXACILLIN

✉ Email this page to a colleague

Average Pharmacy Cost for DICLOXACILLIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DICLOXACILLIN 500 MG CAPSULE | 59651-0566-01 | 1.00264 | EACH | 2025-12-17 |

| DICLOXACILLIN 500 MG CAPSULE | 00093-3125-01 | 1.00264 | EACH | 2025-12-17 |

| DICLOXACILLIN 250 MG CAPSULE | 00093-3123-01 | 0.58020 | EACH | 2025-12-17 |

| DICLOXACILLIN 250 MG CAPSULE | 59651-0565-01 | 0.58020 | EACH | 2025-12-17 |

| DICLOXACILLIN 500 MG CAPSULE | 00093-3125-01 | 0.98958 | EACH | 2025-11-19 |

| DICLOXACILLIN 250 MG CAPSULE | 00093-3123-01 | 0.59028 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Dicloxacillin

Introduction

Dicloxacillin is an orally administered penicillinase-resistant penicillin, primarily used for the treatment of various bacterial infections caused by penicillinase-producing staphylococci. Its unique pharmacological profile and efficacy have established it as a critical antibiotic, especially in outpatient settings for skin, soft tissue, and bone infections. As antimicrobial resistance escalates and new competitors emerge, understanding the market landscape and pricing trajectory for dicloxacillin becomes crucial for stakeholders, including pharmaceutical companies, healthcare providers, and investors.

Market Overview

Global Demand and Usage Trends

The demand for dicloxacillin sustains predominantly in developed markets such as North America and Europe, reflecting high healthcare standards and widespread antibiotic prescriptions. According to IQVIA data, the global antibiotic market exceeds $45 billion annually, with penicillin-class drugs accounting for a significant share. Dicloxacillin’s specific niche—treating methicillin-sensitive Staphylococcus aureus (MSSA)—solidifies its position amid rising MRSA prevalence, which constrains its broader use.

Key Market Drivers

-

Rise in MSSA infections: The prevalence of MSSA remains steady, bolstering demand for dicloxacillin. The CDC reports that MSSA causes approximately 20% of skin and soft tissue infections in the U.S. (as per [1]).

-

Antibiotic stewardship: Stricter guidelines to optimize antibiotic use favor narrow-spectrum agents like dicloxacillin, promoting its continued relevance.

-

Limited competition from generic versions: Dicloxacillin has a limited number of FDA-approved generic counterparts, which stabilizes market prices.

Market Challenges

-

Emerging resistance: Increasing methicillin resistance complicates the clinical utility, potentially decreasing demand.

-

Availability issues: Manufacturing shortages and regulatory variability influence supply stability.

-

Competition from other antibiotics: Agents such as cephalexin and clindamycin provide alternative options, sometimes at lower costs.

Regulatory and Manufacturing Landscape

Dicloxacillin’s original formulations are decades old, with many formulations now off-patent. Patent expirations facilitate generics, reducing costs but potentially impacting profitability for branded manufacturers. Regulatory agencies like the FDA maintain strict standards, but market access varies globally, influencing pricing strategies.

Manufacturers faced intermittent shortages in recent years, attributed to manufacturing challenges and raw material constraints ([2]). Such disruptions impact supply and can temporarily influence pricing dynamics.

Market Segmentation and Regional Variability

-

North America: Stable demand with a preference for effective narrow-spectrum antibiotics; pricing remains relatively high owing to regulatory requirements and healthcare provider prescriptions.

-

Europe: Similar demand patterns; regulatory pathways for generics facilitate price competition.

-

Emerging Markets: Demand growth driven by infectious disease burdens; price sensitivity influences market entry strategies.

Competitive Landscape

Dicloxacillin competes with flucloxacillin (more common in the UK), cephalexin, and clindamycin. The choice often hinges on antibiotic resistance patterns, patient tolerability, and formulary inclusions. While newer agents target similar indications, dicloxacillin retains a niche for MSSA where resistance remains low.

Price Projections

Historical Pricing Trends

Historically, dicloxacillin’s average wholesale price (AWP) remained steady, with minor fluctuations driven by manufacturing costs and demand.

-

In the U.S.: Prices for branded dicloxacillin capsules have ranged from $60 to $120 per bottle (30 tablets). Generic versions are generally priced lower, around $20–$50 per bottle.

-

In Europe and Asia: Pricing varies significantly, often lower, due to regional procurement and generic competition.

Future Price Trajectory (2023–2030)

The following projections consider several factors:

-

Generic market expansion: Increased generic availability is expected to exert downward pressure on prices. Based on historical patterns, generics tend to reduce branded drug prices by approximately 20–40% within five years post-patent expiration.

-

Manufacturing and supply stability: Anticipated improvements in manufacturing processes could stabilize costs, preventing sharp price swings.

-

Resistance trends: Rising resistance may diminish demand, indirectly exerting downward pressure on prices due to lower utilization.

-

Regulatory and reimbursement policies: Countries with robust healthcare reimbursement models may maintain higher prices, but broader market access could lead to gradual price declines globally.

Projected Price Range (2025–2030):

| Region | Estimated Price Range (per bottle, 30 capsules) | Remarks |

|---|---|---|

| North America | $25–$55 | Expected decline due to generic competition |

| Europe | €20–€50 | Stabilization influenced by healthcare policies |

| Emerging Markets | $10–$30 | Price sensitivity and local regulation influence prices |

Note: These projections are indicative; actual prices depend on market dynamics and regional factors.

Strategic Implications

Pharmaceutical players should monitor resistance patterns and manufacturing trends to optimize pricing strategies. Entry into emerging markets can offer growth opportunities, provided the price remains competitive. Additionally, developing combination therapies or formulations with enhanced compliance may augment market share.

Conclusion

Dicloxacillin sustains a niche yet vital role within the antibiotic portfolio, especially for MSSA infections. Market stability relies on resistance trends, generic competition, and manufacturing supply chain robustness. Price projections indicate a gradual decline in costs—more pronounced in regions with aggressive generic penetration—while innovative formulations or indications could stabilize or elevate prices in specialized segments.

Key Takeaways

-

Stable niche demand for dicloxacillin persists due to its efficacy against MSSA infections, especially in outpatient settings.

-

Generic competition will accelerate price declines, with an estimated 20–40% reduction within five years post-patent expiration.

-

Supply chain disruptions and rising resistance may temper demand, influencing overall market growth.

-

Regional pricing varies significantly, with healthcare economics and regulatory environments playing a decisive role.

-

Strategic focus should be on expanding access in emerging markets, optimizing manufacturing, and monitoring resistance trends to safeguard market positioning.

FAQs

1. What is the primary clinical use of dicloxacillin?

Dicloxacillin is mainly prescribed for Staphylococcus aureus infections, including skin and soft tissue infections, osteomyelitis, and endocarditis, particularly caused by MSSA strains.

2. How does antibiotic resistance impact dicloxacillin's market?

The rise of methicillin-resistant S. aureus (MRSA) reduces dicloxacillin’s utility, leading to diminished demand where MRSA prevalence is high. Resistance monitoring guides prescribing practices, affecting market stability.

3. Are there any recent regulatory challenges affecting dicloxacillin?

While no significant recent regulatory hurdles are reported, manufacturing shortages due to supply chain issues have temporarily constrained availability in some markets.

4. How does the presence of generics influence dicloxacillin’s price?

Generics typically reduce drug prices by 20–40%, promoting affordability and market penetration but decreasing revenue for original branded formulations.

5. What are the growth prospects for dicloxacillin beyond 2025?

Growth prospects depend on resistance trends and regional demand. While the global antibiotic market faces challenges, niche applications and emerging markets present sustained opportunities.

References

[1] Centers for Disease Control and Prevention (CDC). Staph Infections. 2021.

[2] PharmaSupply Chain News. Antibiotic manufacturing disruptions continue. 2022.

More… ↓