Last updated: July 27, 2025

Introduction

Diclofenac, a non-steroidal anti-inflammatory drug (NSAID), is widely prescribed for pain management, inflammation, and musculoskeletal disorders. With its established efficacy and extensive market presence, diclofenac remains a key player in the pharmaceutical landscape. This report provides a comprehensive market analysis and price projection for diclofenac, considering current trends, regulatory environments, patent status, competitive dynamics, and evolving healthcare policies.

Market Overview

Global Market Size and Growth Dynamics

The global diclofenac market was valued at approximately USD 1.7 billion in 2022, with projections estimating a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030. Growth drivers include rising prevalence of arthritis, osteoarthritis, and chronic musculoskeletal pain, especially in aging populations. Additionally, increasing awareness of NSAID efficacy and advancements in drug formulations bolster market expansion.

Geographical Market Distribution

- North America: Dominates due to high prescription rates and widespread awareness. The U.S., accounting for over 45% of the North American market, benefits from advanced healthcare infrastructure and an aging demographic.

- Europe: The second-largest market, driven by aging populations and regulatory approval for both oral and topical formulations.

- Asia-Pacific: Exhibits rapid growth potential driven by improving healthcare access, increased disease prevalence, and generic drug penetration.

Segmental Analysis

- Formulations: Oral tablets, topical gels/patches, injectables.

- Application Areas: Rheumatology, orthopedics, dermatology.

- Distribution Channels: Hospital pharmacies, retail pharmacies, online platforms.

Regulatory Landscape and Patent Status

While diclofenac's original patents expired decades ago, new formulations and delivery systems—such as transdermal patches or sustained-release gels—are protected by recent patents, providing opportunities for branded differentiation. Regulatory agencies like the FDA and EMA have approved generic formulations, increasing price competition. Recent regulatory updates emphasize safety protocols, especially concerning cardiovascular risks associated with long-term NSAID use.

Impact of Patent Expiry and Genericization

The patent landscape shifted significantly post-2010, with generics capturing major market share. However, pharmaceutical companies continue to innovate through novel formulations, which often carry new patent protections and higher price points.

Competitive Landscape

Major players include:

- Novartis (Voltaren): A leading brand offering oral, topical, and injectable formulations.

- Teva Pharmaceuticals: Prominent manufacturer of generic diclofenac products.

- Sandoz: Focuses on cost-effective generics.

- Mylan (now acquired by Viatris): Broad portfolio of diclofenac formulations.

The competitive pressure from generics has resulted in declining prices but also increased market accessibility.

Price Analysis and Trends

Current Pricing Dynamics

- Brand-Name vs. Generic: Branded diclofenac (e.g., Voltaren) remains pricier, with retail prices averaging USD 25-40 for a 100-count supply of 75mg tablets. Generics are priced substantially lower, often below USD 10 for similar quantities.

- Formulation Influence: Topical formulations (gels, patches) generally command higher prices due to convenience and targeted delivery, with prices ranging from USD 15-30 per tube or patch.

- Geographical Variations: Prices are higher in developed countries (e.g., U.S., Western Europe) compared to emerging markets, primarily due to regulatory standards, healthcare infrastructure, and purchasing power.

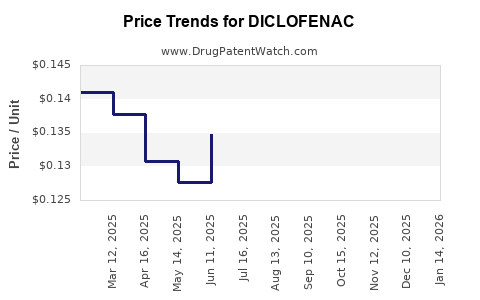

Price Trends and Future Projections

Over the last five years, the retail price of diclofenac has declined by approximately 15%-20%, primarily due to increased generic competition. However, innovative formulations and delivery systems sustain higher price points for premium segments.

Price Projections (2023-2030)

- Generic Diclofenac: Expect a stable or marginally decreasing price trend, with an average annual decrease of 1%-2%. Despite market volume growth, intense price competition constrains margins.

- Branded Diclofenac: Likely to retain premium pricing owing to differentiation and patent protections on novel formulations. Prices may increase marginally at a CAGR of about 2%, influenced by inflation and R&D costs.

- Premium Formulations: Topical patches and injectable forms could see a 3%-4% annual increase, driven by technological innovation and targeted therapy preferences.

Market Challenges and Opportunities

Challenges

- Safety Concerns: Cardiovascular risks associated with long-term NSAID use may impact prescribing trends, possibly affecting demand.

- Regulatory Restrictions: Stricter safety regulations and label updates could influence formulation approvals and market access.

- Pricing Pressure: Continued generic proliferation exerts downward pressure on prices, especially in highly regulated markets.

Opportunities

- Innovative Delivery Systems: Development of safer, sustained-release, or targeted delivery methods can command premium prices.

- Localized Markets: Expansion into emerging markets with increasing healthcare expenditure offers growth prospects.

- Combination Therapies: Integration with other agents (e.g., gastro-protective drugs) may create differentiated products with higher margins.

Strategic Recommendations

- Companies should invest in R&D for novel formulations that improve safety and compliance.

- Focus on expanding generic markets in developing countries to capture volume.

- Explore partnerships and licensing opportunities for innovative delivery systems.

- Maintain vigilant regulatory surveillance to adapt quickly to safety warnings.

Key Takeaways

- The global diclofenac market is mature, with steady growth driven by aging populations and increased musculoskeletal conditions.

- Price competition predominantly stems from generic formulations, suppressing retail prices but ensuring widespread accessibility.

- Branded, innovative formulations hold potential for higher margins, supported by patent protections and patient preferences.

- Upside opportunities include novel delivery systems, strategic entering into emerging markets, and value-added combination products.

- Regulatory environments emphasizing safety will influence market dynamics and product development.

FAQs

1. How will patent expirations impact diclofenac pricing?

Patent expirations have led to a proliferation of generic products, significantly reducing prices. Branded formulations protected by new patents on delivery systems or formulations are less affected, maintaining higher price points.

2. What are the primary factors influencing off-patent diclofenac prices?

Market entry of generics, manufacturing costs, regional regulatory frameworks, and reimbursement policies primarily influence prices. Increased competition typically drives prices downward.

3. Are innovative diclofenac formulations priced higher than traditional forms?

Yes. Novel formulations such as transdermal patches or sustained-release gels are priced higher due to manufacturing complexity and perceived therapeutic advantages.

4. What regulatory challenges could affect diclofenac’s market?

Safety concerns, particularly cardiovascular risks, may lead to stricter labeling or usage restrictions, potentially reducing demand or increasing formulation costs.

5. What is the outlook for diclofenac in emerging markets?

Rapid infrastructure development and a growing burden of chronic inflammatory conditions will continue to expand demand. Cost-effective generic options will dominate, but opportunities exist for premium formulations.

Sources

[1] Market data and projections from GlobalData and IQVIA reports, 2022.

[2] Regulatory updates from FDA and EMA official publications, 2023.

[3] Industry analysis reports from EvaluatePharma, 2022.

[4] Price trend assessments from GoodRx and similar platforms, 2023.

[5] Pharmaceutical patent databases and patent filing records, 2022-2023.