Last updated: August 4, 2025

Introduction

Diclofenac Potassium (Diclofenac Pot) is a prominent non-steroidal anti-inflammatory drug (NSAID) widely prescribed for managing pain, inflammation, and arthritic conditions. Its rapid absorption profile, owing to the potassium salt formulation, positions it as a preferred choice for acute pain scenarios. As an established pharmaceutical with broad clinical applications, understanding its market dynamics and forecasted pricing trends is vital for stakeholders across pharmaceutical manufacturing, distribution, and healthcare sectors. This comprehensive analysis evaluates current market conditions, competitive landscape, regulatory influences, and projected pricing strategies for Diclofenac Pot.

Market Overview

Global Market Size and Growth Trends

The global NSAID market, valued at approximately USD 15 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of around 4.2% through 2030, driven by rising incidences of musculoskeletal disorders, osteoarthritis, rheumatoid arthritis, and increased awareness of pain management therapies [1]. Diclofenac, accounting for nearly 30% of NSAID prescriptions, is a key contributor to this growth trajectory.

Therapeutic Position and Usage Trends

Diclofenac Pot's advantage in rapid onset of action makes it especially relevant in acute pain management. The proliferation of prescription medicines and evolving chronic disease demographics amplify demand. Notably, the transition towards combination therapies, where Diclofenac is combined with other agents (e.g., misoprostol to prevent gastrointestinal side effects), influences market preferences.

Geographical Market Dynamics

- North America: Dominates with a 40% market share driven by high prescription rates and healthcare expenditure, despite rising concerns over NSAID-associated cardiovascular risks that have prompted regulatory scrutiny.

- Europe: The second-largest market, with mature healthcare systems and high prevalence of musculoskeletal conditions.

- Asia-Pacific: Exhibits the fastest growth, owing to increasing healthcare access, aging populations, and rising affordability, projected to expand at a CAGR of 5.5% [2].

- Latin America and Middle East: Rapid market penetration, supported by expanding pharmaceutical infrastructure.

Regulatory Landscape

Regulatory agencies, such as the FDA (U.S.) and EMA (Europe), have tightened safety profiles for NSAIDs due to cardiovascular and gastrointestinal risk concerns, influencing formulation guidelines and prescription patterns. The approval of novel formulations (e.g., novel topical and parenteral Diclofenac variants) also impacts market behavior.

Market Drivers and Restraints

Drivers

- Increasing prevalence of chronic inflammatory diseases

- Growing global aging population

- Preference for fast-acting formulations

- Expanding healthcare coverage in emerging markets

- Development of new formulations improving safety profiles

Restraints

- Regulatory restrictions limiting dosage and indications

- Competition from other NSAIDs and analgesics (e.g., ibuprofen, celecoxib)

- Concerns over adverse cardiovascular events

- Patent expirations leading to generic market saturation

Competitive Landscape

Major players include Pfizer (Voltaren), Novartis, and Mylan, among others. The generic segment commands approximately 60% of the global Diclofenac market, exerting significant price pressure. Patent expirations have facilitated proliferation of low-cost generics, influencing both pricing strategies and profitability.

Pricing Analysis

Current Price Framework

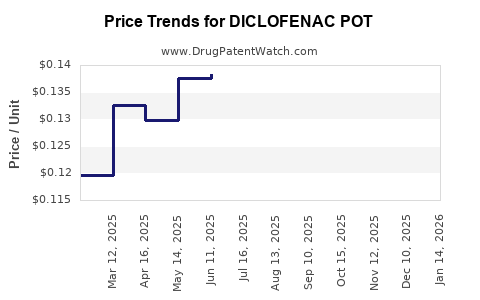

Brand-name Diclofenac Pot formulations typically retail between USD 8 and USD 15 per 100-tablet pack, varying by region and formulation. Generic prices have plummeted, with per-tablet costs often below USD 0.50 in developed markets, fostering widespread accessibility but compressing profit margins for manufacturers.

Factors Influencing Pricing | Short-term and Long-term

-

Regulatory approvals for new formulations, such as slow-release or topical versions, can command premium pricing.

-

Market competition from generics causes downward pressure, especially post-patent expiry.

-

Manufacturing costs fluctuate with raw material prices, notably the supply of Active Pharmaceutical Ingredients (APIs). Diclofenac API's price has historically experienced volatility due to geopolitical factors and supply chain disruptions.

-

Reimbursement policies profoundly impact retail pricing, with payers favoring low-cost generic options.

-

Safety profile enhancements through reformulation can enable higher pricing, provided safety concerns are adequately mitigated.

Projected Price Trends (2023-2030)

-

Short-term (Next 2 Years): Prices are expected to decline marginally due to intensified generic competition, especially in mature markets. Innovative formulations with improved safety profiles may command higher prices, but these will represent a niche segment.

-

Medium-term (2023-2026): As patent protections for some branded formulations expire, average prices are projected to stabilize or decrease overall. Nonetheless, targeted premium pricing could persist for advanced delivery systems.

-

Long-term (2027-2030): Market penetration of biosimilars or innovative NSAID delivery systems may introduce pricing variability. Strategic collaborations and patent acquisitions could also influence pricing strategies.

Regional Pricing Variations

- In North America, brand-name formulations retain higher price points due to branding and insurance reimbursements.

- The Asia-Pacific market, driven by generics, is characterized by significantly lower costs, often 30-50% of Western prices.

- Regulatory and reimbursement landscape differences will continue to influence regional pricing disparities.

Strategic Implications for Stakeholders

- Pharmaceutical companies should monitor patent expiry timelines and invest in formulation innovation to maintain premium pricing.

- Manufacturers of generics will continue to operate under aggressive pricing models fueled by high volume sales.

- Distributors and healthcare providers should balance access with cost-effectiveness, especially where regulatory restrictions lessen NSAID use.

- Investors should position themselves by evaluating pipeline developments, regulatory trends, and regional market expansion strategies.

Key Challenges and Opportunities

- Safety concerns may prompt shifts toward alternative analgesics, necessitating continual product innovation.

- Emerging markets’ growth presents opportunities for market share expansion through affordable formulations.

- Regulatory barriers could delay new formulations, impacting pricing dynamics.

- Digital health integration and personalization of therapy could influence future demand and pricing models for Diclofenac Pot.

Conclusion

The Diclofenac Potassium market operates within a complex landscape marked by evolving regulatory standards, fierce generic competition, and shifting consumer preferences. Prices are set to trend downward in the short-term due to increased generics but may stabilize or see premium applications for advanced formulations. Stakeholders who invest in formulation innovation, geographic expansion, and safety profile enhancements will better position themselves amidstThis dynamic environment. Careful navigation of regional regulatory and reimbursement nuances will maximize profitability and market reach.

Key Takeaways

- Market growth remains robust driven by aging populations and rising inflammatory disease prevalence.

- Pricing trends will predominantly trend downward due to generic competition but offer niches for premium formulations.

- Regional disparities will persist, with developing markets offering growth opportunities through affordable generics.

- Regulatory scrutiny influences both formulation development and pricing strategies, emphasizing safety safety as a differentiator.

- Innovation in drug delivery and safety enhancements represent critical avenues to sustain or command premium pricing.

FAQs

Q1: How will patent expirations of Diclofenac formulations impact prices?

A1: Patent expirations typically lead to a surge in generic entries, significantly reducing prices. Manufacturers must adapt through innovation or seeking new formulations to maintain higher margins.

Q2: What are the main safety concerns associated with Diclofenac Pot?

A2: The primary safety issues involve increased cardiovascular risk (e.g., heart attack, stroke) and gastrointestinal side effects, prompting regulatory agencies to recommend cautious prescribing and higher safety standards.

Q3: How does regional regulation influence Diclofenac Pot pricing?

A3: Strict regulatory environments can delay approvals or restrict indications, impacting market availability and pricing, whereas deregulated markets may see more aggressive competition and lower prices.

Q4: Are there innovative formulations of Diclofenac Pot on the horizon?

A4: Yes, extended-release, topical, and combination formulations aim to improve safety and patient adherence, potentially commanding higher prices in the market.

Q5: What are the key factors for new entrants aiming to compete in the Diclofenac market?

A5: They should focus on formulation innovation, cost-effective manufacturing, regulatory compliance, and strategic regional expansion to compete effectively.

References

[1] Allied Market Research, NSAID Market Forecast (2022).

[2] GlobalData, Asia-Pacific Pharmaceutical Market Outlook (2022).