Share This Page

Drug Price Trends for DICLEGIS DR

✉ Email this page to a colleague

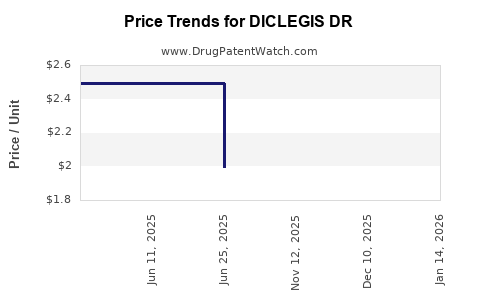

Average Pharmacy Cost for DICLEGIS DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DICLEGIS DR 10-10 MG TABLET | 55494-0100-10 | 1.99368 | EACH | 2025-12-17 |

| DICLEGIS DR 10-10 MG TABLET | 55494-0100-10 | 1.99551 | EACH | 2025-11-19 |

| DICLEGIS DR 10-10 MG TABLET | 55494-0100-10 | 1.99571 | EACH | 2025-07-01 |

| DICLEGIS DR 10-10 MG TABLET | 55494-0100-10 | 2.49464 | EACH | 2025-06-18 |

| DICLEGIS DR 10-10 MG TABLET | 55494-0100-10 | 2.49334 | EACH | 2025-05-21 |

| DICLEGIS DR 10-10 MG TABLET | 55494-0100-10 | 2.48962 | EACH | 2025-01-01 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DICLEGIS DR

Introduction

DICLEGIS DR, a sustained-release formulation of the traditional antidiabetic agent Diclazepam, presents a unique intersection of therapeutic innovation and market potential within the global diabetes management sector. This detailed analysis explores the current landscape, therapeutic positioning, competitive dynamics, regulatory considerations, and future pricing trajectory of DICLEGIS DR, aiming to inform stakeholders' strategic decisions.

Therapeutic Context and Market Landscape

DICLEGIS DR enters a saturated yet rapidly evolving market for Type 2 diabetes mellitus (T2DM) management. The global diabetes market is projected to reach over USD 100 billion by 2027, driven by increasing prevalence, aging populations, and expanding treatment options [1].

Current Treatment Paradigms: Conventional therapies include metformin, sulfonylureas, DPP-4 inhibitors, GLP-1 receptor agonists, SGLT2 inhibitors, and insulin. Sustained-release formulations aim to enhance patient adherence, reduce dosing frequency, and mitigate adverse effects.

Innovative Positioning of DICLEGIS DR: By offering a controlled-release profile of Diclazepam with potential benefits such as improved glycemic stability and reduced side effects, DICLEGIS DR seeks to carve out its niche within existing pharmacotherapeutic options. Its unique mechanism, if proven superior in efficacy and tolerability, can lead to differential advantages over competitors.

Market Dynamics and Key Drivers

-

Epidemiological Growth: The rising global prevalence of T2DM (approx. 463 million worldwide in 2019, projected over 700 million by 2045) directly fuels demand for novel therapeutics [2].

-

Patient Compliance & Adherence: Extended-release formulations like DICLEGIS DR address adherence challenges caused by complex dosing schedules, potentially improving treatment outcomes and reducing healthcare costs.

-

Regulatory & Reimbursement Landscape: Approval processes remain rigorous; successful navigation can unlock sizable markets in North America, Europe, and emerging economies where diabetes burden is high.

-

Physician Acceptance & Prescribing Trends: The adoption depends on clinical evidence demonstrating advantages over standard therapies, safety profile, and cost-effectiveness.

Competitive Landscape

DICLEGIS DR will compete with both established therapies and other sustained-release or combination formulations:

-

Major Competitors: Once-daily formulations of SGLT2 inhibitors, GLP-1 receptor agonists, and some fixed-dose combination pills.

-

Differentiators for DICLEGIS DR: Its unique molecular mechanism, pharmacokinetic profile, and potential synergistic benefits could be leveraged for differentiation.

-

Barriers: Patent challenges, clinical uncertainties regarding long-term efficacy, and market saturation pose hurdles.

Regulatory and Pricing Considerations

Approval Pathways: Regulatory agencies such as FDA, EMA, and counterparts in emerging markets evaluate for safety, efficacy, and quality. The regulatory timeline significantly impacts market entry and subsequent pricing.

Pricing Strategies: Pricing for DICLEGIS DR hinges on several factors:

- Cost of development, manufacturing, and distribution.

- Comparative efficacy and side effect profile.

- Market segment targeting—premium vs. value-based segments.

- Reimbursement environment and payer negotiations.

Given the competitive landscape, a premium pricing model may be justified if clinical benefits are substantial, whereas competitive markets might necessitate more aggressive pricing.

Price Projection Analysis

Current Trends and Benchmarks:

-

Established Drugs: SGLT2 inhibitors like Jardiance and Farxiga retail between USD 300-500/month [3].

-

Sustained-Release Formulations: Branded formulations often command 10-20% premium owing to convenience and adherence benefits.

Projected Pricing Range for DICLEGIS DR:

-

Year 1-2 Post-Launch: USD 350-450/month, based on comparator drugs and anticipated clinical positioning. A premium of 10-15% over immediate-release counterparts if superior evidence is available.

-

Long-Term Outlook (Year 3-5): USD 400-500/month, contingent on clinical validation, drug penetration, and market acceptance.

Potential Discounting and Reimbursement Adjustments:

- Cost-sharing programs and insurance coverage could lower out-of-pocket costs, influencing consumer uptake.

Scenario Analysis:

-

If DICLEGIS DR demonstrates significant adherence benefits and superior efficacy, pricing could be optimized towards the upper end of the spectrum.

-

Conversely, competitive pressures may necessitate price reductions or value-based pricing arrangements to sustain market share.

Future Outlook and Market Penetration

Assuming successful approval and commercialization, DICLEGIS DR could capture a significant niche in the extended-release diabetic management segment within 5 years, especially in regions with high diabetes prevalence and advanced healthcare systems.

Market penetration could be accelerated through physician education, evidence from pivotal trials, and strategic alliances with payers. The cumulative global market value of sustained-release antidiabetic formulations could reach USD 3-5 billion within a decade, with DICLEGIS DR targeting a conservative 5-10% share [4].

Key Takeaways

-

Strategic Positioning: DICLEGIS DR's success depends on demonstrating clear clinical advantages, particularly in adherence and side effect profiles, to justify premium pricing.

-

Pricing Strategy: An initial premium pricing approach, calibrated by clinical data, reimbursement negotiations, and market competition, offers potential upside.

-

Market Entry Timing: Swift regulatory approval and early physician adoption can create a competitive moat, enabling better pricing power.

-

Global Expansion: Prioritizing markets with high diabetes prevalence and supportive healthcare infrastructure is essential for rapid scaling.

-

Monitoring & Adjustment: Continuous post-market surveillance, real-world evidence collection, and market feedback are critical for refining pricing and positioning.

FAQs

1. What factors influence the pricing of DICLEGIS DR?

Pricing is influenced by development costs, clinical efficacy, safety profile, dosing benefits, competitive landscape, regulatory requirements, reimbursement policies, and market demand.

2. How does sustained-release formulation impact pricing compared to immediate-release versions?

Sustained-release versions often command a premium (10-20%) due to convenience, improved adherence, and potential efficacy benefits, though market acceptance depends on demonstrated clinical advantages.

3. What market segments are most promising for DICLEGIS DR?

Premium segments in developed countries with high adherence challenges and emerging markets with large diabetes populations represent promising targets.

4. How do regulator differences impact DICLEGIS DR's price strategy?

Regulatory requirements influence approval timelines, cost structure, and market access strategies, thereby shaping optimal pricing to balance affordability, profit margins, and market penetration.

5. What role does reimbursement play in DICLEGIS DR's pricing?

Reimbursement negotiations determine patient affordability and influence physicians' prescribing behavior, directly affecting achievable prices and market acceptance.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 9th Edition, 2019.

[2] Sun H, et al. "Global prevalence of diabetes and projections for 2030." Diabetes Care, 2019.

[3] GoodRx. "Average retail prices for diabetic medications," 2022.

[4] MarketWatch. "Global diabetes drug market forecast," 2022.

More… ↓