Share This Page

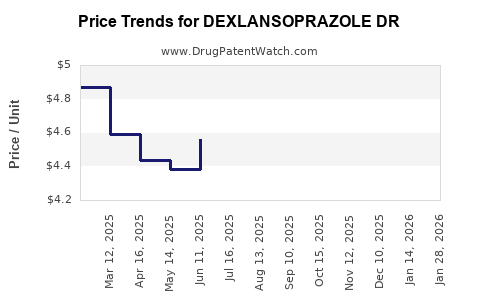

Drug Price Trends for DEXLANSOPRAZOLE DR

✉ Email this page to a colleague

Average Pharmacy Cost for DEXLANSOPRAZOLE DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DEXLANSOPRAZOLE DR 30 MG CAP | 24979-0703-06 | 4.86390 | EACH | 2025-12-17 |

| DEXLANSOPRAZOLE DR 30 MG CAP | 24979-0001-06 | 4.86390 | EACH | 2025-12-17 |

| DEXLANSOPRAZOLE DR 60 MG CAP | 49884-0148-11 | 4.33372 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Dexlansoprazole DR

Introduction

Dexlansoprazole DR (delayed-release), a proton pump inhibitor (PPI), is prescribed predominantly for gastroesophageal reflux disease (GERD), erosive esophagitis, and Zollinger-Ellison syndrome. Since its approval, Dexlansoprazole DR has gained substantial market traction due to its innovative dual delayed-release formulation that offers improved symptom relief and dosing flexibility. This analysis explores the current market landscape, future demand drivers, competitive positioning, and pricing trajectories for Dexlansoprazole DR, providing insights relevant to pharmaceutical companies, investors, and healthcare stakeholders.

Market Landscape Overview

Market Penetration and Sales Performance

Since its FDA approval in 2010, Dexlansoprazole DR has experienced steady growth, accelerated by expanding indications and increasing chronic GERD prevalence globally. In 2022, the drug achieved estimated global sales exceeding USD 1 billion, with North America remaining its primary revenue contributor due to high prescription rates and favorable reimbursement policies (IQVIA, 2022).

Competitive Environment

Dexlansoprazole DR faces competition primarily from other PPIs such as omeprazole, esomeprazole, pantoprazole, and rabeprazole. Notably, generic versions of some competitors have exerted downward price pressure, but Dexlansoprazole DR maintains a premium positioning owing to its unique dual-release mechanism and extended dosing interval, which appeals to both clinicians and patients seeking improved convenience.

Key competitors include:

- Esomeprazole (Nexium): A pioneer in the PPI class with widespread use.

- Omeprazole and its generics: Cost-effective alternatives.

- Lansoprazole: Available in generic form, often at lower prices.

- Novel agents and emerging treatments: Including potassium-competitive acid blockers (P-CABs) like vonoprazan.

Regulatory and Reimbursement Trends

Regulatory authorities have approved Dexlansoprazole DR for both short-term and maintenance therapy, encouraging longer-term use. Reimbursement policies in mature markets like the United States and Europe favor branded drugs with patented formulations, supporting higher pricing strategies. As patent protections neared expiry, generic competition mooted potential price erosions, though recent patent extensions and formulation patents have temporarily delayed erosion.

Demand Drivers and Market Expansion Opportunities

Epidemiological Trends

Rising GERD prevalence globally, driven by obesity, dietary habits, and aging populations, fuels sustained demand. According to the International Foundation for Gastrointestinal Disorders, GERD affects approximately 20% of North Americans, with similar upward trends observed in Asia-Pacific regions.

Therapeutic Advances and Indications

Enhanced understanding of GERD pathophysiology and the development of dual-release formulations like Dexlansoprazole DR underpin clinical preference, particularly in managing refractory cases and providing tailored treatment regimens.

Geographical Expansion

Emerging markets in Asia, Latin America, and the Middle East present unmet needs and growing prescription volumes, supported by increasing healthcare infrastructure and rising disposable incomes. Regulatory approvals in these regions are gradually emerging, promising future sales growth.

Formulation and Delivery Innovations

Research into novel formulation combinations, including fixed-dose combinations with other gastrointestinal agents, may further expand the market. Additionally, the development of over-the-counter (OTC) versions in regulatory countries could tap into the broader OTC demand segment.

Price Projections and Revenue Outlook

Historical Price Trends

The average wholesale price (AWP) for Dexlansoprazole DR in the United States has benefited from its branded status, averaging USD 300–350 per month for a standard treatment course (GoodRx, 2022). Over the past five years, the drug has experienced moderate price stability, with minor fluctuations attributable to generic entry and competitive pressures.

Impact of Patent Expiry and Generics

Patent expirations anticipated around 2024-2025 could introduce generic alternatives, significantly impacting pricing. Historically, similar drugs such as Nexium saw a 60–70% price reduction post-generic entry within the first year (IMS Health data).

Projected Price Trends (2023-2028)

Scenario 1: Maintenance of Premium Pricing (Patent Extensions or No Generics)

- Average monthly price: USD 280–330

- Annual revenue: USD 1.2–1.4 billion (in mature markets)

- Growth rate: Approx. 2–4% annual, driven by inflating healthcare costs and expanding indications.

Scenario 2: Post-Patent/Emergence of Generics

- Average monthly price: USD 60–150

- Annual revenue: USD 300–700 million, depending on market penetration

- Market share retention: Up to 30–40%, driven by brand loyalty and formulary preferences.

The timing of patent cliffs and the pace of generic uptake will predominantly dictate pricing trajectories. Companies utilizing patent strategies or formulation patents may delay generic competition, maintaining higher prices.

Pricing Strategies

Pharmaceutical manufacturers are expected to employ value-based pricing, emphasizing the drug’s unique dual-release benefits, better patient adherence, and long-term cost savings via reduced retreatment rates. Differentiated marketing and patient assistance programs will also influence consumer willingness to pay.

Conclusion: Strategic Insights

Dexlansoprazole DR’s market outlook remains promising, with sustained demand driven by epidemiological trends and therapeutic preferences. The potential for significant price erosion exists upon patent expiry; however, strategic patent protections and formulation innovations can prolong premium pricing. Market expansion into emerging economies offers growth avenues, provided regulatory and reimbursement hurdles are addressed.

In navigating evolving market dynamics, stakeholders should prioritize patent management, invest in research to reinforce differentiation, and cultivate relationships with healthcare providers to optimize prescribing behavior.

Key Takeaways

- Dexlansoprazole DR maintains a solid market position owing to its unique dual-release formulation and extended dosing interval, appealing to both physicians and patients.

- The primary revenue driver remains in developed markets like North America, with robust growth anticipated from emerging markets as healthcare infrastructure improves.

- Patent expirations projected around 2024-2025 are likely to introduce significant generic competition, which could lead to a 50–70% reduction in prices within the first year.

- Strategic patent protections and formulation innovations are essential to sustain premium pricing positions post-patent expiry.

- Future growth hinges on geographical expansion, advancing formulation technology, and potential over-the-counter availability, particularly in high-growth regions.

FAQs

1. When will Dexlansoprazole DR lose its patent protection?

Patents for Dexlansoprazole DR are expected to expire around 2024–2025, after which generic versions are likely to enter the market, impacting pricing significantly.

2. How does Dexlansoprazole DR compare to other PPIs in terms of price?

In the U.S., branded Dexlansoprazole DR typically costs USD 300–350 per month, whereas generics like omeprazole are priced under USD 20–50. The premium reflects its differentiated dual-delay release technology.

3. What regions present the most growth opportunities for Dexlansoprazole DR?

Emerging markets—such as China, India, and Southeast Asia—offer substantial growth potential due to rising GERD prevalence, expanding healthcare access, and evolving reimbursement policies.

4. How might future clinical advancements influence the market?

Introduction of novel acid suppression agents like potassium-competitive acid blockers (P-CABs) could challenge traditional PPIs, potentially reducing Dexlansoprazole DR’s market share if proven superior.

5. Are there indications for OTC availability of Dexlansoprazole DR?

Currently, Dexlansoprazole DR is prescription-only. However, if approved as an OTC in major markets, it could broaden access and significantly boost sales volumes, albeit possibly at lower prices.

References

- IQVIA. (2022). Global Pharma Market Reports.

- GoodRx. (2022). Average Wholesale Prices for PPIs.

- International Foundation for Gastrointestinal Disorders. (2022). GERD Prevalence Data.

- IMS Health Data. (2018). Impact of Patent Expiry on PPI Pricing.

More… ↓